Gold: The Metals Are Finally Ready For Take-Off

Fundamentals Are Collapsing

The gold market is very volatile, given the pandemic, political uncertainty, trade tensions and crises around the world. In March, we saw a shift in paradigm with gold going from being a commodity to being a currency, while the US dollar became a commodity. It is a fiat or paper currency. Trust in its value has been falling since 1971 when the US went off the gold standard. It has fallen in value more than 98% since then. Gold has not. As the government keeps printing more money, the value of each dollar decreases, and gold is bound to rise.

The initial stimulus of $3.5 trillion was just a sign that the Fed was going to be the buyer of last resort for every financial instrument. That move injected confidence into the markets. Gold then rose to $2,089. There was a $600 premium for gold, even when no one knew the damage the pandemic would cause.

Recently, we have begun to see investors think that the damage was less than expected, but that is just because the data was not yet available. The data is still coming in, and most of it is dire. Bankruptcies, unemployment and signs of weakness in the economy are everywhere. Even so, buoyed by confidence in the Fed's reaction, stocks rose to a new high of 3,587 for the E-mini S&P, right after making a low of 2,174. However, the economic crisis continues. Inflation is looming on the horizon, given all the money the Fed injected into the economy. That move will also weaken the US dollar, which can only help gold to reach new highs. Now, it appears that we are going to need even more stimulus. It has become a political issue, but in the meantime, Main Street is suffering with unemployment and bankruptcies. To pay for the new increased debt, taxes will need to rise both at the state and federal level. The other alternative is to allow inflation. Either choice will lead to gold rising in value.

Now, we are entering the second phase of this crisis. We will begin to see the magnitude of the damage. The number of businesses that are out of business. The number of people who are not going to be able to find jobs long term. The painful effects of the crisis continue to become clear. Homelessness is increasing. Food banks are hard-pressed. Federal aid is ending, and homelessness is going to skyrocket. The system is under extreme stress.

With the US elections, it may not matter too much who wins. The damage is done. Whoever wins is going to face a dire situation. The economy needs stimulus on a massive scale, yet that action will lead to inflation and further devalue the US dollar. Not providing stimulus will mean widespread unemployment, homelessness, and a devastated economy.

In such a situation, you must look out for yourself and your family. Gold is a solid hedge against potentially hyperinflation. Metals and natural resources are already inflating. Food and crude are not counted in federal inflation rates, which falsely show low inflation when, in reality, there is significant inflation at around 10%. To catch up to that inflation, gold needs to go up significantly. The metals are finally ready for take-off to their real price discovery and to identify their true mean in relation to the local and global debt, and to inflation rates. Every currency on earth faces the same issues. All of the currencies, which are fiat currencies, are in danger of losing almost all of their value. Any asset valued based on the US dollar appears to increase in value, such as stocks, even as they lose value against other assets, such as gold, which have intrinsic value. It appears that the Fed will have to cap the interest rate on long-term bonds to control payments on the debt, it will open the doors to hyperinflation around the world, and gold will rise in price significantly.

(Click on image to enlarge)

Technicals

October 14, 2020, 7 am PST. Gold is up $21.90. The Variable Changing Price Momentum Indicator (VC PMI) tells us that $1,905 is the average daily price. Gold met the daily average price and is now meeting the average price for the weekly. When the market trades around the average price, it is a basis for equilibrium between supply and demand. When the price is around the average price, you should take profits and go neutral because there is a 50/50 chance of the market going up or down. You want to wait to trade the extremes above or below the market.

When gold came above $1,897 last night, it activated the weekly Buy 1 signal. It tested that level again last night. It then met the targets of the averages of $1,905 and $1,920, which allowed us and our subscribers to lock in a profit of about $4,550.

Ninety percent of people who trade commodities lose. They lose because they do not realize that the key to analyzing the markets isn't all the chatter. The key is supply and demand. The key is to listen to what the market is telling you. The VC PMI acts as a GPS for your trading to show you where the market is likely to go. Most people attempt to analyze the market in real time, as they trade. The VC PMI does it all for you, so when you sit down to trade, you know which buy and sell levels to watch for automatically.

If the price closes above $1,897, then go long. It is a buy trigger. You can place a stop at your entry point, use a trailing stop or a dollar stop based on your risk tolerance. Last week recommended buying gold at $1,870. From that level, the VC PMI forecast that buying pressure would be greater than the supply and the price would rise, which it did.

We trade gold futures to identify the direction of movement. Gold represents many different financial dimensions. It is a commodity, but it is also a currency. You can day, swing or long-term trade it or any of the many derivatives based on gold, such as NUGT, GLD, GDX and, for silver, SILJ. We are long in all four of them. The triple X derivatives are not to be held long term. Only trade them short term, since they have a slight long-term time decay. GDX is one that you can hold longer term. Even while we build a long-term position in precious metals, we also day trade futures to take advantage of the price volatility to scalp some profits based on the VC PMI.

We went long at $1,898 with the first target at $1,905, and then $1,917 was the weekly mean target, and $1,914 was the monthly mean target. Gold reverted from the weekly Buy 1 level and completed the pattern from $1,897 to $1,917. With five contracts, that profited about $4,500. We are trading around the monthly average of $1,914 now. On the 13th, we got a bearish signal down to the low we made today at about $1,885, where the market found buyers. The daily buy signal at $1,897 was triggered yesterday, and then, the weekly and monthly average signals came into play, suggesting that the market was likely to continue rising. The market is telling you there is a bullish momentum from around $1,895, and now, we have reverted back to the mean. The process of the reversion to the mean was completed today. We appear to have completed this correction, which we had been expecting. There is still a small chance that the $1,879 area may be tested. Right below that level is a cluster of blue lines: the daily level at $1,879; the monthly Buy 1 at $1,869 and the Buy 2 at $1,864, and the Buy 2 weekly at $1,857. They all cluster around the same area, which indicates that buyers are likely to enter the market in that area, and the price will revert from that level back to the mean. By closing above $1,917, it validates that the bottom is in. The targets of the weekly of $1,956 and $1,976 are going to be activated. For the monthly, we are looking at the market trading above $1,914, which activates the targets of $1,978 to $2,065 - which are targets for the rest of the week. We appear to be in a bullish price momentum phase.

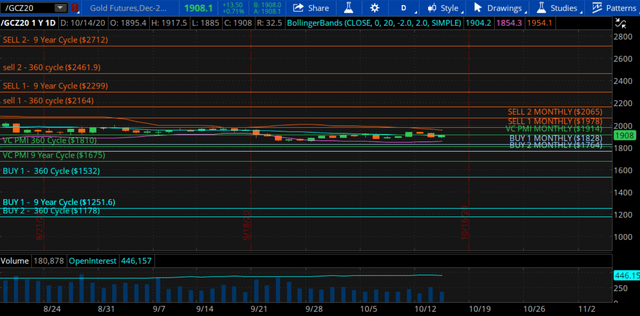

The 360 Day Seasonal Cycle And The 9 Year Cycle S&D Structure

Courtesy: TDAmeritrade

Adding in the 360-day cycle, then the average price for the year is $1,810. The Buy 1 is $1,828, and we are trading around the average price of $1,914. Trading above $1,914 means we are coming in with $1,978 and $2,065 being in play. The higher 360-day cycle goal is $2,164 and the 9-year cycle target is $2,299, with the Sell 2 level for the 360-day cycle is at $2,461 and the 9-year cycle Sell 2 target level is $2,712.

Disclosure: I am/we are long GDX.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold and silver, check us out on more