Gold Vs Diamonds: Which Is The Safer Haven?

The commodities market is one of the most complicated markets to invest in, especially for those who have not specialized in a particular commodity.

Most investors who have attained success in the commodities market focus on investing in one or a few commodities. Unlike in the stock market where investors can combine several stocks from different sectors, commodities offer a different type of challenge to the investment community.

For instance, there are those who specialize in investing in Gold, including gold bullion, gold stocks, and various ETFs like the SPDR Gold ETF (GLD). There are also those who specialize in oil, and with oil, there are those who only invest in Crude Oil and its associated ETFs.

Most commodities tend to be affected by several factors akin to the stock market. However, gold has for several years proved to be a safe haven, especially when the stock market is characterized by high levels of volatility across several sectors.

There are also those who believe that other precious metals like silver, platinum and even diamonds can provide a good alternative to investing in gold as a safe haven. However, most of these precious metals are thinly traded and thus do not provide enough liquidity for short-term traders.

In fact, when you look at some of them like diamonds, for instance, they are also affected by other unconventional factors such as fashion, and the pricing can differ massively depending on the color, clarity, the cut, and carat size. And according to various platforms that provide in-depth information about investing in diamonds, the cut of a diamond can easily be confused with the shape of a diamond, and it too plays a crucial part in pricing the precious metal.

Therefore, if you are looking to invest in diamonds, there are a lot of things to consider. Different colors have different pricing ranges, and a change in fashion could easily swing the price of diamonds significantly either side of the curve.

Yet, as per this Wall Street Journal report from 2012, their average return between 2003 and 2010, especially for the white diamonds, was as good as most investors would consider for a safe haven during a financial crisis.

White diamonds had a CAGR of about 10% during the period. Nonetheless, this is easily dwarfed by the average return on gold investments. During the same period, the price of the yellow metal rallied from about $370 to about $1,270 resulting in an annualized return of about 19.27%.

On the other hand, colored diamonds averaged 5.5% return between 2003 and 2010, thereby illustrating the importance of the color in the diamonds market.

Unlike Gold, silver and several other commodities, diamonds are not exchange traded, which means that prices are determined by “Over the Counter” markets. This means that the level of liquidity is not as abundant as is the case of gold, and this puts the pricing of diamonds in plain sight for potential manipulation.

It is clear that Gold still emerges on top when compared to diamonds as a safe haven. However, recent pricing trends suggest that diamonds might yet provide a good alternative for those still holding doubt over the yellow metal.

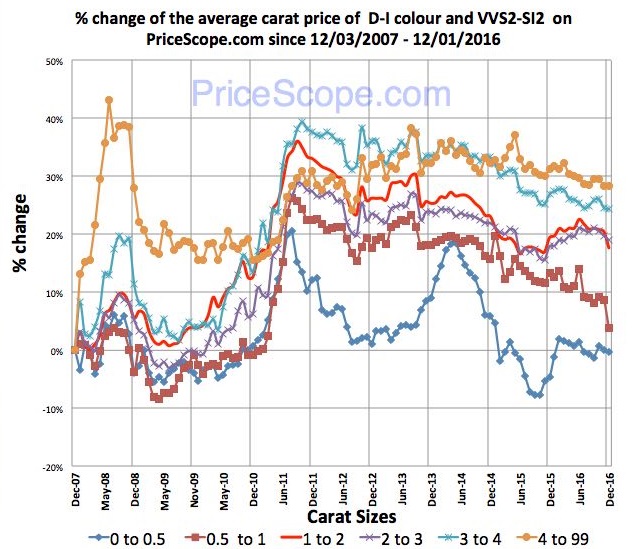

Since hitting an all-time high upwards of $1,900, the price of gold has dropped by more than 30% based on the current price of about $1,240 in the futures markets. On the contrary, the prices of diamonds have remained relatively unchanged, especially the larger carat size category, as demonstrated in the chart below.

However, when you look at the prices a few years back between 2008-2009, there was a huge collapse in prices which matched the great depression of 2008/2009. This implies that when economic conditions are tough, diamond prices tend to be affected accordingly.

This is primarily because, unlike gold which central banks use as reserves to boost the value of their currencies, diamonds have no real institutional value. Their value is determined by private markets and other things such as fashion trends and disposable incomes. Very few people look at diamonds as a form of investment, which means that it could take some time before they finally become an exchange-traded commodity.

Conclusion

In summary, diamonds are still far from being an ideal commodity for safe haven investing. However, they still are among the most precious commodities in private markets and their pricing can be tricky for those with limited knowledge on how they are traded.

But perhaps, one of their biggest advantage over gold is that with just a few diamonds, you can lock millions of dollars in a safe deposit box while with gold, it would take several bars to bank the same value.

Disclosure: The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor ...

more

Thanks for sharing

What I'm looking for is some insight. How can someone buy investable diamonds, for example. This isn't very helpful.