Gold: We Appear To Be Heading Inevitably Toward Inflation In 2021

Fundamentals

Given the economic, health and political crises occurring, it does not make sense that we are seeing record levels in the stock market. Therefore, it's extremely difficult to use the analysis of fundamentals to trade the markets. The market is looking ahead. The market is focused on the economic recovery that has been starting a little. We are at a bottom economically, so almost anything looks good in comparison. Major fiscal issues including interest rates need to be resolved. We also are facing massive debt that has reached staggering levels. It will need to be addressed at some point. Leaders do not appear to be showing any inclination to change current policies of printing record amounts of money to stimulate the economy, not only in the US but on a global basis. Debt is going to increase even more. We do not yet know the consequences of the pandemic and the printing of money, but the stock market appears to be discounting the effects of the pandemic and the massive stimulus.

We appear to be heading inevitably toward inflation. Food prices already have increased 50% or 60% since March 2020, in terms of futures for corn, soybeans and such. Prices in retail food stores already are going up. The new US administration appears to be set to continue to provide massive stimulus or quantitative easing. According to the latest Fed meeting notes, interest rates remain unchanged. They cannot change them. It's the only way they can finance the debt. If interest rates rose even a decimal point, the debt payments would lead to extensive defaults around the world. There's no sign that the Fed is planning to raise interest rates at any point in the foreseeable future.

The US dollar’s value in international markets may be affected by the US debt levels and amount of stimulus. China, Russia and Saudi Arabia already are using other currencies more and more as reserve currencies instead of the US dollar. The purchasing power of the US dollar has fallen almost 100% since going off the gold standard in 1971.

The Fed has few options to resolve this dilemma. They must print money to keep the economy staggering along, even as they risk significant inflation in the future. They can’t raise interest rates now, or defaults on debt will ripple throughout the economy. No one knows what happens to the value of the dollar if we continue to create US dollars by the trillion. Stimulus may reach $13 trillion or even $15 trillion.

Britain is going back into a lockdown. Other countries also are facing lockdowns. They will all damage the world’s economy. Precious metals may benefit, since they are a safe haven or hedge against the risk of inflation in the US dollar.

The Fed’s balance sheet has exploded about 25%, which has meant that we have been able to avoid an economic implosion. Yet, in the face of all of this, gold yesterday came down and the stock market made new highs. These are anomalies, which at some point will have to be resolved. We are facing a major social, economic and political change in paradigms. In March 2020, we saw a shift in the value of gold against the dollar, as gold became a currency. The US dollar, in a way, became a commodity. US dollars were in demand as investors fled to a perceived safe haven--including gold. Gold rallied from $1450 to $2089 as the market assumed that the Fed would pump a record amount of stimulus into the economy. At the same time, the stock market also rebounded from a low of 2174 for the E-mini S&P in March to a high of 3798. And today it's making a new high, as the new Biden administration is confirmed by Congress. Technically, the stock market has reached highs that are a harmonic convergence between the daily and weekly Variable Changing Price Momentum Indicator (VC PMI) numbers. There is a high probability that this will mark a high, and a high chance of a reversion back down toward the mean,

Gold and Silver

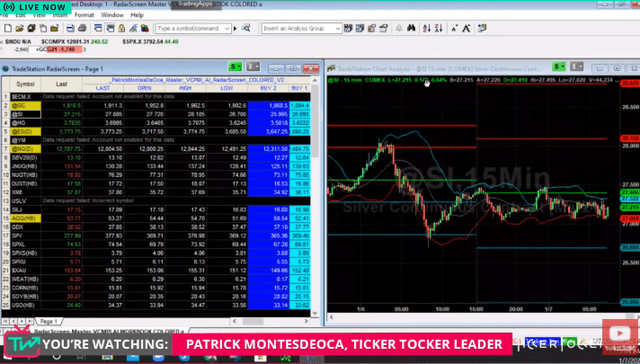

(Click on image to enlarge)

Courtesy: Ticker Tocker

Gold is trading last at $1916.50, up about $7. Gold is trading below the VC PMI average price of $1928. Silver also is below the average price, so we have a slightly bearish trend momentum on silver and gold. We are looking for a rally or, if it declines, we are looking for support down to about $1894 or $1893, which is a harmonic relationship between the VC PMI daily and weekly numbers. We are looking at $1928 as the daily average and $1925 is the weekly Sell 1 level. The $1962 level begins to identify the level of resistance on a weekly basis. Gold rallying to $1962 early yesterday morning means that for most traders who traded the GLOBEX they got a short trigger from the VC PMI with the goal of the average price of $1893. The low yesterday was $1902.60 before the market reverted and found buyers at a higher level than the $1893 that was the target for the week. The buyers brought the market up to the Sell 1 level of $1925.

(Click on image to enlarge)

Gold is trading right into an uptrend line into $1967. If the trend line does not hold, gold may come down to the VC PMI Buy 1 level of $1894. We tested the upper end of that resistance around $1925 and we break out of this resistance, then we are looking at $1962 to $1954 being tested. Closing above $1954, puts $1988 into play. This is a critical level of support that needs to be maintained today.

(Click on image to enlarge)

Gold trading above $1912 means that $1980 and $2000 are now the new targets. $1912 was a critical level that had to be broken, and it was. February to April are usually the seasonal top for gold and we expect it to hit about $2100.

We are buying and holding gold on corrections. We are trading it as a speculative instrument, but holding it as a hedge against the devaluation of the US dollar, which is happening before our eyes. To pay the bill for all of the stimulus, the Fed is going to inflate the dollar, which is already happening. However, they may not be able to control how fast the dollar inflates, so we could jump from inflation to hyperinflation overnight.

Silver

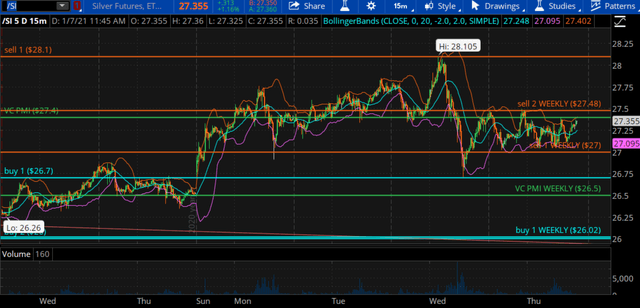

(Click on image to enlarge)

Silver is also highly volatile, like gold. It's not as liquid as gold, but it offers tremendous opportunity because it is still one of the cheaper assets at $27 an ounce. Gold in 2011 made a high of $1900 and silver went to about $50. More recently, gold hit a high of $2089 in March and silver hit $29.91. Silver appears to have some catching up to do.

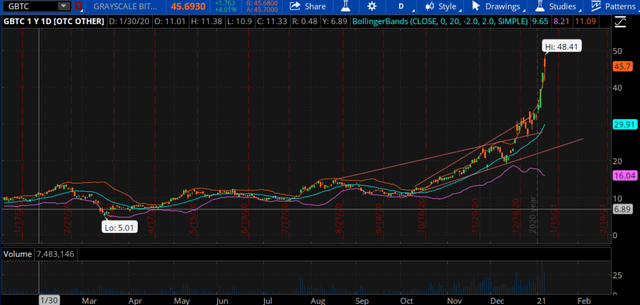

GBTC

(Click on image to enlarge)

The GBTC just made a new high of 48.41. The Grayscale Bitcoin Trust and Bitcoin are where the money went to from other assets. This just from December from a low 30.35. It's a significant virtual speculative asset. Investors are looking for alternatives to the US dollar as the world’s reserve currency. It's a good instrument if you are a day trader and you are looking for volatility.