Gold Rallies, Silver Sells Off, & Banks Keep Increasing Their Price Targets

Image Source: Unsplash

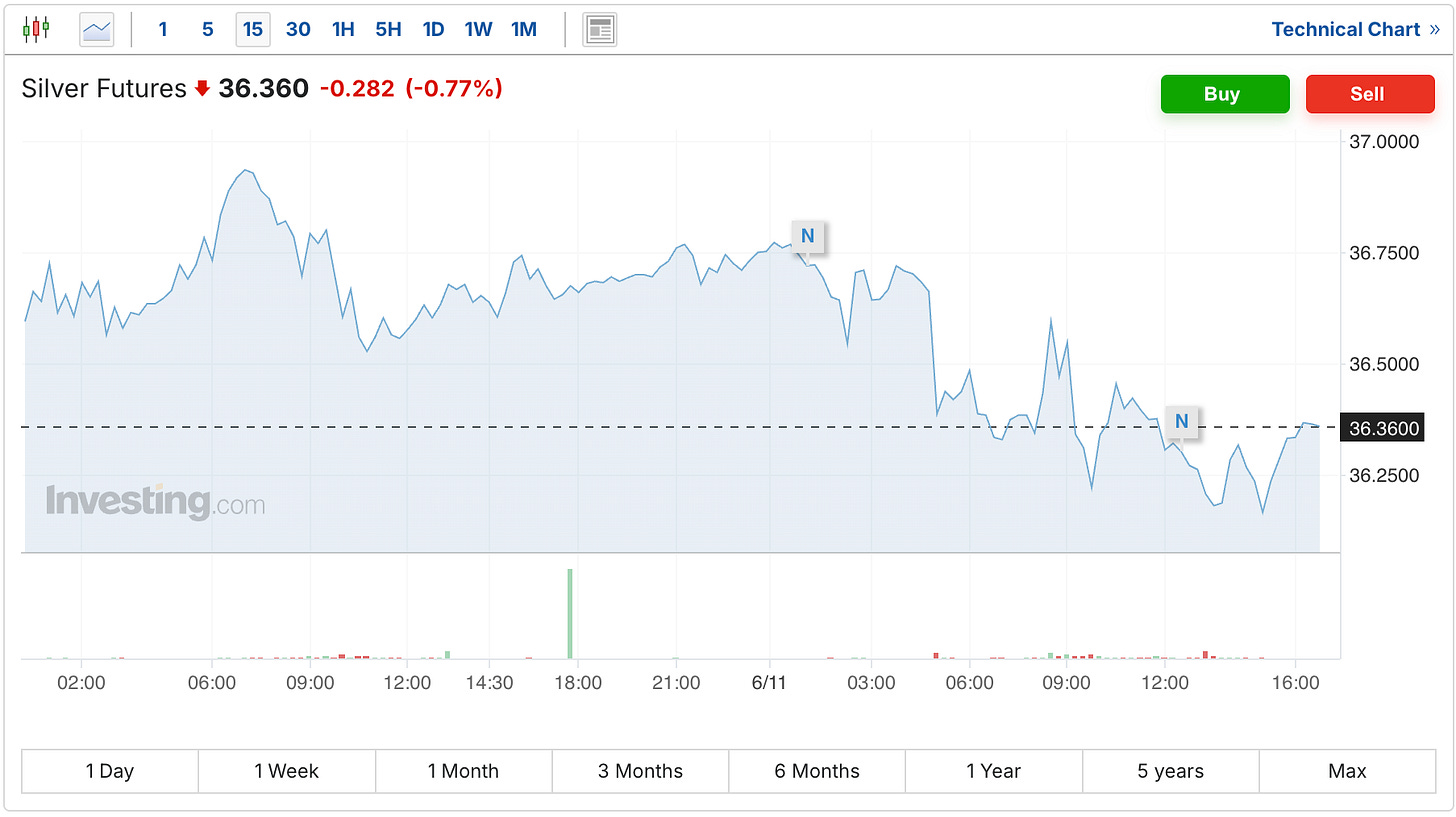

There was no further rallying in the silver market on Wednesday, even though this morning's CPI report came in slightly softer than expected.

The silver futures declined 28 cents to $36.36.

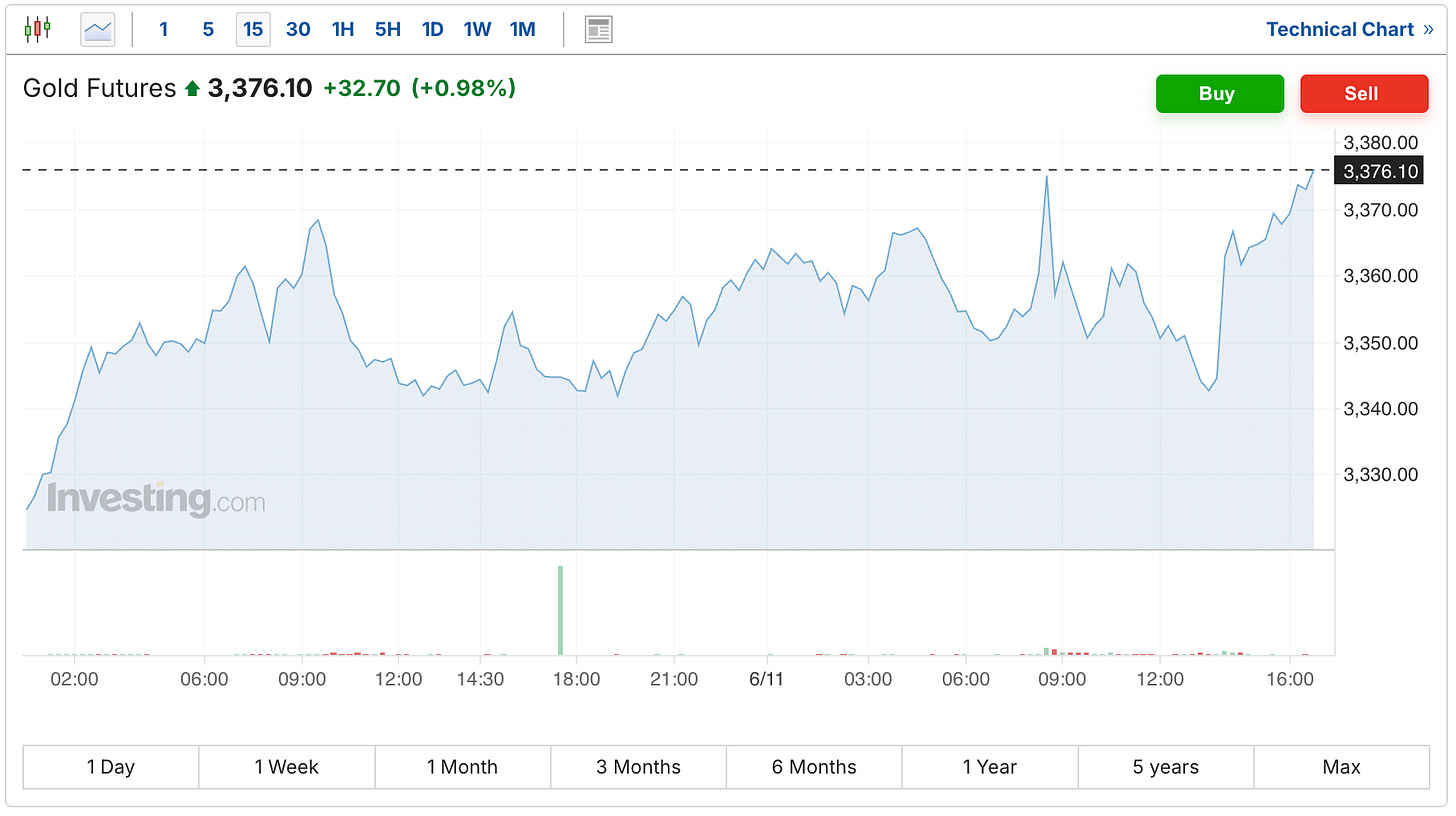

While gold climbed another $33 higher to $3,376.

So here are a few thoughts on a somewhat quieter day (and isn't it a statement in and of itself that a $30 move higher in the gold market has now become one of the quieter day).

Keep in mind that as you hear lawmakers talk about the deficit reduction provided by the Big Beautiful Bill, they’re not talking about actually reducing the debt. They’re just arguing over whether it will go up or more less relative to the previous (and generally silly) set of projections.

Nowhere have you, nor will you hear talk about the fact that the number is still going up, regardless of whether it’s by $1.5 trillion or $2.5 trillion. So the debt load is still going to increase indefinitely, and there’s still not even any public discussion about how it will ever be repaid.

Perhaps aside from Scott Bessent’s assertion that ‘we’ll grow our way out of it.’ Which could be possible, but I would surmise only at a significantly lower dollar valuation. Which for what it’s worth, is what just about everyone in the Trump administration has said they want.

More By This Author:

Bank Silver Short Position Grows To 2nd Largest In HistorySilver Breaks $37, As Bank Short Position Grows To 2nd Largest In History

Silver Continues Its Rally To Finish Week, Even As Gold Falls...