Gold Retains Gains With Ukraine Ceasefire Deal On The Table

- Gold adds to weekly gains after China vows to counter US tariffs.

- A US-brokered ceasefire deal in Ukraine is on the table for Russia to consider.

- Traders are mulling the upcoming US inflation data on Wednesday.

Gold’s price (XAU/USD) holds onto weekly gains and trades above $2,915 at the time of writing on Wednesday ahead of the United States (US) Consumer Price Index (CPI) release for February. Market consensus is for a deceleration in all inflation measures, both monthly and yearly gauges. However, many analysts and economists have commented that the current US tariff approach will be inflationary for the US, which could trickle through in the numbers.

Meanwhile, traders are still cautious about tariffs after the Chinese Minister of Foreign Affairs Wang Yi commented that if the US wants to suppress China with its steel and aluminum tariffs. Europe, meanwhile, committed to putting countermeasures in place by April 13. On the geopolitical side, a ceasefire deal in Ukraine brokered by the US has been put forward to Russia for consideration.

Daily digest market movers: Concerns on Wall Street

- Chinese consumption stocks rise as the nation’s annual political gathering wraps up with support for domestic demand. Hong Kong jewelers lead the gains, bolstered by haven demand for Gold proxies, Bloomberg reports.

- Wall Street is growing angsty as investors become increasingly unnerved by whipsawing tariff policy, sticky inflation, and the unknown pace of the Federal Reserve’s (Fed) interest-rate easing. Market forecasters at banks, including JPMorgan Chase & Co. and RBC Capital Markets, have tempered bullish calls for 2025 as Trump’s tariffs stoke fears of slowing economic growth, Bloomberg reports.

- The CME Fedwatch Tool sees a 97.0% chance for no interest rate changes in the upcoming Fed meeting on March 19. The chances of a rate cut at the May 7 meeting currently stand at 39.5%.

Technical Analysis: Catalyst warning

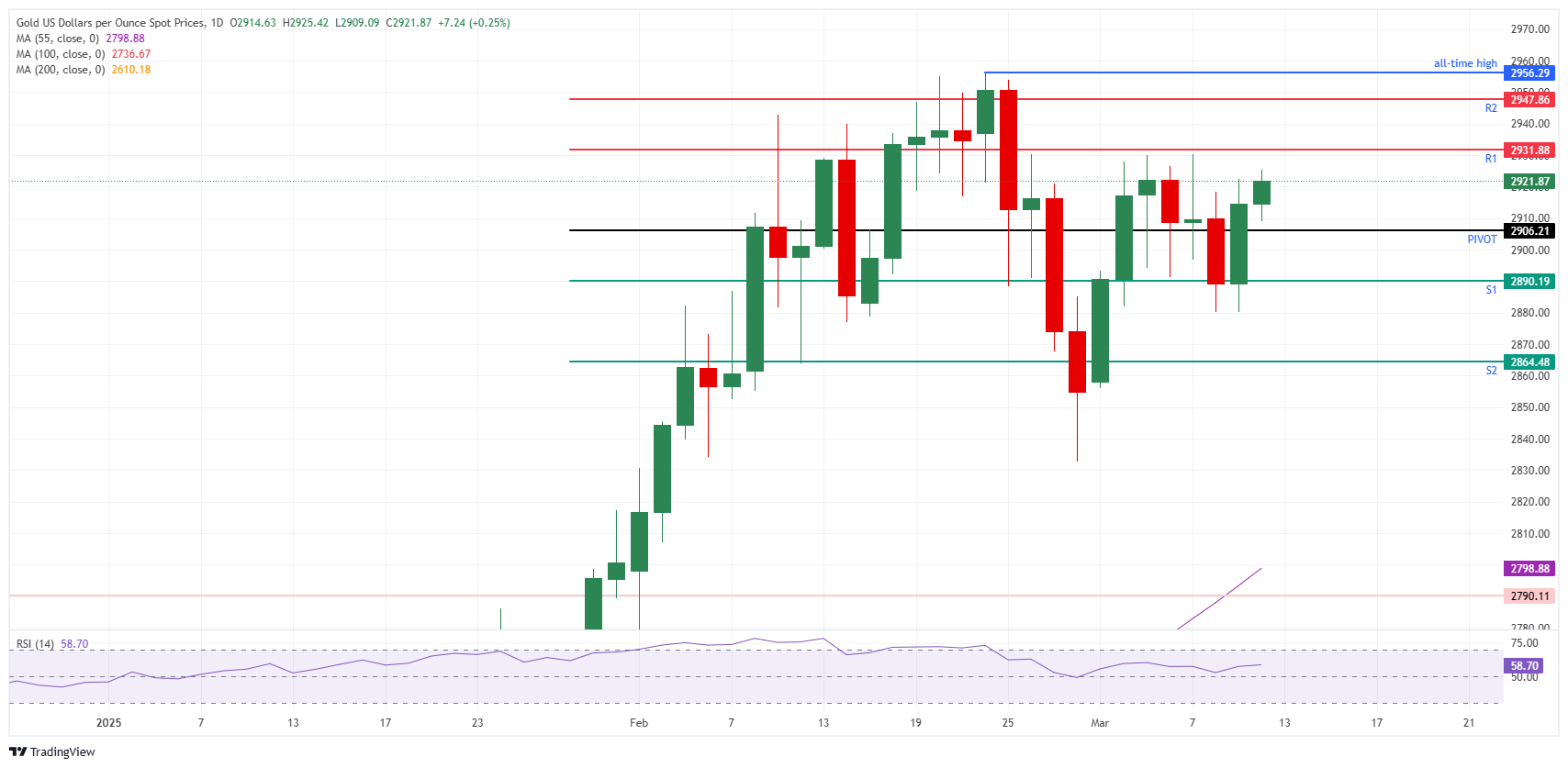

Relentless – that is wording that comes to mind when thinking about both the headlines on tariffs and the move in Gold this week. The Monday dip was bought eagerly, while Bullion now makes its way to test the monthly cap around $2,930. Once that level breaks, a move toward a new all-time high is back in the cards.

Gold is back above the $2,900 round level and, from an intraday technical perspective, it is back above the daily Pivot Point at $2,906. Gold is on its way to the R1 resistance near $2,931, converging with last week’s highs. Once through there, the intraday R2 resistance at $2,947 comes into focus on the upside ahead of the all-time high of $2,956.

On the downside, the Wednesday Pivot Point stands at $2,906. In case that level breaks, look at the S1 support around $2,890. The S2 support at $2,864, coinciding with the February 12 low, should avoid any further downturn.

(Click on image to enlarge)

XAU/USD: Daily Chart

More By This Author:

US Dollar Hits A Fresh Four-Month Low On German Spending Deal OptimismUS Dollar Under Pressure Amid US Economic Recession Fears

Gold Steadies As Traders Look For Direction On Trump Tariffs

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more