Gold Undergoes Correction Amid Divergent Forces

Image Source: Pixabay

Gold prices face continued pressure from a resilient US dollar and expectations that the Federal Reserve will maintain its restrictive monetary policy stance. These headwinds have triggered a technical correction in the precious metal.

However, ongoing geopolitical tensions and instability in the Middle East continue to underpin demand for safe-haven assets, providing a buffer against more substantial price declines.

In the coming sessions, investor attention will focus on key inflation data and scheduled speeches from Fed officials, which are likely to provide fresh direction for the precious metal.

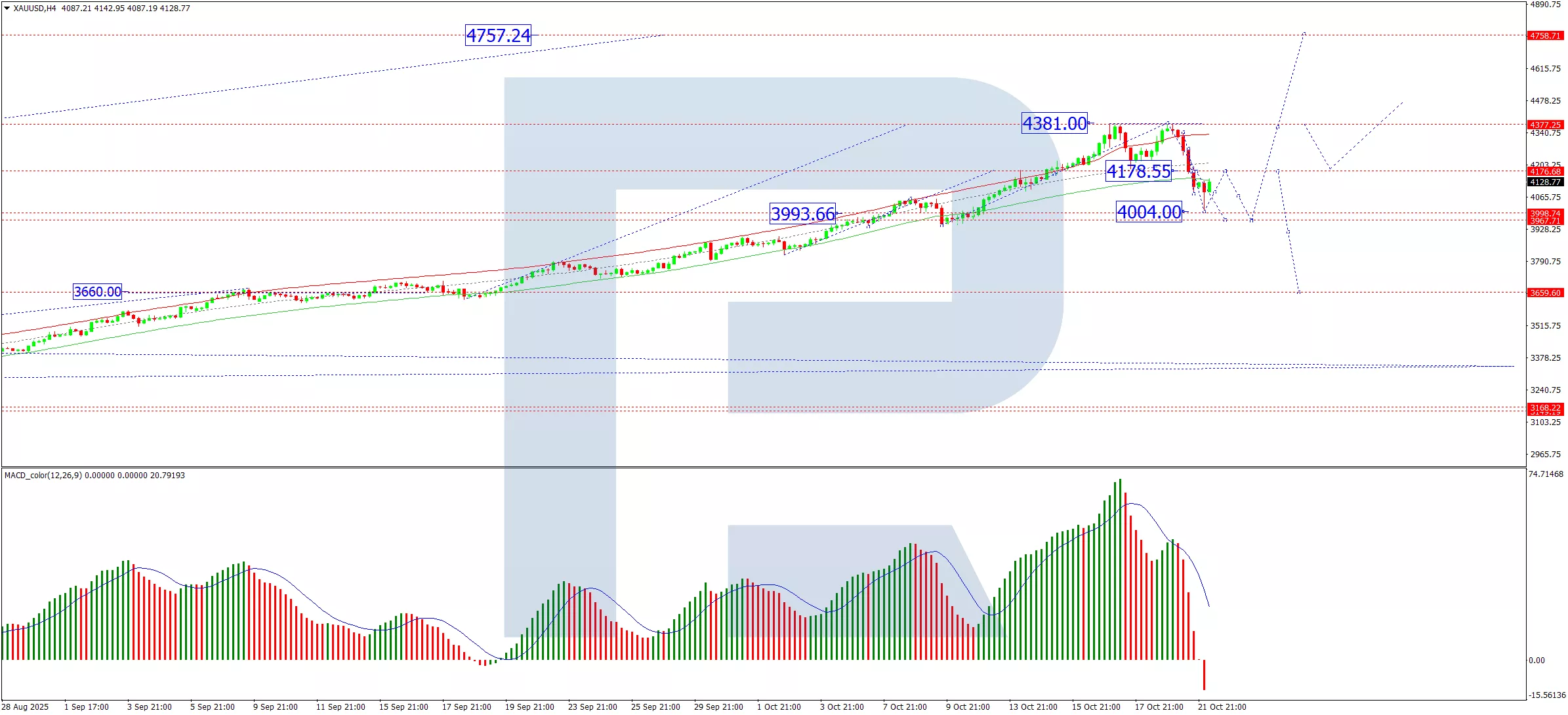

Technical Analysis: XAU/USD

H4 Chart:

(Click on image to enlarge)

On the H4 chart, XAU/USD broke below the 4,175 USD support level, reaching the initial corrective target at 4,004 USD. The market is currently forming a retracement towards 4,175 USD, testing this former support level from below. Following the completion of this pullback, another leg down is anticipated within the broader correction, with a subsequent target at 3,970 USD. The MACD indicator confirms this bearish near-term outlook: its signal line is pointing downward while the histogram remains entrenched in negative territory, indicating continued selling pressure.

H1 Chart:

(Click on image to enlarge)

On the H1 chart, the instrument completed a downward wave to 4,004 USD before establishing a growth structure. The price is currently consolidating around 4,107 USD. An upward breakout from this range would likely propel prices toward 4,175 USD, retesting the previously breached support level. The Stochastic oscillator supports this short-term bullish scenario, with its signal line positioned above 50 and advancing toward 80, reflecting building upward momentum.

Conclusion

Gold remains caught between monetary headwinds and geopolitical support. While the broader correction appears intact, the current bounce from 4,004 USD suggests potential for further near-term recovery toward 4,175 USD. However, this upward move is likely to present selling opportunities for a resumption of the downtrend towards 3,970 USD. Traders should monitor incoming US data and Fed commentary for catalysts that could determine whether this correction deepens or concludes.

More By This Author:

EUR/USD Under Downward Pressure

The Yen Extends Its Correction

Yen Nears End Of Corrective Phase

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for ...

more