Gold Remains Bid As Lack Of Fed Clarity And Geopolitical Frictions Persist

Image Source: Pixabay

Gold (XAU/USD) advances modestly on Friday as traders seem to book profits ahead of the weekend, yet clings to gains of over 0.51% after reaching a seven-week high of $4,353. At the time of writing, XAU/USD trades at $4,302 as traders digest comments from Federal Reserve (Fed) officials.

Bullion trims gains ahead of the weekend, but remains supported by Fed uncertainty, weak data

The US economic docket was light, yet Federal Reserve officials crossed the wires. Two of the three dissenters expressed concerns about inflation remaining too high, specifically amid a period of scarce economic data, particularly the Consumer Price Index (CPI), which would indicate the pace of price increases.

Last Thursday, a weaker-than-expected jobless claims report justified the central bank’s decision as the number of Americans filing for unemployment benefits rose. However, as the Fed Chair Jerome Powell stated, most data could be “distorted” due to the US government closure.

In the meantime, Russia-Ukraine peace talks seem to have stalled. The White House press secretary expressed that US President Trump is frustrated with the pace of talks and disappointed with Ukraine’s President Volodymyr Zelenskiy, who has not signed off on the peace plan made by the US.

Daily digest market movers: Gold advances as the Greenback remains pressured

- Bullion mostly ignored Fed officials’ comments, which so far are setting the stage for interest rates next year. Kansas City Fed Jeffrey Schmid dissented because inflation is “too hot” and feels that monetary policy should remain modestly restrictive. He added that “Right now, I see an economy that is showing momentum and inflation that is too hot, suggesting that policy is not overly restrictive.”

- The other dissenter voting for a hold was Chicago Fed President Austan Goolsbee, who said that it was better to wait for more data, particularly about inflation and the job market. Despite this, he said that he was “not hawkish on rates for next year,” and projects 50 bps of easing if the economy evolves as he expects.

- Philadelphia Fed President Anna Paulson said she remained worried about job market weakness. She added, “That's partly because I see a decent chance that inflation will come down as we go through next year with the waning of tariff impacts, which have been the main driver of price pressures overshooting the target this year.”

- Cleveland Fed Beth Hammack remains focused on high inflation and said she would prefer monetary policy to be tighter. She sees the current policy rate as “right around a neutral” level, though she added that she would prefer a more restrictive stance to exert further pressure on inflation.

- US Initial Jobless Claims for the week ending December 6 rose to 236K, up sharply from the prior week’s upwardly revised 192K, according to the Department of Labor. In contrast, Continuing Claims for the week ending November 29 fell to 1.838 million from 1.937 million, suggesting some stabilization in longer-term unemployment.

- US Treasury yields are rising, with the 10-year benchmark note rate up four basis points at 4.19%. US real yields, which correlate inversely with Gold prices, fall nearly two and a half basis points to 1.872%, a tailwind for Bullion.

- The US Dollar Index (DXY), which tracks the Greenbacks’ performance against a basket of six peers, is flat at 98.35.

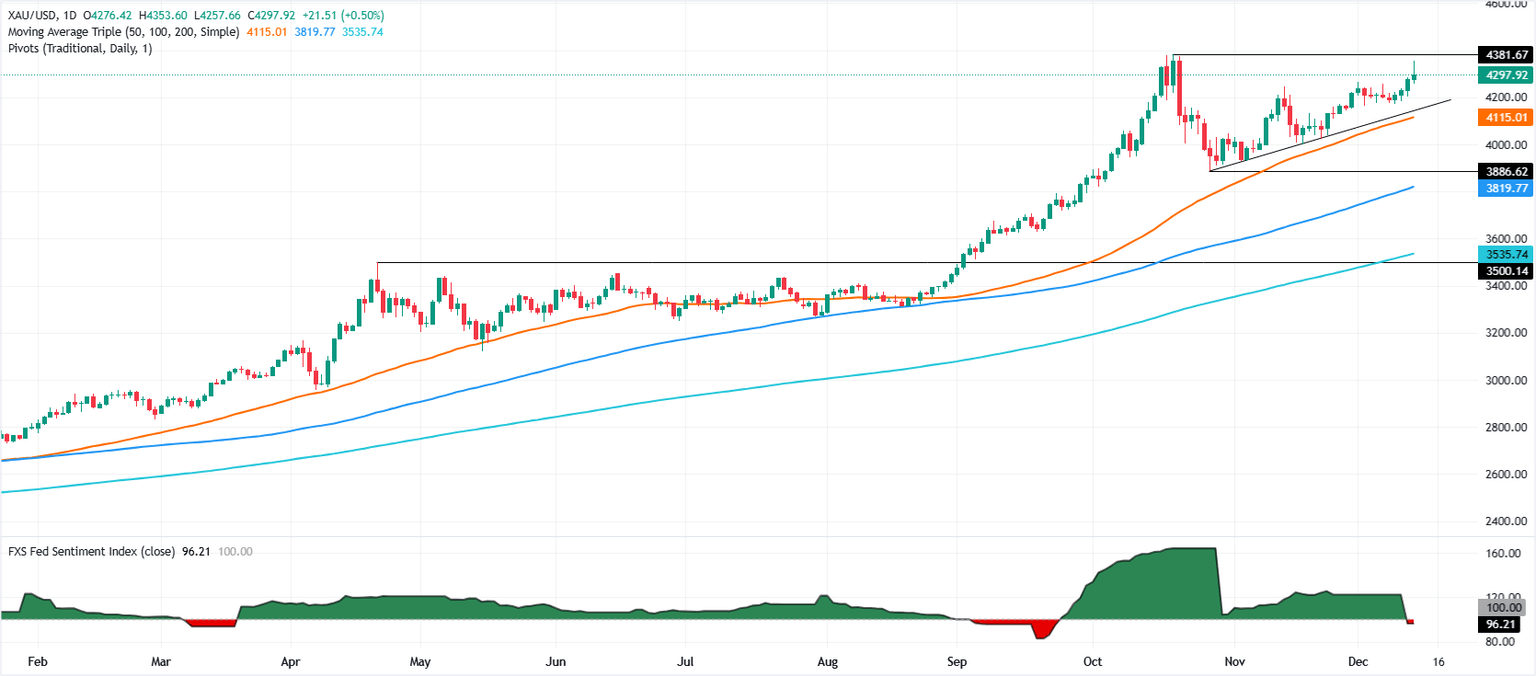

Technical Analysis: Gold’s uptrend intact as bulls take a breather

Gold is upward biased, even though it hovers above/beyond the $4,300 mark, with bulls remaining in charge as depicted by the Relative Strength Index (RSI). The RSI is bullish and as it enters overbought territory, it hints that buying pressure is strong.

If XAU/USD climbs above the current day's high of $4,353, this opens the door to test the all-time high at $4,381. Once surpassed, the next stop would be $4,400, $4,450 and $4,500. Conversely, if Gold prices tumble below the December 11 high of $4,285, look for further downside to $4,250 ahead of $4,200.

(Click on image to enlarge)

Gold daily chart

More By This Author:

EUR/USD Stable Near 1.1740 As Fed Officials Suggest A Pause In EasingEUR/USD Continues Its Rise As Dollar Retreats On Fed Action And Soft Data

Gold Soars Above $4,270 As Fed Cut Ignites Bullion Breakout