Gold Shrugs Off Solid U.S. Jobs Print, Surges Above $4,200 On Fed Easing Hopes

Image Source: Unsplash

Gold (XAU/USD) resumed its uptrend on Tuesday and is up 0.57% following a solid jobs report from the United States (US), which wouldn’t deter the Federal Reserve (Fed) from easing rates on Wednesday. XAU/USD trades at $4,213 after bouncing off daily lows of $4,170.

Bullion climbs despite strong US labor data, markets remaining confident the Fed will ease policy on Wednesday

The latest US Job Openings and Labor Turnover Survey (JOLTS) report showed that the labor market is more resilient than expected, as the number of vacancies rose, according to the US Bureau of Labor Statistics (BLS). Earlier, ADP revealed that private companies added an average of 4,750 people per week to the workforce in the week ending November 22, exceeding the previous 13,500 reduction.

After the data, expectations that the Fed will reduce rates on Wednesday remained unchanged at 88%, according to Capital Edge rate expectations data.

Regarding geopolitics, the Ukrainian President Volodymyr Zelensky said that Ukraine and Europe are ready to present a peace plan to the US in the “near future.”

Risk appetite has improved as trade headlines between the US and China have been more conciliatory. US President Donald Trump approved the sale of Nvidia H200 chips to China, while Beijing is poised to buy more soybeans as promised.

On Wednesday, the economic docket will feature the Federal Reserve monetary policy decision, the Fed Chair Jerome Powell press conference and the update of the Summary of Economic Projections (SEP), which could lay the path for monetary policy in 2026.

Daily digest market movers: Gold surges as US Treasury yields remain firm

- US Treasury yields remain firm with the 10-year benchmark note rate standing flat at 4.178%, following Monday’s rise of three basis points (bps). US real yields, which correlate inversely with Gold prices, are also unchanged at 1.912%, a headwind for bullion.

- The US Dollar Index (DXY), which tracks the Greenbacks’ performance against a basket of six peers, gains over 0.16% up at 99.26.

- US JOLTS data showed a surprise increase in labor demand for October, with job openings rising to 7.67 million from 7.658 million, according to the Bureau of Labor Statistics (BLS).

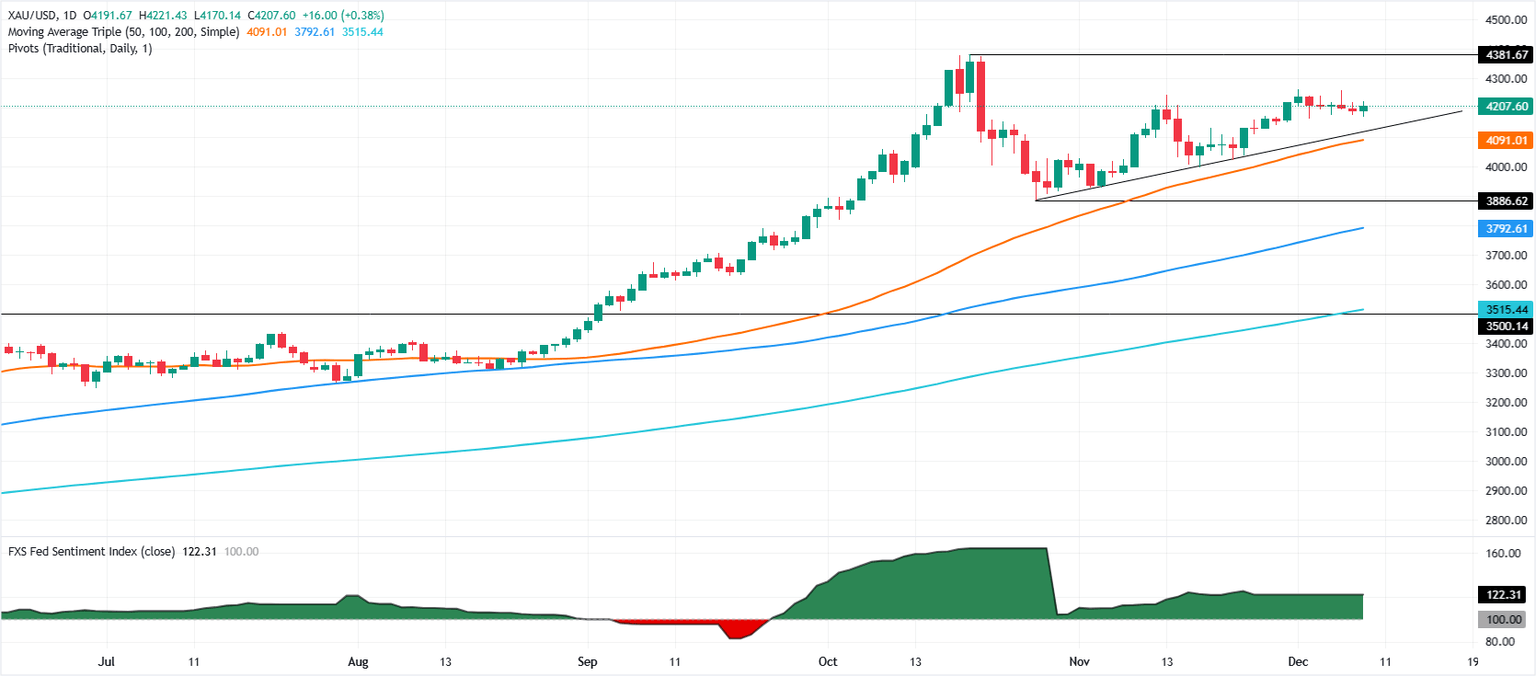

Technical Analysis: Gold climbs past $4,200 eyes on $4,250

Gold’s uptrend resumed on Tuesday as the yellow metal reached a new weekly high of $4,221, opening the door to testing higher prices like last Friday’s peak at $4,259. Bulls are gathering momentum as depicted by the Relative Strength Index (RSI).

That said, XAU/USD first resistance would be the December 5 high of $4,259, followed by the $4,300 milestone and the record high at $4,381. Conversely, a drop below $4,200 would expose the 20-day Simple Moving Average (SMA) near $4,149, and also the $4,100 mark. On further weakness, the next support would be the 50-day SMA at $4,083.

(Click on image to enlarge)

Gold daily chart

More By This Author:

Gold Dips Under $4,200 As Rising Yields And Fed Jitters Hit BullionGBP/USD Steady As Markets Brace For Blockbuster Fed–BoE Two Weeks

EUR/USD Consolidates At 1.1650 As Us Inflation And ECB Risks Shape Outlook