Gold Targets $3,000 Amid Geopolitical Tensions

Image Source: Pixabay

Gold has maintained a consistent presence in the financial markets, as it is often considered a safe haven during economic uncertainty. This past week, gold’s price movements have shown a consolidation pattern, oscillating around the $90 level and avoiding a downward correction that the market has been expecting to see after such a strong rally.

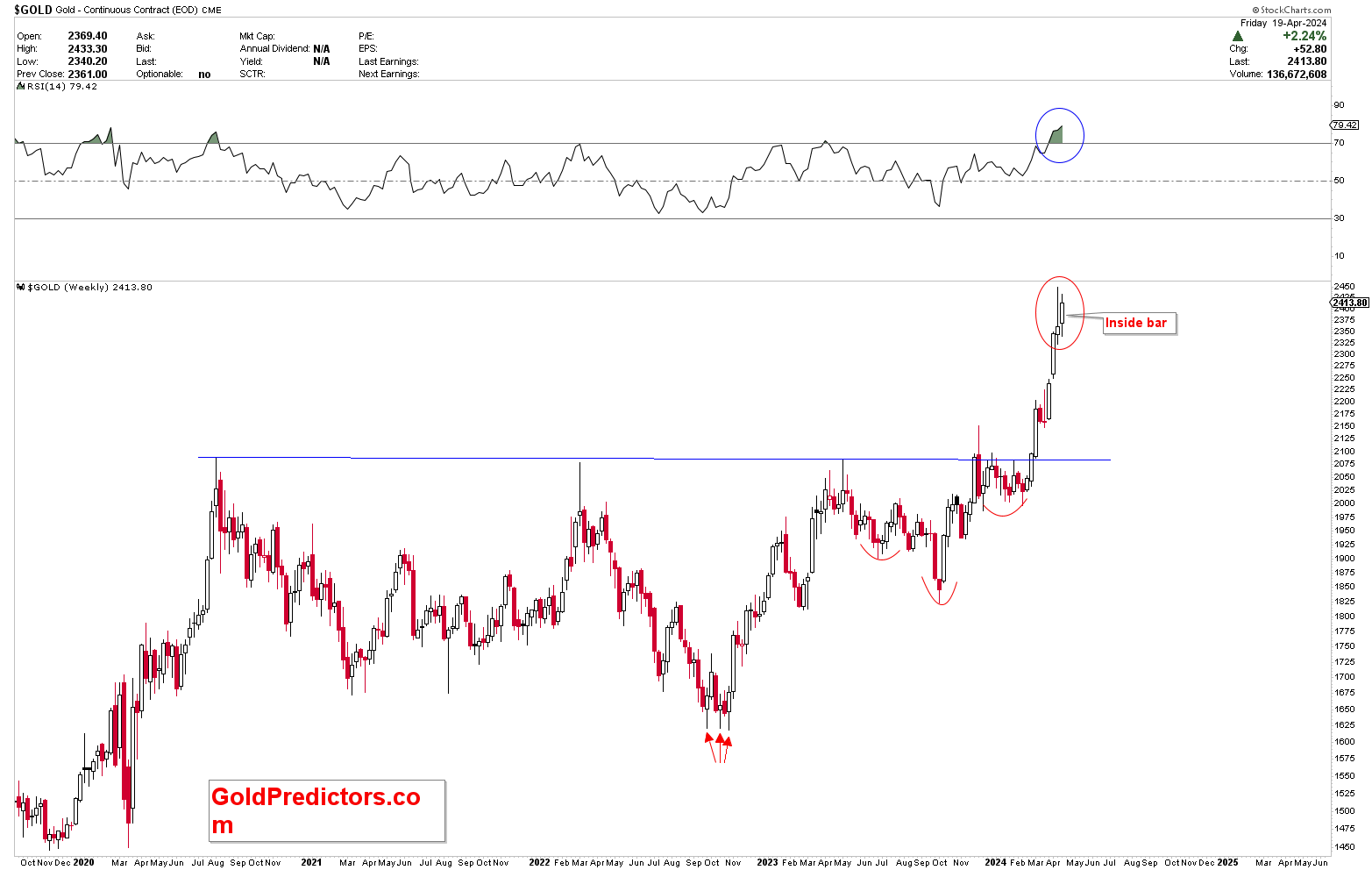

This consolidation has set the stage for another bullish outlook. The closing price of the week was intense, resulting in an inside bar on the weekly chart. Inside bars are significant, as they often indicate a potential shift in market dynamics and hint at a future change in price direction.

The strength of this inside bar, which emerged after a close at higher levels, suggests a solid upcoming move if the bar’s upper limit is broken, possibly leading to new highs. The rise in gold due to geopolitical tensions might be huge.

(Click on image to enlarge)

The short-term cycles were previously discussed as a potential peak for gold prices on April 9, with the highest price point being reached on April 12, 2024. Since then, prices have not broken to new highs, instead entering a short-term corrective phase. We are now on the seventh day of this correction. This indicates that gold may establish a market bottom next week, and it may potentially rally after that.

Geopolitical Tensions and Future Price Targets

Recent escalations in geopolitical tensions in the Middle East have spurred increased demand for gold as a haven asset. These tensions are impacting investor sentiment, and this is starting to reflect in the gold market’s price actions.

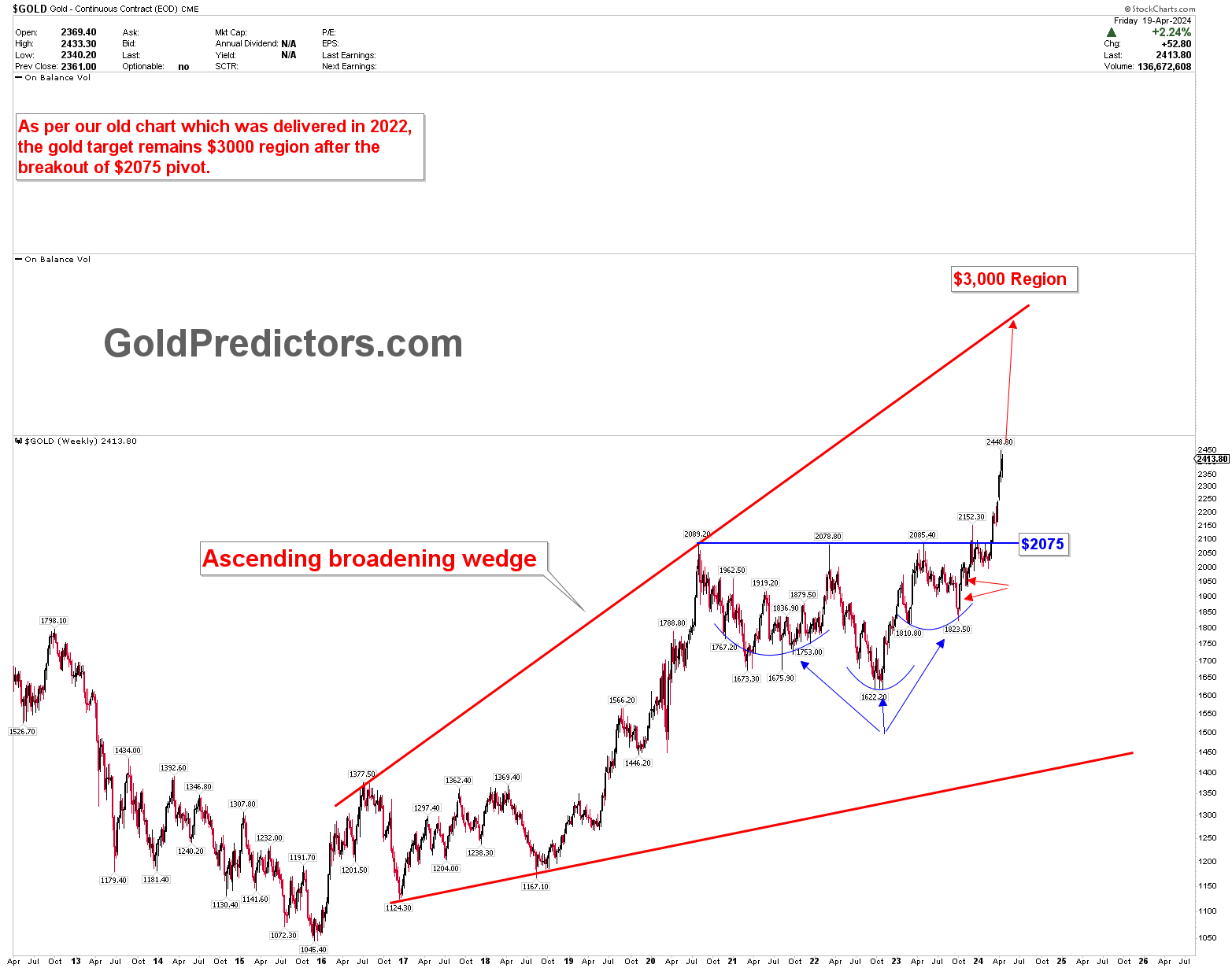

Last week’s inside bar formation suggests we might be on the brink of another significant surge in the gold market. This is underscored by the breach of a long-term pivotal resistance at $2075, which had capped price movements for many years. The breakout from this critical resistance point suggests a potentially substantial upward trajectory for gold prices.

A recently updated chart analysis that was previously shared with members in 2022 shows that gold prices are currently situated within an ascending broadening wedge. This pattern is further corroborated by an inverted head-and-shoulders formation, projecting a potential target in the $3,000 region.

While this target may seem ambitious given the current price levels, the prevailing market volatility, amplified by global crises, adds to the plausibility of such a surge. These factors will likely significantly influence the gold and broader commodity markets, including oil. The rise in gold might hit the regions above $3,000.

(Click on image to enlarge)

The confluence of market patterns and geopolitical events presents a complex but potentially rewarding scenario for gold investors. As the situation unfolds, the strategic positioning and analysis of market signals will be crucial for capitalizing on these volatile conditions’ opportunities.

With the market at a critical juncture, investors and traders must stay attuned to global events. The market signals to navigate the uncertainties and harness the potential gains from gold’s dynamic movements. As per the above explanation, the breakout from the $2,075 mark seems to indicate that gold is targeting the $3000 level.

More By This Author:

Silver Set To Outperform Gold As Global Crisis EscalatesGold Price Responses To Market Stress And Geopolitical Tensions In The Middle East

Silver Primed For Surge As Renewable Energy And Electric Vehicles Drive Demand

Disclosure: Materials distributed by GoldPredictors.com has no regard to the specific investment objectives, financial situation or the particular needs of any visitor or subscriber. This site ...

more