Gold: Selling Off Now. But Just Wait Until Powell Throws In The Towel

Image Source: Unsplash

Markets have trembled — and gold has weakened — because investors are finally starting to take the Fed seriously and the US economy keeps refusing to collapse. Still, with a global economy built upon a foundation of zeroed interest rates being pummeled by one of the harshest tightening cycles ever seen, everyone seems to be simply waiting for whatever will spark the next crisis.

There are lots of cross-currents in the financial and macro-economic world today, but I think we can peer through the fog and distill it all down to this: After well over a decade of the easiest monetary policy in human history, followed immediately by one of the steepest tightening cycles ever seen, we fully expect a major event of some sort that will force the Fed to pivot.

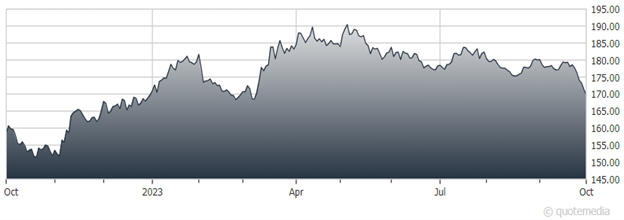

SPDR Gold Shares (GLD)

Yet Fed Chairman Jerome Powell and his minions seem blithely unconcerned about what may lie ahead, and hell-bent to maintain this ultra-hawkish monetary stance as long as possible. The result of this tension is that investors keep trying to price in a Fed pivot, only to be forced to retreat as the Fed maintains its harsh policy and rhetoric.

Note that we get these periodic rebounds in stocks, bonds, and gold even though investors have no idea where the next crisis will originate. There are lots of potential candidates.

They include the recession that every indicator continues to point toward...a stock market crash (which looks increasingly likely given the performances of the past few trading sessions)...the always-concerning derivative-market dominoes...the soaring cost of servicing the federal debt (which will make headlines next month as official numbers put it well past $1 trillion annually)...and the tsunami of debt resets that’s about to crash on companies around the world in the weeks ahead (James Grant puts the total increased costs at $8 trillion!).

While we can wonder what will cause the next crisis, we have certainty as to what the Fed will do about it. They’ll unleash a flood of liquidity that will make the post-Covid rescue operation pale in comparison. Because, again, the addicted financial markets and the economy will require a much greater dose of monetary adrenaline to get the same effect as before.

The Fed will strive for shock and awe, and you can bet that they’ll get it. But we know all this. The real question isn’t so much what will happen, but when. And that’s the tough part, as it usually is. So far, any bet that the inevitable crisis is imminent has turned up a loser.

That said, the consequences will come...and the Fed will have to deal with them when they do. In the meantime, that day of destiny keeps getting moved further back in the calendar, and markets — particularly gold and silver — keep getting punished.

More By This Author:

Conquer Your “FUD” Now, Because A Rally Should Come Later

A Cable Giant Set To Benefit From Integration Of Several Businesses

BIZD: A High-Yielding ETF Tailor Made For This Interest Rate Environment

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.