Gold: Stagflation Or Deflation

Inflation Or Stagflation?

The latest Consumer Price Index (CPI) just came out and was slightly lower than expected. The CPI rose in August but inflation appears to be easing. The CPI increased 0.3% from July. Compared to a year ago, the CPI rose 5.4% excluding food and energy.

Gold

The gold market was choppy today and made a low of $1780.60. It stabbed into the area of support and accumulation of supply, where our AI algorithm, the Variable Changing Price Momentum Indicator (VC PMI), expects buyers to come into the market at these levels. The AI advises not to sell into this area. In fact, there is a 90% to 95% probability that a reversion will occur from these levels. Such a reversion then occurred and we ran back up to the target above the mean of 1802.

Courtesy: ema2trade.com

The metals markets have the most bullish fundamentals in history from a monetary policy point of view with the printing of so much money, from an economic point of view based on supply chain issues and shortages, and from a physical supply point of view. We want to see the delayed reaction in the gold market to all of these factors which could be explosive.

Courtesy: TD Ameritrade

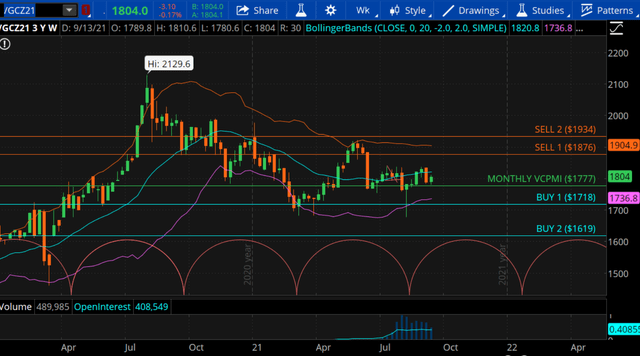

Since the pandemic hit in March 2020, when gold made a low of $1450.90, it has rallied all the way up to $2089. The rally was in relation to the shift in monetary policy when the government announced a massive stimulus package to prevent the economy from slipping into recession. It triggered a solid $600 move in gold in a fairly brief time. Then gold discounted the potential damage from the pandemic and reverted to wait to see the real damage that had been done to the economy. Gold came back down to $1673 on March 8, 2021. It was a golden ratio retracement. It was, however, against all the fundamentals for gold. We had never seen such damage to the economy caused by the pandemic, yet gold came down. The market bottomed in March 2020. The stock market also transitioned at that time, marking the beginning of the virtual economy in which we are in today. The smart money discerned that March 2020 marked a change and since then the stock market has more than doubled, except for the yellow metal.

Courtesy: TD Ameritrade

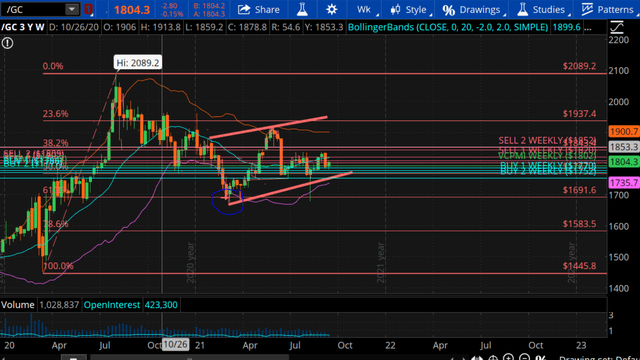

Gold rallied from $1673 to a high on May 26 of $1919. It is a technical rally. The fundamentals have been bullish since the pandemic hit, yet gold has come way down and then back up. We are in a long-term uptrend channel. There was another sell-off when the Fed mentioned they were possibly talking about tapering. Metals, stocks and commodities all fell on the news that tapering might be under discussion. Short sellers came in around August 9 and tried to break the previous low from last March, but the market reversed and started up again. It activated a major buy signal.

Courtesy: TD Ameritrade

The market last week reached $1836, a resistance level, and could not follow through up to $1852, which was the weekly level of resistance. It fell back to $1820, a weekly level, and activated the VC PMI weekly mean of $1802. We are now trading at a support level of $1780 or $1786. We are looking for a major weekly reversal.

Courtesy: TD Ameritrade

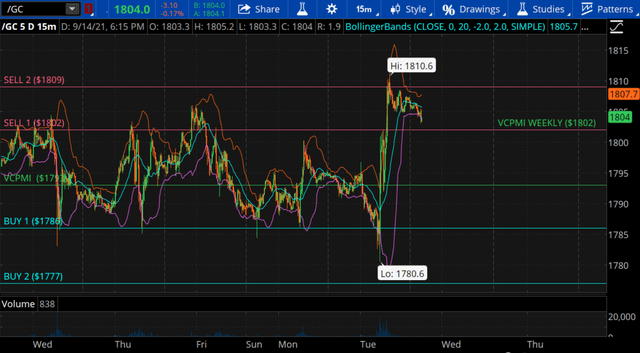

For the VC PMI daily signals, gold came down to the levels of support around $1786 to $1777. Then it reverted. It completed the daily target of $1802. The second target is $1809. A close above $1802 will make this resistance level support and activate the $1809 target. It will also activate the VC PMI weekly price momentum. The trend momentum is the 9-day or 9-week moving average which gives us the big picture, whether it is a bearish trend or bullish. The price momentum identifies the volatility of the price within that trend. If gold closes above $1809, then we are likely to see $1820. We bought at $1791.20, which was the weekly buy signal. We are holding onto that position with a nice profit already built-in with a trailing stop.

Disclosure: I/we have a beneficial long position in the shares of GDX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own ...

more