Gold Stocks Get Into An Elevator With The S&P 500 – Up Or Down?

As might have been deduced, the stock market invalidated its recent upswing. What's more, it dragged gold miners down. But is this really a bearish story?

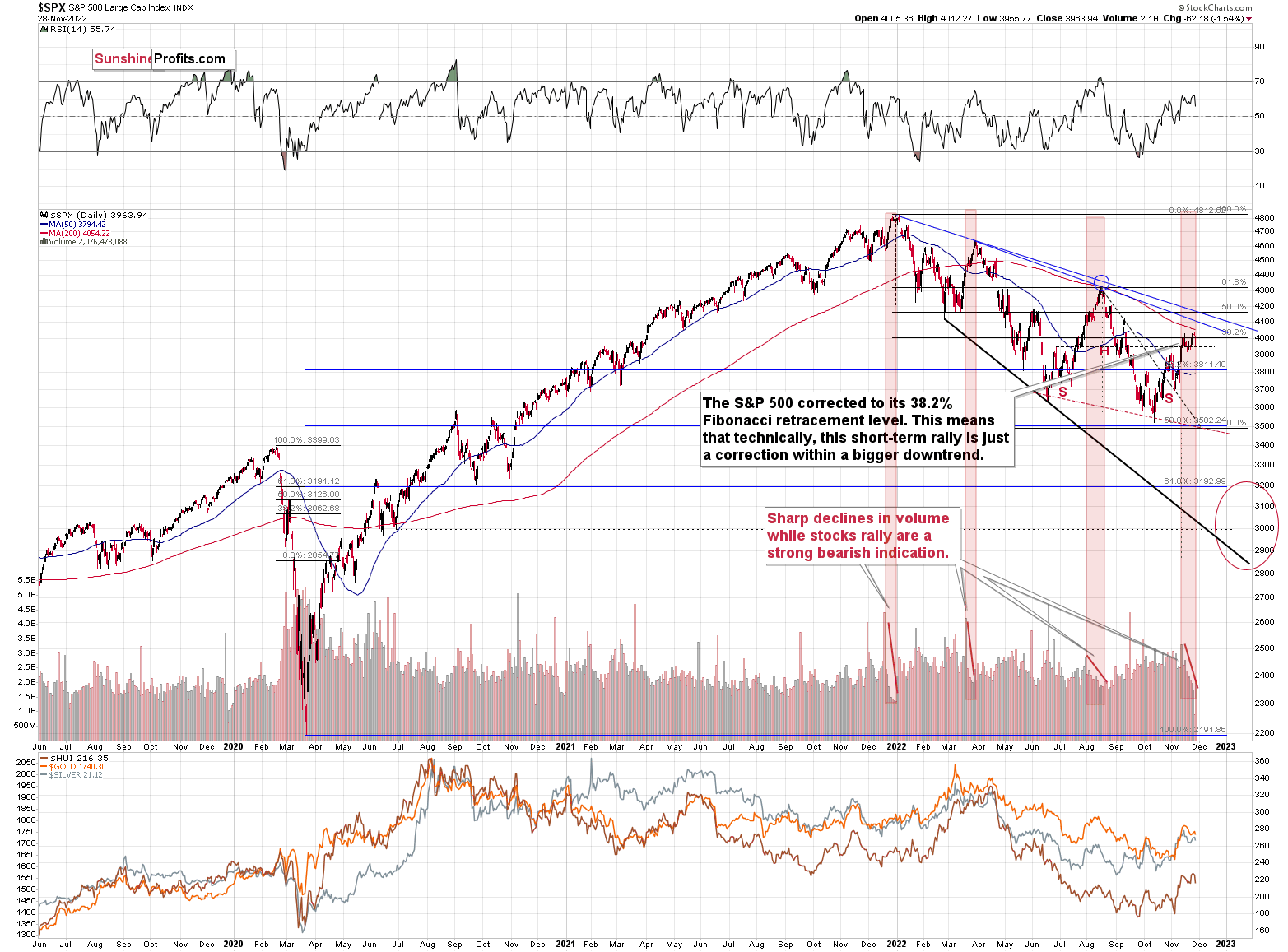

In yesterday’s analysis, I wrote that the stock market was likely to invalidate its recent upswing above its 38.2% Fibonacci retracement level, and that’s exactly what happened.

I wrote the following:

We just saw a small attempt to break above the 38.2% Fibonacci retracement, and I doubt that this breakout will be confirmed. The “why” behind it is currently the most interesting analogy that we see on this market.

Please take a look at the areas marked with red rectangles. In all those cases, the S&P 500 index rallied on big volume at first, and then the volume declined over the course of a few weeks. And as that happened, the price approached its top.

All three previous important tops that we saw this year were accompanied by this indication.

We also see it right now.

Even more interestingly, the volume levels that have just been seen are similar to the ones that accompanied previous tops.

Consequently, it seems that the end of the rally is near. This is likely to have very bearish implications for junior mining stocks.

Stocks declined and ended the day below the above-mentioned 38.2% Fibonacci retracement and the 4,000 level, which has profoundly bearish implications for the following weeks.

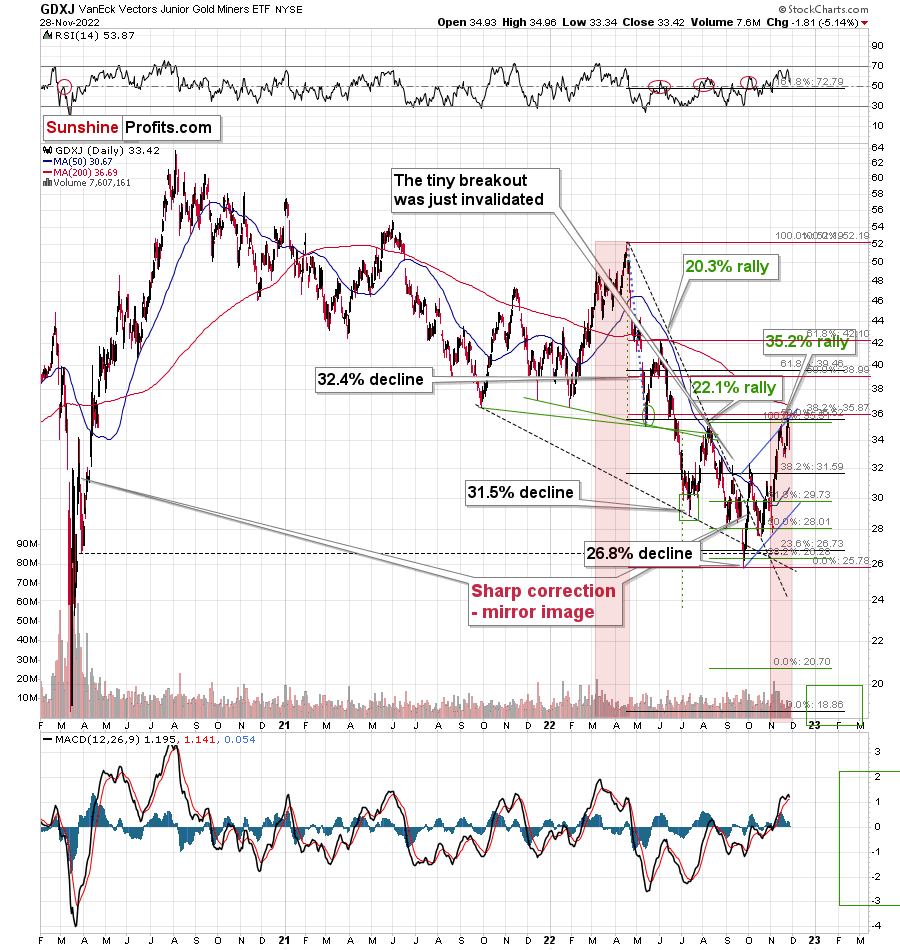

Indeed, junior miners’ prices fell substantially during yesterday’s trading.

When viewed broadly, a drop of more than 5% is not that significant, but it is, in my opinion, not so huge yet. Silver’s price was down more than gold’s (1.42% vs. 0.78%), but junior miners declined the most. Even more than senior miners – the GDX ETF was down by 4.01%.

No wonder – junior miners’ prices have the strongest link with the performance of the general stock market, and as the rallying stocks uplifted juniors in the previous weeks, now they are likely to drag juniors lower. Much lower.

I previously compared the current situation to the one from March and April 2022 in the following way:

The ETF moved higher on Wednesday and then lower on Friday. Most importantly, it moved in near-perfect tune with how it had moved earlier this year – in March and April.

I marked both situations with red rectangles. The initial rally was accompanied by huge volume, which then waned over the following days and weeks. That’s pretty much what we saw in November – and earlier this year.

Moreover, the GDXJ touched its upper border of the flag pattern once again. It also touched the resistance levels provided by the previous highs (moved slightly above them) and the 38.2% Fibonacci retracement level based on the entire 2022 decline.

This means that the top is likely in or at hand.

Juniors just moved back below their previous November high as well as back below their August high. This invalidation – similarly to the invalidation in stocks – suggests that lower values of mining stocks are likely just around the corner.

What about gold’s outlook?

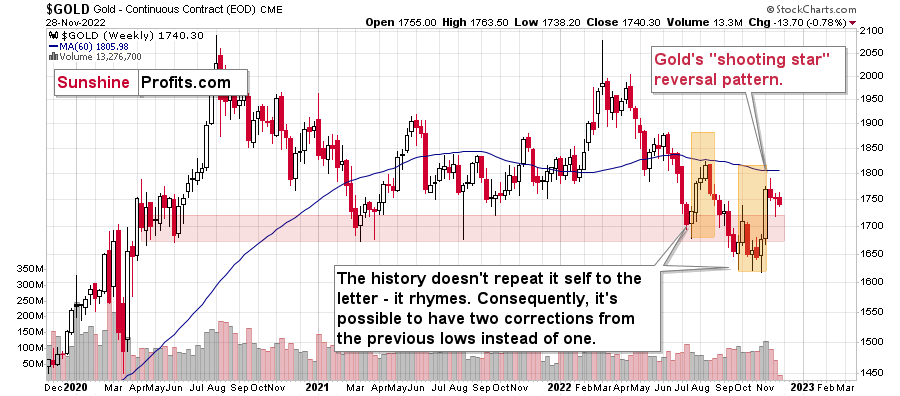

Well, gold is behaving just like it was likely to after the powerful weekly reversal that we saw a bit over a week ago.

Last week it reversed to the upside, but the volume on which it did so was weak, so it wasn’t believable.

And indeed, this week gold is moving lower.

What’s next? As stocks are likely about to slide, and so is gold, the prices of mining stocks are likely to tumble – rather sooner than later.

More By This Author:

If The Correction Is Over, It Can Mean One Thing For The Gold Price

Could Bitcoin’s Movements Indicate The Fall Of Junior Gold Stocks?

If Gold Started Plunging, Is The Miners’ Fate Already Sealed?

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more