Gold Stocks: The Upcoming Decline's Harbinger

What a beautiful day that was! Well, the weather varied in different places of the planet, so I don’t mean that literally. What I mean is that Mr. Market was generous and provided us with a major confirmation exactly when it was needed.

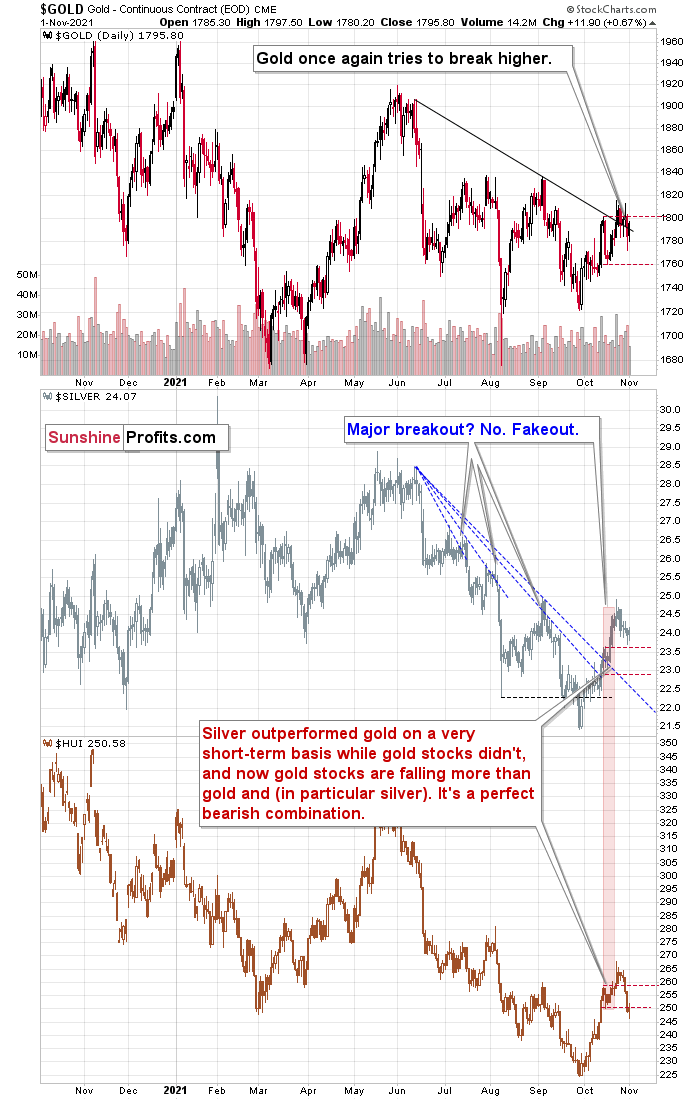

Friday’s performance was breathtakingly bearish, as miners declined a few times more than gold and – in particular – silver, which is exactly the thing that we tend to see at the beginning of a short-term decline.

But maybe it was a single-day event only? One swallow doesn’t make a summer.

The question is: was Friday’s session a swallow?

It wasn’t, and what we saw yesterday confirms it.

Gold moved higher and attempted to once again break above its declining resistance line. The move took place on relatively weak volume, which is exactly the opposite of what one should see as a sign of a breakout confirmation. What we saw yesterday was not (at least not yet) a bullish signal for gold. However, that’s not the most interesting thing that happened yesterday.

Silver did very little, and it’s not that informative on its own. It’s informative because it didn’t decline a lot. In particular, it didn’t catch up with mining stocks’ decline.

And this brings us to the main analytical course of today’s menu.

The Main Dish

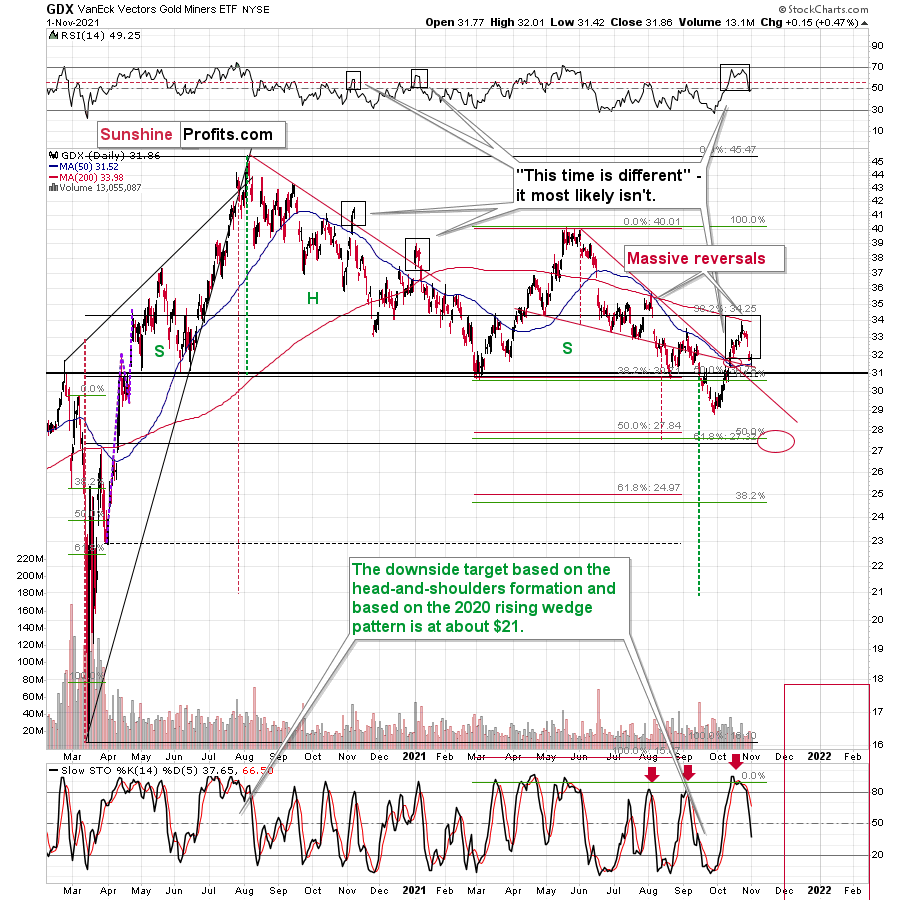

Gold stocks didn’t rally back up despite the volatile nature of Friday’s decline and despite gold’s ~$12 rally. The general stock market was slightly up yesterday, so miners had no good reason not to rally. Unless…

Unless it’s the beginning of another big decline, and we are still very early in the process. In this case, it would be perfectly understandable for the mining stocks to behave this way.

Gold miners had all the reasons to erase a large part of their Friday’s declines, but they didn’t do so. What does it indicate for gold?

The GDX was up by $0.15, and the GDXJ was up by $0.38. So, they barely moved.

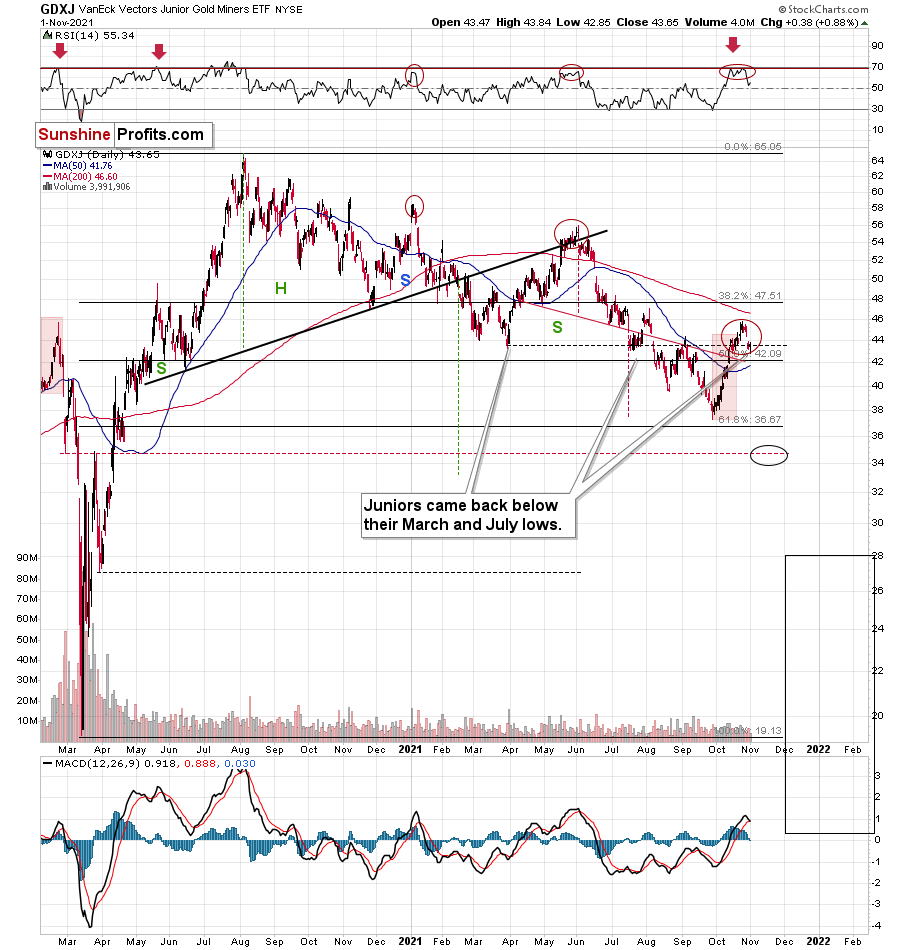

By the way, do you see how little it now takes for the MACD based on the GDXJ (lower part of the above chart) to flash a sell signal? The upcoming sell signal will (as it’s likely just ahead) be similar to only two events from the recent past – the January top and the June top.

What followed in both cases? Significant declines. Is this time different? You already know the answer. It’s highly unlikely.

Moving back to miners’ relative performance, if you take into account Friday’s and Monday’s sessions at the same time, you get the following price moves:

- Gold price is down by $6.8 (0.38%)

- Silver price is down by $0.05 (0.21%)

- GDX is down by $0.73 (2.24%)

Silver is holding up quite well while miners are strongly underperforming – that’s exactly what one should see at the beginning of a big move lower.

All in all, while the outlook for the precious metals sector is very bullish for the following years, it’s very bearish for the following weeks.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more