Gold Slips As Trump-Xi Call Eases Trade Tensions, Markets Await U.S. NFP

Photo by Dmitry Demidko on Unsplash

Gold price pared its earlier gains after breaking news revealed that the call between US President Donald Trump and his Chinese counterpart, Xi Jinping, was positive, with the two primarily discussing trade, according to Trump. At the time of writing, XAU/USD trades at $3,350, down 0.72%.

In his social network, Trump revealed that the call was positive, adding, “There should no longer be any questions respecting the complexity of Rare Earth products.”

He said that US and Chinese teams would be meeting in a location to be determined. The news sent Bullion prices downward, as risk appetite improved even though US economic data disappointed investors and increased the chances for a Federal Reserve (Fed) rate cut this year.

The US Bureau of Labor Statistics revealed that, indeed, the labor market is weakening as the number of Americans filing for unemployment benefits rose. Other data showed the trade deficit narrowed in April, according to the US Bureau of Economic Analysis, as the front-load of goods ahead of tariffs ebbed.

The Greenback trimmed some of its earlier losses, as revealed by the US Dollar Index (DXY). The DXY, which tracks the buck’s value against six peers, is virtually unchanged at 98.75.

Gold’s faith will lie in Friday’s Nonfarm Payrolls (NFP) figures. If the data show that the labor market remains solid, the yellow metal could edge lower as the US Dollar rises. Otherwise, expect further upside in XAU/USD as investors would grow confident that the Fed could cut rates earlier than expected.

Daily digest market movers: Gold sinks on market mood improvement, high US yields

- Gold price dives as Wall Street registers modest gains at the time of writing. Also, a spike in US Treasury yields weighed on the non-yielding metal, which is set to reverse Wednesday’s gains. Despite this, Gold, usually a safe-haven asset during times of political and economic uncertainty, is up around 29% this year.

- The US 10-year Treasury yield rises 4.5 basis points to 4.377%. US real yields have followed suit and are also up two basis points at 2.065%, a headwind for Bullion prices.

- Initial Jobless Claims for the week ending May 31 increased by 247K, above estimates of 235K and up from the previous week's 240K. The data reinforced the ADP Employment Change report for May, which could be a prelude for a negative Nonfarm Payrolls report.

- The US Trade Balance revealed that the deficit narrowed sharply in May, contracting by 55.5% to $-61.6 billion, the lowest since September 2023.

- According to Reuters, Metals Focus said, “Central banks worldwide are set to buy 1,000 metric tons of Gold in 2025, marking a fourth straight year of massive purchases as they shift reserves away from [US D]ollar assets.”

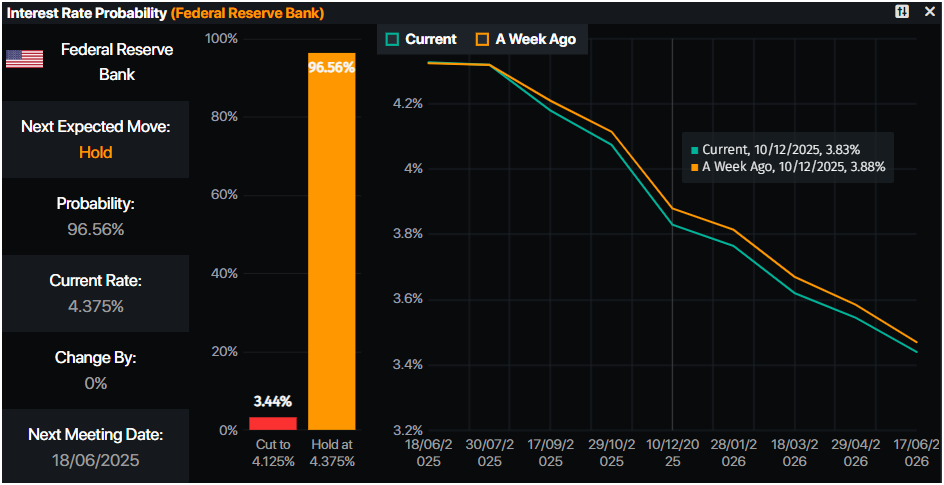

- Money markets suggest that traders are pricing in 54.5 basis points of easing toward the end of the year, according to Prime Market Terminal data.

(Click on image to enlarge)

Source: Prime Market Terminal

XAU/USD technical outlook: Gold remains bullish despite losing some ground below $3,360

Gold remains upwardly biased, but the ongoing dip could send XAU/USD downward to test $3,300. Although the Relative Strength Index (RSI) portrays buyers losing steam, it remains above the 50-neutral line. Unless sellers push the RSI below the latter, if XAU/USD remains above the June 3 low of $3,333 an upside move is on the cards.

Therefore, Gold's next resistance is $3,350. A breach of the latter exposes $3,400, followed by the May 7 peak at $3,438. On further strength, the $3,450 figure and the all-time high (ATH) at $3,500 are up for grabs.

On the other hand, if Gold falls below $3,300, sellers could send XAU/USD on a tailspin, testing the 50-day Simple Moving Average (SMA) at $3,235, followed by the April 3 high, which has since turned into support at $3,167.

(Click on image to enlarge)

More By This Author:

USD/CAD Slips Below 1.3650 As US Jobless Claims Rise, Canada’s PMI Contract

Silver Price Forecast: XAG/USD Holds Steady Near $34.50 As Bulls Take A Breather

Gold Price Surges On Weak US ISM Report; Trade Tensions Boost Safe Haven Demand

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more