Gold Trades $3,347 Higher Than 54 Years Ago Today

Image Source: Pixabay

While Friday finished off the week for gold and silver just about as quiet from a price action standpoint as is possible, our government did provide plenty of action behind the scenes. Which we will get into in just a moment, although first, here's a quick look at the gold and silver charts.

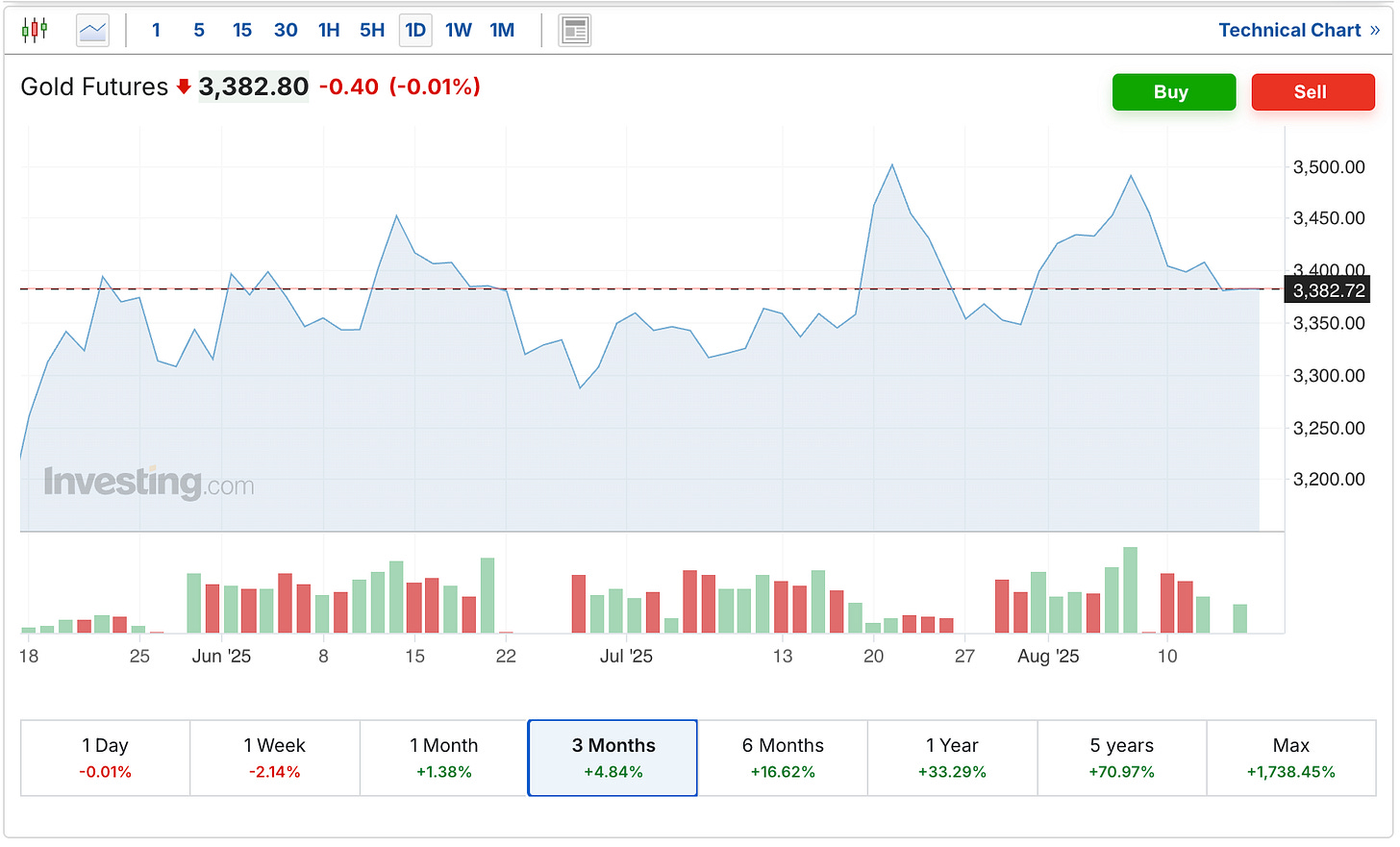

Gold is currently down 40 cents on the day to $3,382. And you can see that it's now been several months, that it's basically been hovering right around that $3,400 level.

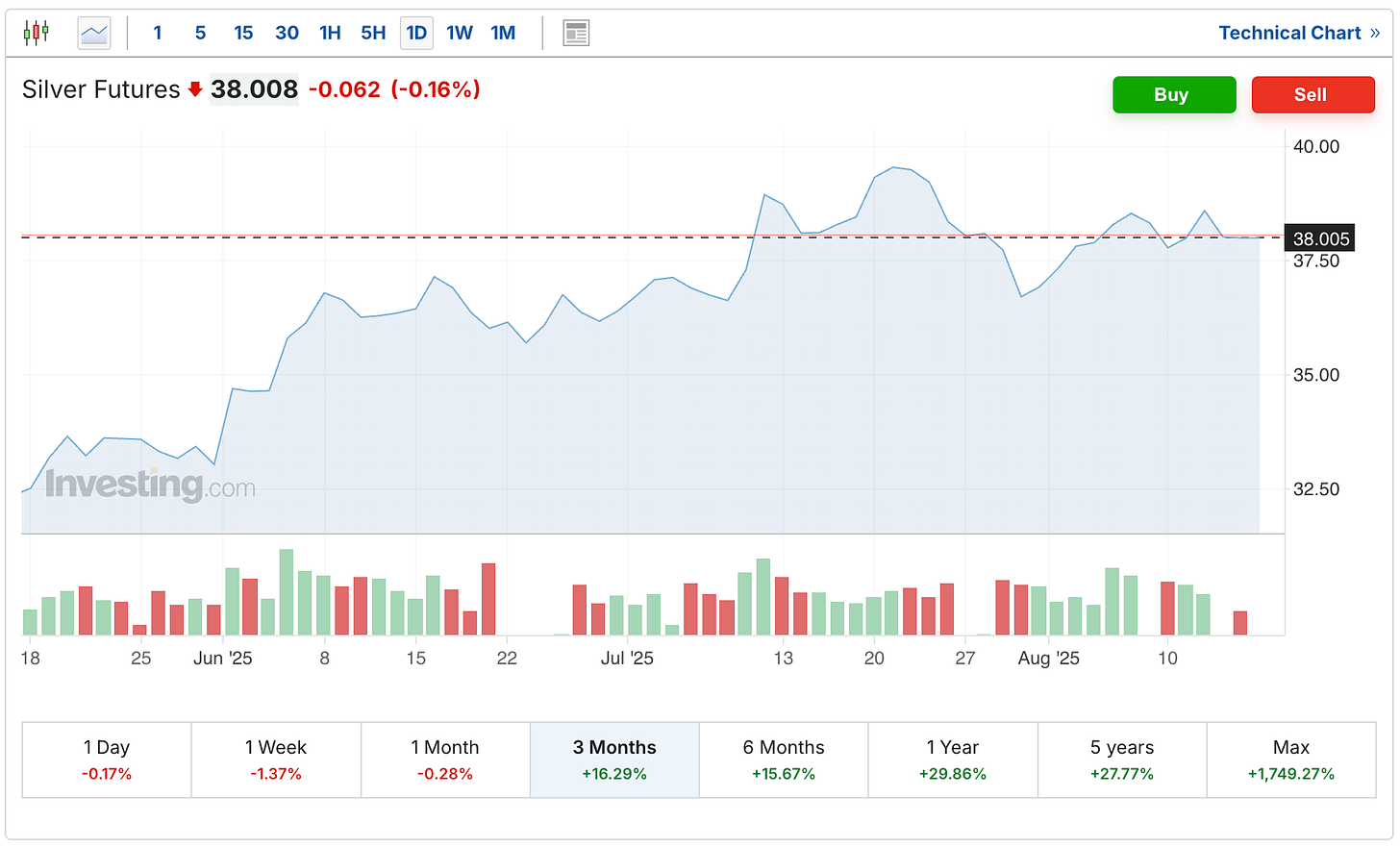

Silver was similarly quiet on Friday, down 6 cents to $38, and you can see how it's also been a couple of months that silver has floated around that $38 level.

Although my suspicion remains that we will have enough volatility to make even the most high-adrenaline traders happy before the year is out, and here are some of the reasons why.

You may have seen the other day that President Donald Trump was talking about modernizing the technical backbone of the financial system using state-of-the-art crypto technology.

‘The technical backbone of the financial system is many, many years out of date. Paul and others are straightening it out, but payments and money transfers are costly and take days or even weeks to clear. Under this bill, the entire ancient system will be eligible for a 21st century upgrade using the state of the art crypto technology.’

By no means am I disputing that the technical infrastructure of our financial system seems a bit out of date. Although if he really wants to bring the financial system into modern times, I would suggest that there's a lot more that needs to be done outside of just using crypto technology for payments.

Today is actually the 54th anniversary since Richard Nixon ‘temporarily’ removed us from the gold standard, in order to heroically save us from the greedy ‘speculators,’ in ‘the interests of monetary stability.’

However, as noble as Nixon may have thought that effort was, it didn't end up being so temporary, and it never quite ‘stabilized the dollar’ like he promised. And with gold taking an increasing market share of the global foreign reserves pool, while the BRICS countries continue to de-dollarize and use gold as collateral, this is certainly an area that could use some modernization.

Especially given this summation of the Michael McNair interview I shared on Wednesday (and if you didn't have time to watch the whole 1-hour video, here's the perfect cliff-notes version for you).

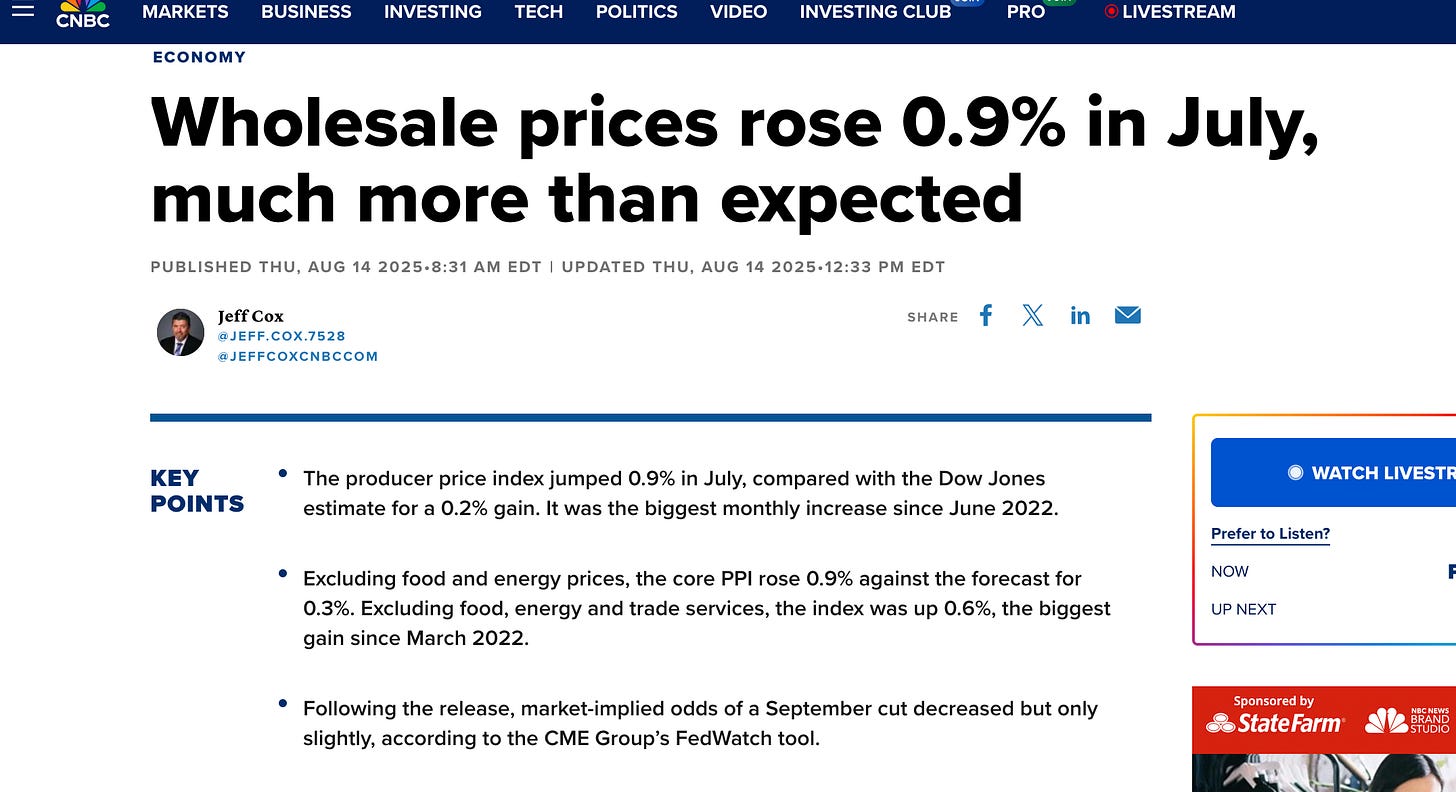

I'm curious to see how much longer the Trump administration will continue to shout from the hilltops that there's no inflation. Especially after this week's wholesale PPI report, which was, or at least should have been rather alarming to them.

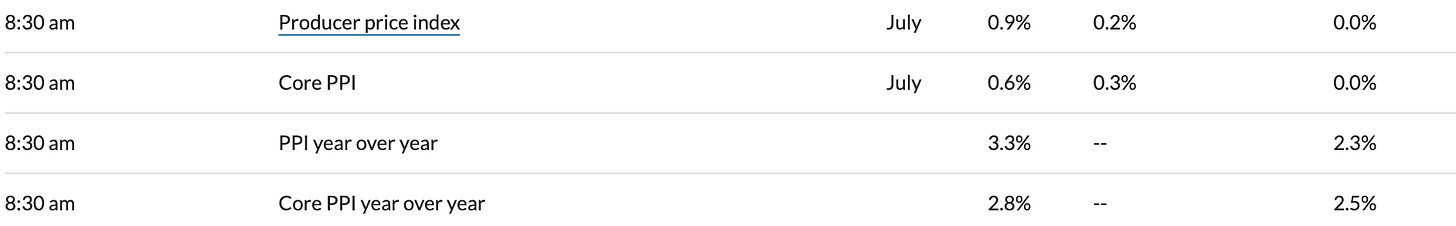

PPI came in at 0.9%, versus a 0.2% median forecast, and 0% in the prior month, while core PPI came in at 0.6% vs. an expectation of 0.3%, and the previous month's figure of 0%.

You can also see here how the yearly PPI figure went from 2.3% two months ago to 3.3% last month, while core PPI went from 2.5% to 2.8%. All of which certainly appear to be well in excess of the Fed’s 2% mandate.

Although given some of the comments I shared from Treasury Secretary Scott Bessent yesterday, I doubt that's going to change anything they're saying about inflation, or how they want a 50 basis point rate cut in September.

Although in the rare category of government statements that almost all people can actually enjoy, it was fun to see Bessent asked about insider trading, and hear him and Larry Kudlow talk quite a bit about Nancy Pelosi.

Who has either become one of the greatest part-time speculators in the history of finance, or is perhaps more likely doing some things that if you or I did, it wouldn't work out so well.

So hopefully at the end of all of that, you've had a great week and are getting set for a relaxing weekend.

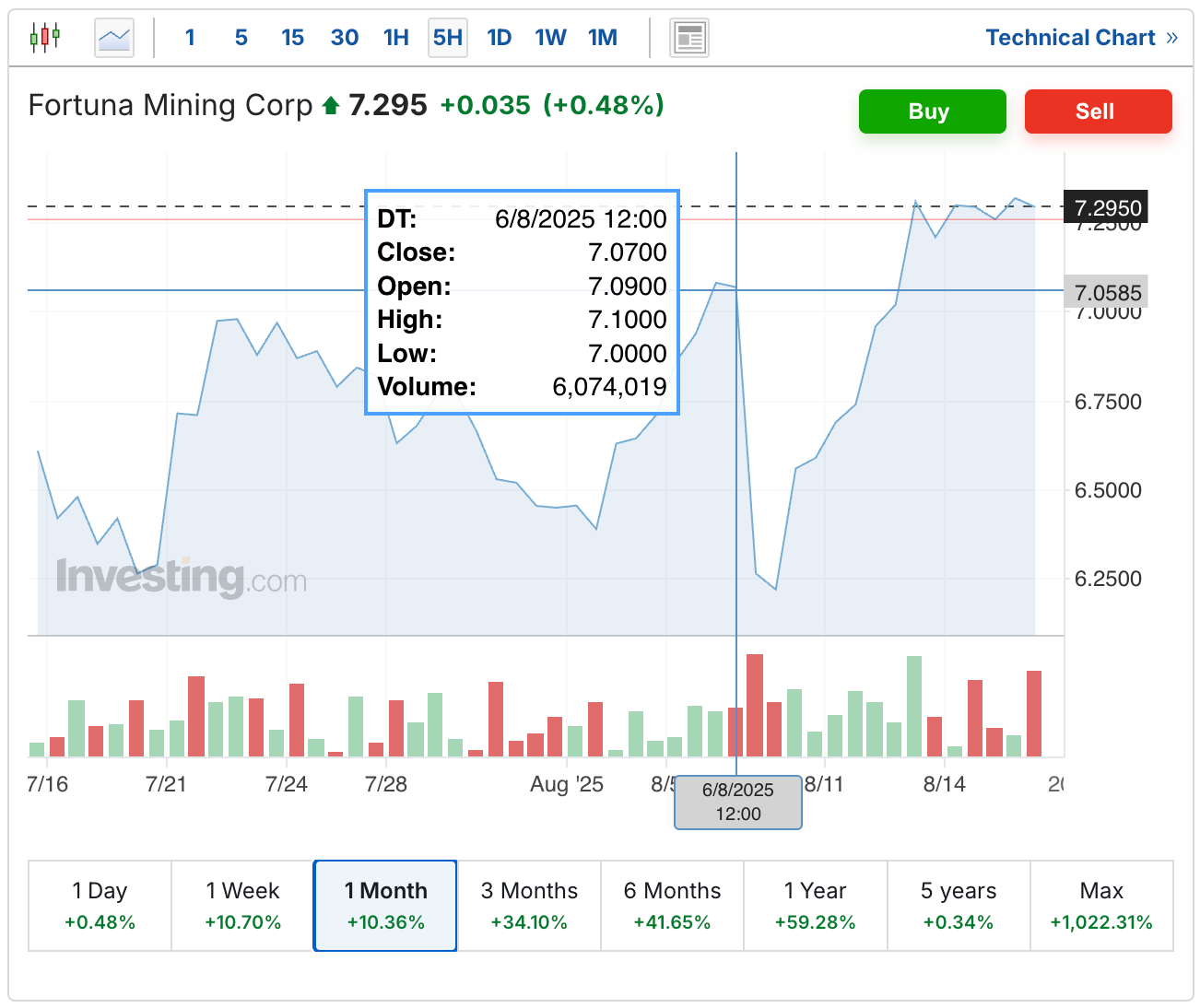

Although since I know that we do have a lot of Fortuna Mining (FSM) shareholders in our audience, I did also want to pass along the post-earnings call I did with Jorge Ganoza, the CEO of Fortuna Mining. Where he talked about the reaction in the stock following the earnings announcement (it was down 12% that day), and also the rather rapid reversal, which now has the price higher than before all of that happened.

(the price box appears just prior to the earnings release)

So thanks as always for reading this week. I'll look forward to checking back in with you on Monday.

More By This Author:

How Trump Administration Has Driven The Dollar LowerHow Trump Administration Is Driving The Dollar Lower

Gold & Silver Stay Quiet On Tuesday