Gold Slides Massively – Be Ready For More!

What a week! Gold has dropped almost $60 since Friday, and silver came along reaching new yearly lows! Are you prepared for a wild ride downwards?

The USD Index (USDX)

While many investors forecasted a sharp decline in the USD Index, I warned on Aug. 2 that the stars were aligning for the greenback. And with gold, silver, and mining stocks exhibiting strong negative correlations with the U.S. dollar, the latter’s rise could result in the former’s demise.

I wrote:

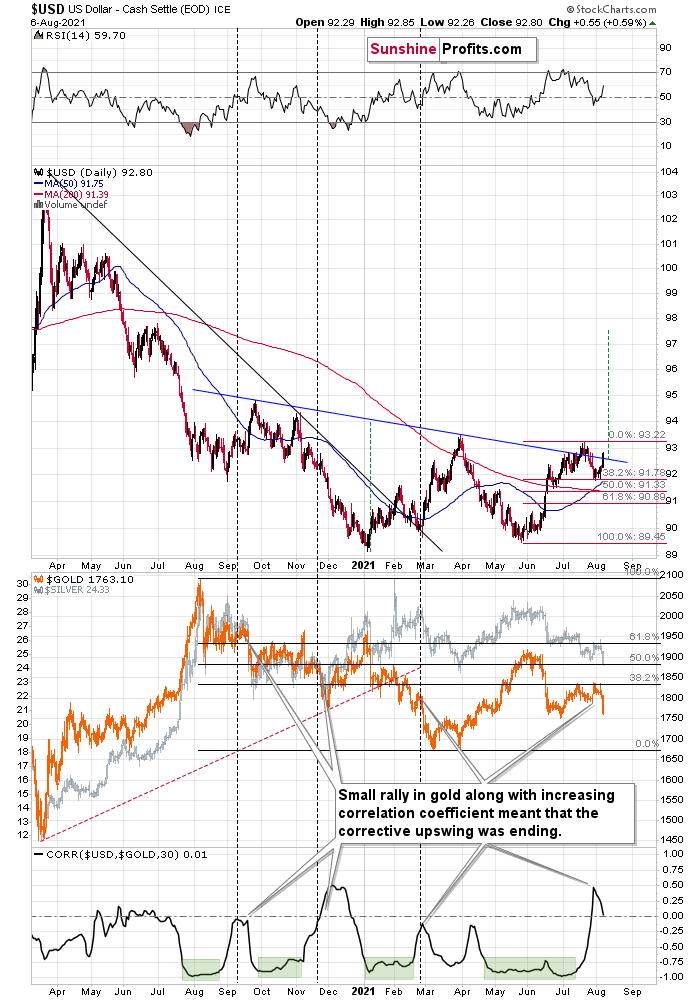

With the USD Index demonstrating late-week strength and bouncing off of the 38.2% Fibonacci retracement level, the greenback may have recorded a short-term bottom. In both 2008 and 2014, small moves lower solidified the USD Index’s short-term bottoms and remarkable rallies followed. In fact, the rapid reversals in both cases occurred with RSIs near 50 (close to the current reading of 53.32) and it’s likely a matter of when, not if, the greenback records a significant upward re-rating. The bottom line? The PMs will likely bear the brunt of the USD Index’s forthcoming strength.

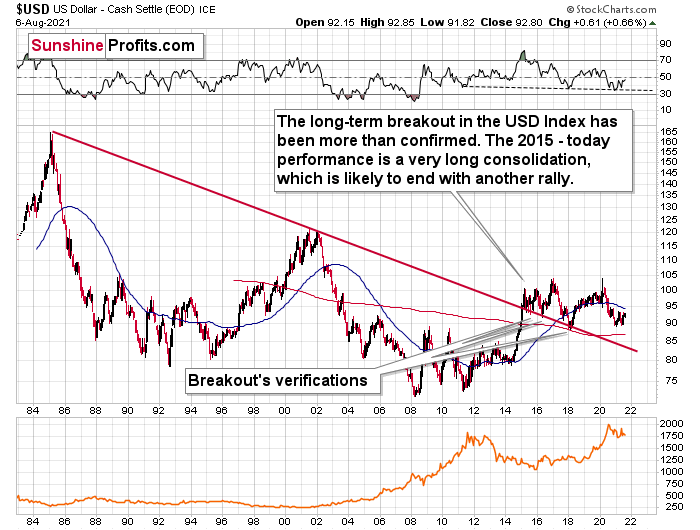

And after the USD Index soared back above the neckline of its inverse (bullish) head & shoulders pattern last week – and caused gold, silver, and mining stocks to plunge in the process – the USDX remains poised to recapture ~98 over the medium term.

Please see below:

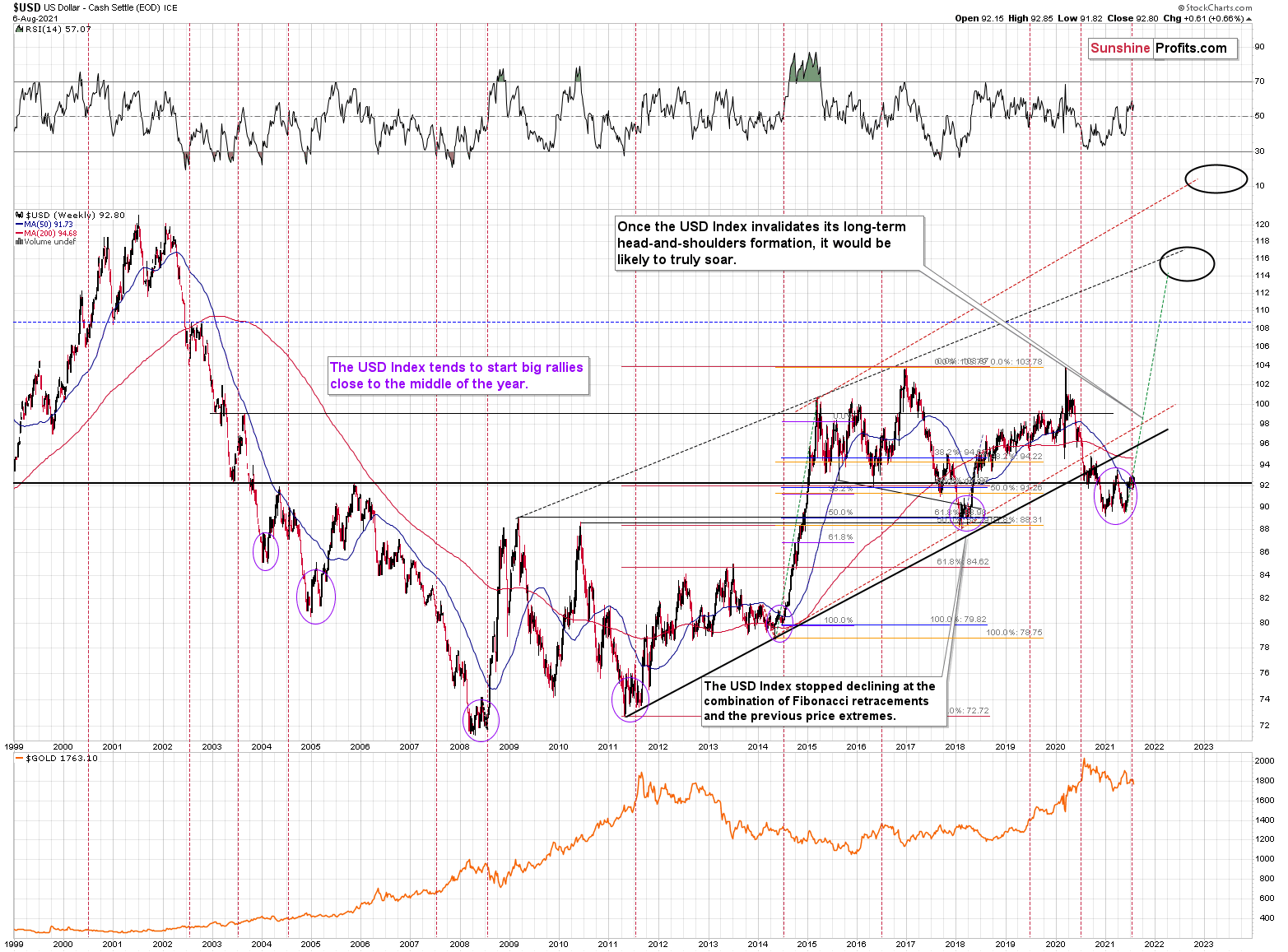

To explain, the USD Index often sizzles in the summer sun and major USDX rallies often start during the middle of the year. For example, summertime spikes have been mainstays on the USD Index’s historical record and in 2004, 2005, 2008, 2011, 2014, and 2018, a retest of the lows (or close to them) occurred before the USD Index began its upward flights.

What’s more, profound rallies (marked by the red vertical dashed lines below) followed in 2008, 2011, and 2014. And with the current situation mirroring the latter, a small consolidation on the long-term chart is exactly what occurred before the USD Index surged in 2014. Likewise, the USD Index recently bottomed near its 50-week moving average; an identical development occurred in 2014. More importantly, though, with bottoms in the precious metals market often occurring when gold trades in unison with the USD Index (after ceasing to respond to the USD’s rallies with declines), we’re still far away from that milestone in terms of both price and duration.

Please see below (quick reminder: you can click on the chart to enlarge it):

Just as the USD Index took a breather before its massive rally in 2014, it seems that we saw the same recently. This means that predicting higher gold prices here is likely not a good idea.

As further evidence, the eye in the sky doesn’t lie. And with the USDX’s long-term breakout clearly visible, the smart money is already backing the greenback.

Please see below:

The bottom line?

Once the momentum unfolds, ~94.5 is likely the USD Index’s first stop, ~98 is likely the next stop, and the USDX will likely exceed 100 at some point over the medium or long term. Keep in mind though: we’re not bullish on the greenback because of the U.S.’ absolute outperformance. It’s because the region is fundamentally outperforming the Eurozone, the EUR/USD accounts for nearly 58% of the movement of the USD Index, and the relative performance is what really matters.

In conclusion, the USD Index’s comeback dropped the guillotine on gold, silver, and mining stocks, and with the GDXJ ETF (profits on our short position here increased further) also plunging by more than 5% last week, the greenback is having a profound impact on the precious metals. Moreover, with the latter also pressured by rising interest rates and the Fed’s increasingly hawkish rhetoric, lower lows are likely to materialize over the medium term. However, with robust fundamentals signaling a significant comeback over the long term, we eagerly await the opportunity to go long the precious metals once again.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more

Accurate as always ☀🙌