Gold Steadies Above $4,000 As US Dollar Loses Momentum

Image Source: Pixabay

Gold (XAU/USD) is attempting to stabilize on Wednesday after a brutal selloff from record highs the previous day, finding some support as the US Dollar (USD) softens. At the time of writing, XAU/USD is trading around $4,040, down over 1.50% after briefly dipping to $4,004 earlier in the day.

Bargain hunters are stepping in near the $4,000 psychological mark, but the rebound so far remains shallow. The yellow metal suffered its biggest one-day decline since August 2020 on Tuesday, plunging over 5% as investors rushed to lock in profits following an overextended rally to $4,380. The correction was long overdue, with momentum indicators flashing signs of exhaustion in recent sessions.

Meanwhile, investor optimism that a renewed escalation in US-China tariffs can be avoided, with high-level trade talks scheduled later this week, has curbed safe-haven demand.

In the near term, Gold’s bias appears mildly bearish as markets continue to digest Tuesday’s sharp correction. However, the broader outlook remains constructive. The metal could regain traction if trade tensions flare up or if risk sentiment deteriorates.

Meanwhile, downside risks are likely limited by expectations of a dovish Federal Reserve (Fed) stance, the prolonged United States (US) government shutdown, and persistent geopolitical and economic uncertainties that continue to underpin long-term demand for safe-haven assets.

Market movers: Focus stays on tariffs, Fed and shutdown

- US President Donald Trump said at the White House on Tuesday that he expects to meet Chinese President Xi Jinping in South Korea, adding that he hopes to “make a good deal with him.” He later suggested the meeting “might not happen,” leaving investors uncertain as his shifting remarks on trade continue to cloud expectations around the upcoming talks. Earlier, he floated the idea of imposing 155% tariffs on Chinese imports starting on November 1 if no agreement is reached.

- US Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng will meet in Malaysia this week for high-level trade discussions aimed at easing tensions and preventing a new tariff escalation. The talks are expected to cover tariffs, rare-earth export controls, and agricultural trade commitments, coming ahead of the current US-China tariff truce deadline on November 10. Analysts expect both sides to seek another short-term extension or limited truce to keep negotiations on track and avoid a renewed escalation.

- The US government shutdown entered its twenty-second day on Wednesday, marking the second-longest in history, with negotiations between the White House and Congress still deadlocked. President Trump reiterated that Republicans “will not be extorted,” as discussions over a funding deal remain stalled.

- On the geopolitical front, Bloomberg reported on Tuesday that Europe and Ukraine are preparing a 12-point peace proposal aimed at ending the war with Russia. The plan reportedly includes a cease-fire along existing front lines, security guarantees for Ukraine, and conditional sanctions relief for Moscow.

- The US economic docket is light this week, with focus on Friday’s Consumer Price Index (CPI) and preliminary S&P Global Purchasing Managers Index (PMI) readings for October. Markets now see a quarter-point rate cut as a near certainty at the October 29-30 monetary policy meeting, though the inflation data could still influence expectations for the Fed’s path ahead.

Technical analysis: XAU/USD extends slide after double-top breakdown

-1761133588517-1761133588519.png&w=1536&q=95)

XAU/USD remains on the defensive, extending its sharp decline from recent record highs and confirming a near-term bearish structure on the 4-hour chart. The metal has clearly violated the neckline of a double-top pattern around $4,200, a move that reinforces the downside bias after buyers failed to defend this key support.

Immediate resistance is seen around the 100-period Simple Moving Average (SMA) near $4,063, followed by the 50-period SMA around $4,193. On the downside, a sustained close below $4,000 would expose the next support zone around $3,950, while any rebound above $4,150 could attract short-covering but is likely to meet fresh supply.

The Relative Strength Index (RSI) remains weak near oversold territory around 31, showing persistent bearish momentum. Unless the metal regains a foothold above the $4,200 neckline, the near-term outlook will likely remain pressured, favoring further consolidation or mild downside extension.

US Dollar Price Today

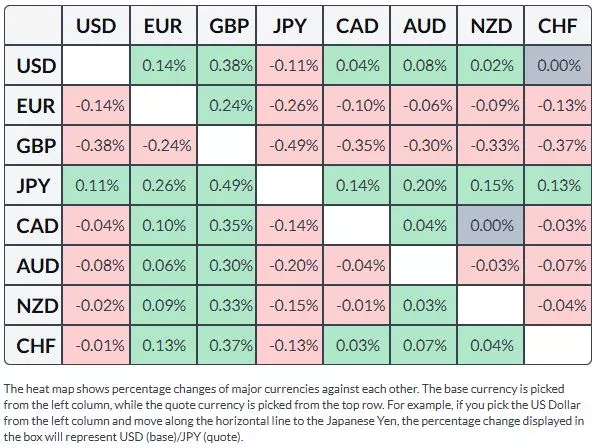

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the British Pound.

More By This Author:

EUR/USD Extends Losses With ECB's Lagarde, Fed Speakers On FocusForex Today: Pound Sterling Drops On Soft UK Inflation Data

Silver Sinks As Risk-On Sentiment, Trade Optimism Weigh

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more