Gold: Recovering From A Food Coma

No market moves in a straight line and neither does gold. We ate a delicious meal during the latest fall, now it’s time to rest a little.

After profound declines, corrective upswings are not uncanny – they are the norm. Consequently, seeing one in gold is not bullish.

The lack of bullish implications here is confirmed by the lack of true strength in the rest of the precious metals sector: silver, senior miners, and junior miners.

Let’s jump into the charts for details:

In yesterday’s analysis I wrote that if gold moved back to the previously broken lows at about $1,750, it wouldn’t invalidate the bearish narrative.

At the moment of writing these words, gold is trading at $1,759, which – from the broader point of view – is still “about $1,750”. The June low in terms of closing prices is $1,763.60, so there was no invalidation of the breakdown in terms of closing prices. In other words, nothing really changed.

Silver did practically nothing, which means that it confirmed the breakdown below the previous 2021 lows. This “nothing” has, thus, bearish implications.

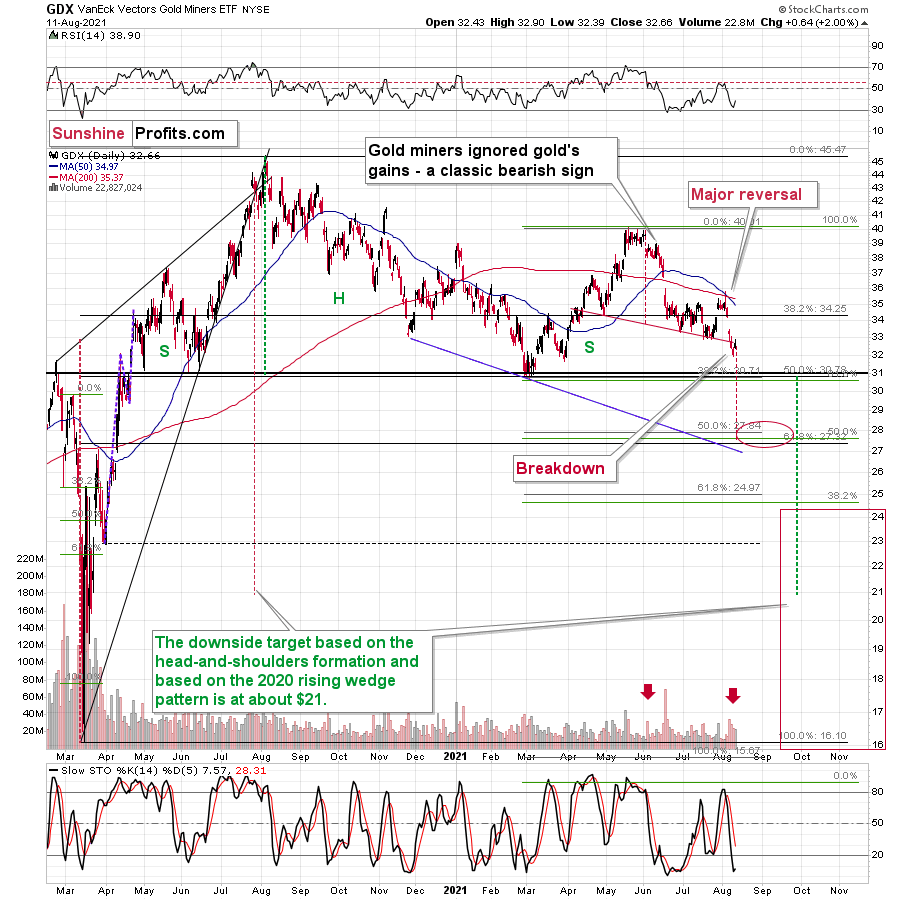

The Gold Miners

The GDX ETF (a proxy for senior miners) moved higher but gave some of the gains away before the end of the session. Interestingly, it declined enough not to invalidate the breakdown below the neck level of the head and shoulders pattern. This means that the breakdown was confirmed and that the overall implications of yesterday’s session are bearish.

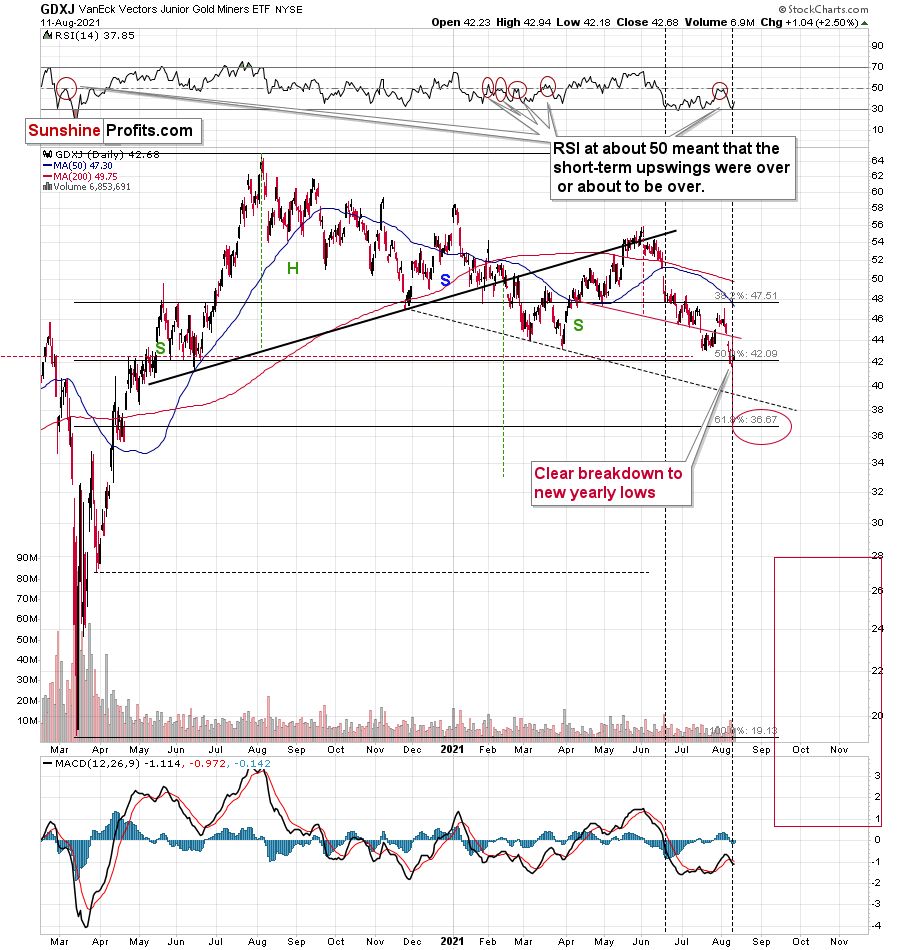

In the case of the GDXJ ETF (a proxy for junior miners), we saw something similar, but with regard to the breakdown to new yearly lows. Juniors moved slightly higher but ended the day below the July lows. Consequently, the breakdown to new 2021 lows was confirmed. This opens the door wide open to new lows.

In other words, it means that the profits from our short positions in the junior miners are likely to increase rather sooner than later.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more