Gold Slips Below $3,300 On US Dollar Strength As Traders Await Fed Minutes

Image Source: Pixabay

- Gold retreats after earlier bounce to $3,325; sellers return as yields and US Dollar regain footing.

- Fed Minutes eyed for clarity; dovish surprise could reignite Bullion’s stalled rally.

- Goldman Sachs urges higher Gold allocation amid geopolitical risks and central bank demand.

Gold price extended its losses during the North American session on Wednesday after hitting a daily high of $3,325 earlier in the day as market sentiment shifted sour. Nevertheless, sellers stepped in, driving the yellow metal prices below $3,300, resulting in a solid 0.18% decline.

Price action has remained calm as traders await the release of the Minutes of the latest Federal Reserve (Fed) meeting at 18:00 GMT. Although it could move the markets, Fed officials have expressed that they are in wait-and-see mode, trying to assess the impact of tariffs imposed by the United States (US).

Bullion’s rally appears to have stalled during the week as US Treasury bond yields recovered some of the previous week’s fall, underpinning the US Dollar. However, a surprise dovish tilt in the Minutes, the less likely scenario, could drive XAU/USD prices higher.

On Tuesday, Fox Business News Gasparino, in a post on X, revealed that a framework between the US and India is close to being announced. It should be noted that the US has taken a more flexible approach to trade talks.

Despite this, the Gold upside remains due to increasing geopolitical tensions between Russia and Ukraine, as well as the Middle East conflict involving Israel and Hamas.

Goldman Sachs analysts recommended a higher-than-usual allocation to Gold in long-term portfolios, revealed Reuters. They cite elevated risks to US institutional credibility, pressure on the Fed, and sustained central bank demand.

Ahead in the week, the docket will feature the Fed’s Minutes, the second estimate for Gross Domestic Product (GDP) in Q1 2025, and the Fed’s preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index.

Gold daily market movers: Bullion retreats on strong US Dollar and high US yields

- US Treasury bond yields are rising as the 10-year Treasury note yield increases by four and a half basis points (bps) to 4.493%. Meanwhile, US real yields also advance four bps at 2.171%.

- The US Dollar Index (DXY), which tracks the buck’s value against a basket of six currencies, rises over 0.33% to 99.89, fueled by an improvement in Consumer Confidence data, which grew the most in four years, revealed the Conference Board .

- New York Fed President John Williams said that inflation expectations are well-anchored and added that he wants to avoid inflation becoming highly persistent, as that could become permanent.

- Data revealed that Gold imports to Switzerland from the US rose to its highest level since at least 2012 in April.

- Besides this, Reuters revealed that “China's net gold imports via Hong Kong more than doubled in April from March, and were the highest since March 2024, data showed.”

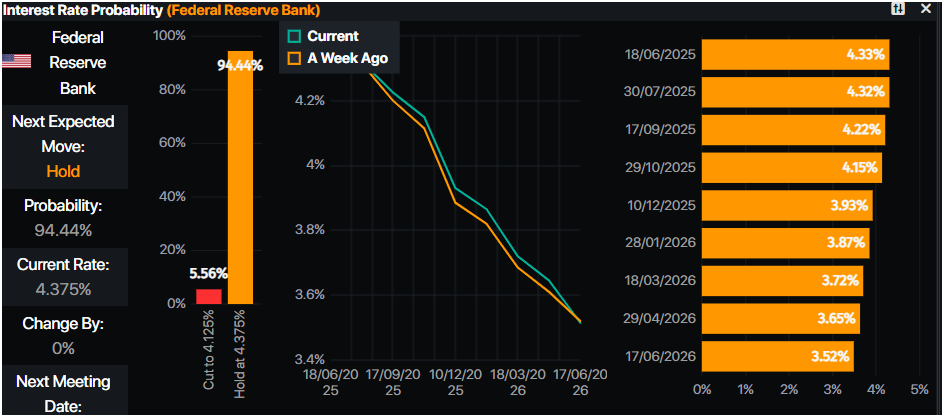

- Money markets suggest that traders are pricing in 44.5 basis points of easing toward the end of the year, according to Prime Market Terminal data.

Source: Prime Market Terminal

XAU/USD technical outlook: Gold price pullback to challenge $3,250

Gold prices have consolidated within the $3,280-$3,330 range over the last four trading sessions, as bullish momentum appears to be fading due to technical reasons. Momentum, as measured by the Relative Strength Index (RSI), is aiming toward its 50-neutral line, which if broken, could sponsor a leg-lower in XAU/USD prices.

For a continuation of the uptrend, bulls must clear $3,300, $3,400 and the May 7 swing high of $3,438. If achieved, Gold’s next goal would be $3,500.

On the downside, Gold tumbling below $3,250 could expose a move to the 50-day Simple Moving Average (SMA) at $3,211, followed by the May 20 daily low of $3,204.

More By This Author:

U.S. Yields Slide As Japan’s Signal Shift In Debt StrategySilver Price Forecast: XAG/USD Slips But Clings Above $33.00

Gold Price Plunges Almost 2% On Risk Rally Spurred By Tariff Delay

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more