Gold Technicals Bullish

Gold’s latest pullback has left traders really down on it, fueling mounting bearishness and apathy. But that healthy selloff accomplished its mission of rebalancing sentiment, eradicating early May’s greed and overboughtness. That has reset gold’s technicals, leaving them very bullish. Hammered back down near major support zones, the yellow metal is nicely set up to start rallying soon and resume its interrupted upleg.

Today’s pessimistic gold psychology has been fueled by recent price action. Gold’s surged into early May, extending its latest upleg’s gains to a strong 26.3% over 7.2 months. But ever since then, gold has ground lower to sideways on balance. At worst last week, gold’s total pullback since its latest interim high grew to 6.9% over 1.8 months. Gold drooped from $2,050 to $1,908 in that span, really damaging sentiment.

That pullback was necessary, as gold was getting seriously overbought while greed ran rampant in early May. Gold blasted higher so fast that it soared 13.2% above its baseline 200-day moving average! That wasn’t quite to the extreme 16%+ upleg-slaying danger zone, but starting to threaten it. Nearly everyone was quite bullish on the yellow metal, expecting its strong gains to continue. That was really unbalanced.

Major uplegs can be prematurely burned out by excessive herd greed and overboughtness. They attract in too much buying too soon, exhausting the near-term capital firepower available to keep feeding uplegs. That forces them to peak, fail, and roll over into larger corrections. With a few more days of surging back in early May, gold could’ve hit that tipping point. But selling returned earlier, preserving this upleg’s longevity.

A confluence of several factors drove gold’s latest pullback. The primary one was speculators selling gold futures on higher odds for more Fed rate hikes. Those flared with better-than-expected economic data and hawkish Fedspeak from top officials. That also often goosed the US dollar, which is the main trading cue for gold-futures speculators. The stronger dollar unleashed more selling, exacerbating gold’s pullback.

The resulting retreating gold prices increasingly discouraged investors, who have pulled more capital out of gold as its selloff festered on. Gold’s price momentum drives their herd psychology, and most of that has been to the downside in the last couple months. That forms vicious circles of self-feeding capital outflows. The more investors sell, the faster gold falls, the more bearish they get, so the more selling they do!

Gold’s mounting pessimism has intensified with stock markets surging in this artificial-intelligence bubble. When general stocks are excitingly blasting higher, investors forget the wisdom of prudently diversifying their stock-heavy portfolios with counter-moving gold. Further aggravating psychology, June is gold’s weakest time of the year seasonally in the heart of its summer doldrums. That all made for a bearish conflux.

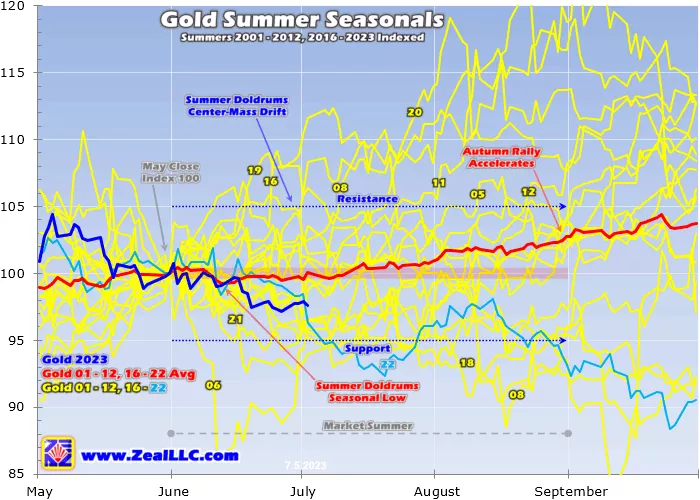

Yet despite those stiff headwinds buffeting gold, it has held its own this summer. This chart is updated from my latest gold-summer-doldrums research thread I analyzed a month ago. Gold’s June, July, and August performances in modern bull years are individually indexed to May’s final close and then charted together. Gold generally drifts sideways to lower in June, as the red line’s averaged indexed seasonals show.

While gold has been tracking below its seasonal average in recent weeks as this pullback grew, it isn’t by much. The yellow metal generally meanders within 5% either way of where it entered market summers. At worst last month, gold was still well within that summer-doldrums trading range only down 2.8%. And this normal seasonal weakness caused by no recurring outsized gold demand spikes is already passing.

The summer doldrums could be more accurately called the June doldrums, as that is their peak month. On average in June during these modern gold-bull years, gold slumped 0.2%. Last month proved a lot worse with a gold pullback already underway entering this market summer, with a 2.3% gold loss. But gold tends to rebound strongly from there, averaging 1.1% gains in July then accelerating to 1.8% in August!

So the usual summer-doldrums apathy should soon stop contributing to gold’s bearish psychology. That is also true of these surging stock markets stunting prudent portfolio diversification. Between mid-March to this week, the flagship S&P 500 stock index has soared 15.6% at best! That has left many major US stocks greatly overbought. The SPX itself stretched way up to 1.113x its 200dma on Monday as Q3 dawned!

That overboughtness is as unsustainable for stock markets as it was for gold in early May, fueling excess herd greed. Amplifying the need for a sharp selloff which could quickly snowball, stock-market valuations remain in dangerous bubble territory. Entering July, the 500 elite SPX stocks averaged literal-stock-bubble trailing-twelve-month price-to-earnings ratios way up at 29.7x! The classic bubble threshold starts at 28x.

The market-darling AI-bubble stocks are far worse, led by NVIDIA which exited June at an absurd 214.1x P/E!So a big stock-market selloff is overdue, which will likely be a serious pullback at best approaching 10%. But that could easily cascade into a full-blown correction running up to 20%, or even beyond that back into bear territory. These lofty euphoric stock markets decisively rolling over will rekindle gold investment.

Incredibly despite this latest gold upleg growing to those strong 26.3% gains in early May, there has been very little identifiable gold investment. Unfortunately, comprehensive global gold investment data is only published quarterly. But the combined holdings of the world-dominating American GLD and IAU gold ETFs have proven a good daily high-resolution proxy for that. They have barely budged during this upleg.

From late September to early May as gold’s upleg ran, GLD+IAU holdings actually fell 3.3% or 47.5 metric tons as the AI bubble gathered momentum!As of mid-week with gold still up 18.1% despite this recent pullback, GLD+IAU holdings are down 4.6% or 65.4t since gold’s stock-panic-grade low that birthed this upleg. At best within this upleg from mid-March to late May, these holdings only climbed 4.3% or 58.2t.

So gold has powered dramatically higher despite virtually no stage-three investment buying, which is what fuels major uplegs. Again up 26.3% at best, this latest one is the biggest by far since a pair of monsters cresting in 2020 where gold soared 42.7% and 40.0% higher. Strong investment buying drove those, with GLD+IAU holdings rocketing up 30.4% or 314.2t during the first and an even larger 35.3% or 460.5t in the second!

The biggest gold uplegs depend on robust investment demand. Thus when investment capital inflows start returning to gold, this latest upleg will resume and grow considerably larger. But since investors love chasing upside momentum, they probably won’t get the ball rolling. That will depend on the gold-futures speculators like usual. The extreme leverage they run grants them outsized influence over gold price trends.

Gold’s recent pullback again extended to 6.9% at worst as of last week. That isn’t unusual at all for a mid-upleg selloff to bleed off excessive overboughtness and rebalance sentiment. Back in February, this same gold upleg suffered a similar but sharper 7.2% plunge in just 0.8 months. That left really-bearish sentiment in its wake much like today, paving the way for gold to rebound sharply resuming its upleg.

Over the next 2.3 months, gold blasted up 13.2% to early May’s new upleg high of $2,050!Speculators’ leveraged gold-futures trading was responsible for all that, not identifiable investment demand. The same is true for gold’s latest pullback. During its 6.9% retreat, GLD+IAU holdings merely edged 0.7% or 9.2t lower as investors weren’t fleeing. But in that same span, speculators dumped a large 41.0k long contracts.

That’s the equivalent of 127.5 metric tons of gold, well over an order of magnitude bigger than investment selling! The more gold-futures selling speculators do, the less they have left to do. Their capital firepower for selling is quite finite. Eventually their longs get low enough and shorts high enough where they don’t have much more to sell. All they can do at that point is resume buying, normalizing their overall positioning.

As of the latest Commitments of Traders report detailing this, speculators’ total longs had fallen down to just 268.9k contracts. Those were their lowest levels since early March when gold’s upleg resumed and soon surged that 13.2% in just 2.3 months. After these traders have excessively sold gold futures, they soon resume buying catapulting gold higher. This perpetual dynamic will soon rekindle gold’s upleg again.

Total spec longs can be considered in a trading range, with this gold upleg’s starting at 247.5k back in late September when it was born. Spec longs have peaked far higher around 413k contracts in recent years, which is near where their buying firepower exhausts. That usually drives gold toppings ending uplegs. Spec longs’ high-water mark in today’s gold upleg was merely 318.5k in early May, still very low!

That 413k upper resistance less this upleg’s starting 247.5k yields a trading range of 165.5k gold-futures long contracts. As of last Tuesday’s latest CoT report, total spec longs are merely about 1/8th up into this key range. That implies a whopping 7/8ths of speculators’ likely gold-futures long buying remains to drive this gold upleg much higher! Even back in mid-October, I was forecasting it growing into another monster 40%+.

Today after this gold upleg’s second pullback, speculators have room to buy an enormous 144.1k gold-futures long contracts. That’s the equivalent of a massive 448.1t of gold! Even if specs only did half of this stage-two buying, it would almost certainly drive gold high enough for long enough to start enticing investors to return. I still expect today’s gold upleg to exceed 40% before giving up its ghost, besting $2,275.

That would generate a heck of a lot of excitement and greed, which investors would chase. Not adjusted for inflation, gold’s nominal all-time-record close is only $2,062 seen in early August 2020. So when spec gold-futures long buying to normalize their positioning inevitably drives gold decisively above that, it will be big and widely-covered financial news. New record highs really stoke investment demand for anything!

Since speculators have fled gold futures in recent months on Fed-hawkish economic data and officials’ jawboning, they’ll flock back when that turns dovish. And that’s increasingly probable soon here. As of early May, the Fed has hiked rates an exceedingly-extreme 500 basis points off zero in just 13.6 months! Now top Fed officials collectively expect another 50bp in their latest projections, or two more 25bp hikes.

So if this violent rate-hike cycle stretches to 550bp total, it is already 91% finished!If it somehow grows even bigger to 600bp, it is 83% complete. No matter what the Fed does from here, the lion’s share of its rate hikes are behind it. The Fed can’t keep hiking indefinitely without hammering the US economy into a severe recession or depression, and literally bankrupting the heavily-indebted US federal government.

So maybe after their next expected late-July hike or a second one in late September, Fed officials will have to start dialing back their hawkish rhetoric. Traders won’t believe they will keep hiking much beyond that. Then they will increasingly look for rate cuts, which often start soon after rate-hike cycles end. That will lead them to interpret Fedspeak and major economic data more dovishly, unleashing gold-futures buying.

Gold’s technicals should be considered against this impressively-bullish backdrop. This upleg’s latest pullback has fully eradicated the serious overboughtness and greed plaguing gold in early May. The yellow metal has been pounded back down near multiple major support zones. And it remains well within this upleg’s uptrend channel despite the surging bearishness lately. Gold is nicely set up to rebound sharply.

Gold’s bullish technicals are readily evident in this chart. Early May’s serious overboughtness with gold stretched way above its 200dma is gone. That collapsed from 1.132x at this upleg’s latest interim high then to just 1.030x last week! These key moving averages are major support zones within bull markets, and gold is within just a few percent of its 200dma. And it is still well above its uptrend’s lower support line.

Despite this latest pullback that so tanked herd sentiment, gold is still carving higher lows and higher highs on balance. The uptrend formed by its latest strong upleg since late September is still intact! Its lower support line is now running around $1,890, well below gold’s pullback-to-date closing low as of mid-week of $1,908. The crazy leverage in gold futures forces their traders to closely watch technicals like these.

They have to like what they see. Gold’s concerning overboughtness and greed in early May have now been totally erased. Gold remains well above important 200dma support, and well within its upleg’s uptrend channel. So any gold-futures buying sparked by increasingly-Fed-dovish news flow as the end of this rate-hike cycle nears will drive gold sharply higher. Investors will start taking note and chasing those gains.

The biggest beneficiaries of higher gold prices ahead as this strong upleg resumes will be gold stocks. The larger gold miners of the leading GDX gold-stock ETF tend to amplify gold’s gains by 2x to 3x. The fundamentally-superior smaller mid-tiers and juniors usually fare even better. GDX has already blasted up 63.9% at best in this gold upleg, for 2.4x upside leverage! And that tends to mount as gold uplegs mature.

The bottom line is gold technicals are very bullish after this upleg’s latest pullback. That has pounded gold back down near major support, eradicating early May’s serious overboughtness. Yet this strong gold upleg’s uptrend channel is intact, with the yellow metal still well above its lower support and 200-day moving average. That healthy mid-upleg pullback also accomplished its mission of bleeding off excessive greed.

Mostly fueled by speculators dumping gold-futures long contracts, gold’s latest selloff is running out of steam. With Fed hawkishness soon giving way to dovishness as this rate-hike cycle peters out, spec long buying will soon return. That will push gold high enough for long enough to start enticing back investors to chase its upside momentum. Gold’s summer doldrums passing and lofty stock markets rolling over will help.

More By This Author:

Gold Stocks At Key Support

Gold-Stock Seasonal Buy

Gold Bottoming Despite Fed