Gold Vs. The Gold Miners

Recently I wrote an article called Hewlett Packard: An Introduction to Statistical Indicator Analysis (SIA), presenting my own unique form of technical analysis, which takes a long term view on how a company, fund, index or commodity is performing relative to its price action. In this article I will concentrate on gold vs. the gold miners and give my opinion on how an investor should act based purely on the technical analysis results.

Let us first begin with analyzing gold (GLD) from 1983 to today.

Obviously gold, as shown in the chart above, has had a hell of a great run, and since 1999 has dramatically outperformed the world’s stock markets by a wide margin. In 1999 an investor would have had the opportunity to buy gold at a 34% discount to its SIA or growth level and actually below its low growth level. When such circumstances occur, the probability of success in an investment is greatly increased, as long as the slide does not continue further to the negative growth level.

Since gold is a commodity and not a company, it will not go out of business and liquidate, so our chances of success are even more improved. Companies on the other hand, can continue to go down to zero and liquidate. As an investor, it is always better to let the price of the instrument you want to invest in, break above its growth level before taking the risk, otherwise you could find yourself in a situation similar to what BlackBerry investors are currently experiencing. SIA analysis of BlackBerry is shown here.

Blackberry (BBRY)

In the end it all depends on the level of risk one is willing to take on. SIA is long term technical analysis, and is only one tool in an investor’s toolkit, but is a very powerful tool indeed, as it gives one a clear historical view of investor sentiment.

In getting back to gold, its current growth level or SIA is $770.42. However I doubt whether we will ever see gold hit that price. That said, you can never tell how many investors have love/hate relationships with their investment in gold and may decide to sell if gold goes much lower.

Now we will analyze the three major players in the gold mining industry.

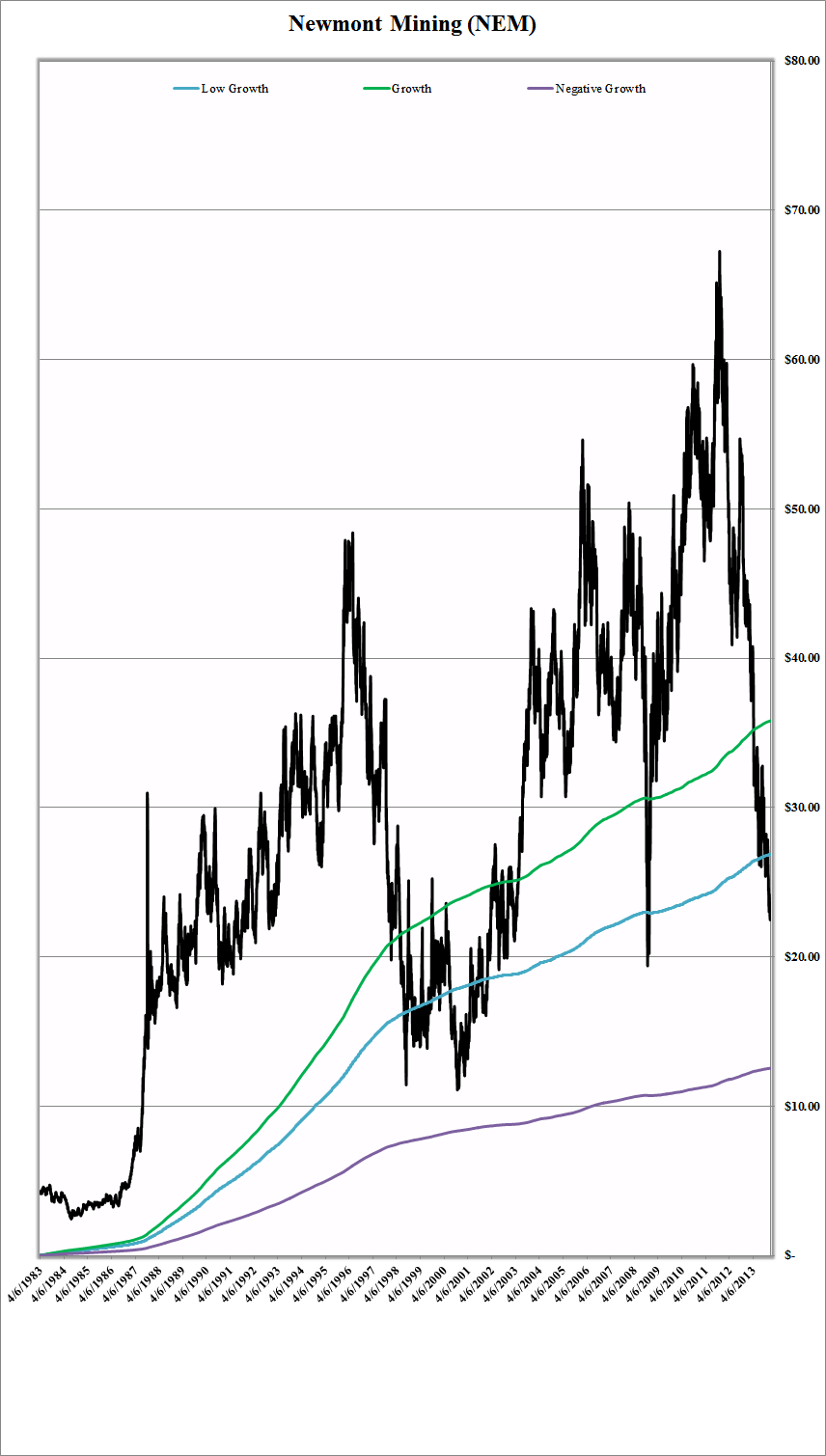

Newmont Mining (NEM)

Newmont Mining is much more volatile than gold. In 2000 it enjoyed great success riding the boom that occurred in the price of gold, but then collapsed in 2008-2009 as it is a component in various indices and unfortunately went down with them, when everyone ran for the exits. Since the peak of gold in 2011, Newmont Mining has just been pummeled by investors and recently broke below its low growth level and is showing no signs that the falling knife is anywhere near stopping its descent. On the other hand it is also reaching the same two “low growth” lows it has reached in the past. So from a historical perspective, could it be bottoming out? Gold miner’s fortunes are naturally dependent on the price of gold, so the smart move here is to wait and see what gold will do.

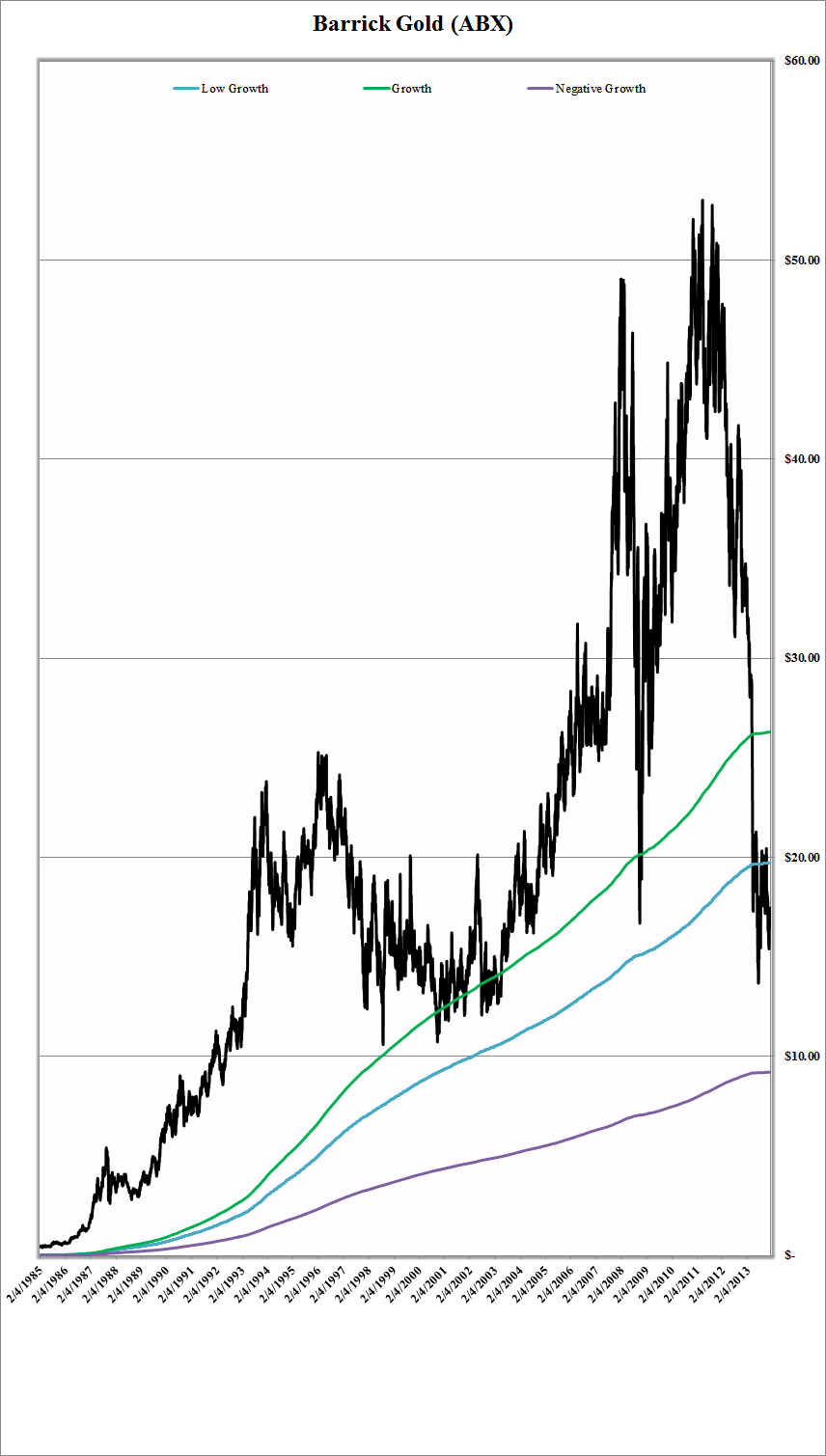

Barrick Gold (ABX)

Barrick Gold, for the first time ever, recently broke below its low growth level, but is showing signs of attracting investors and may just be bottoming out as it is way down from its all-time high. Again it would be smarter to wait and see what the new investors will do who took a chance at these levels and whether they will be forced out if the falling knife scenario were to continue.

Goldcorp (GG)

Finally Goldcorp, from an SIA technical point of view, has the best chart I have seen amongst all the gold miners I have analyzed as it only recently broke below its growth level, while the rest of the pack are below their low growth levels on average. It is clearly the least volatile of the group and seems to be a more conservative bet for those interested in making an investment in a gold miner right now.

In conclusion, gold has gone up substantially over the last 14 years and was due for a correction according to our SIA Charts. Investing in the gold mining industry is highly speculative, but can be very rewarding if the trend in gold is up. Unfortunately the industry is currently in a serious downward trend, so we don’t know when the falling knife will finally hit the table and have gold reverse its course and go up. Gold investing is all about investor sentiment and currently the trend is definitely not the gold investor’s friend.