Gold Pulls Back As Bulls Pause After Fed Decision, Geopolitical Jitters Persist

Image Source: Unsplash

Gold price retreats on Thursday as bulls take a breather following the Federal Reserve's (Fed) latest monetary policy decision and an escalation of hostilities in the Middle East. The XAU/USD trades at $3,042, down over 0.19%.

Market sentiment turned negative, while the Greenback stages a recovery as depicted by the US Dollar Index (DXY), which tracks a basket of six currencies against the buck.

Gold traders failed to drive prices higher, even though the Fed held rates unchanged at the 4.25%–4.50% range for the second consecutive meeting. Officials added that they will slow down the pace of quantitative tightening (QT).

Fed policymakers acknowledged that the jobs market remains solid but added that prices remain high. Therefore, they emphasized they would monitor risks for both sides of the dual mandate.

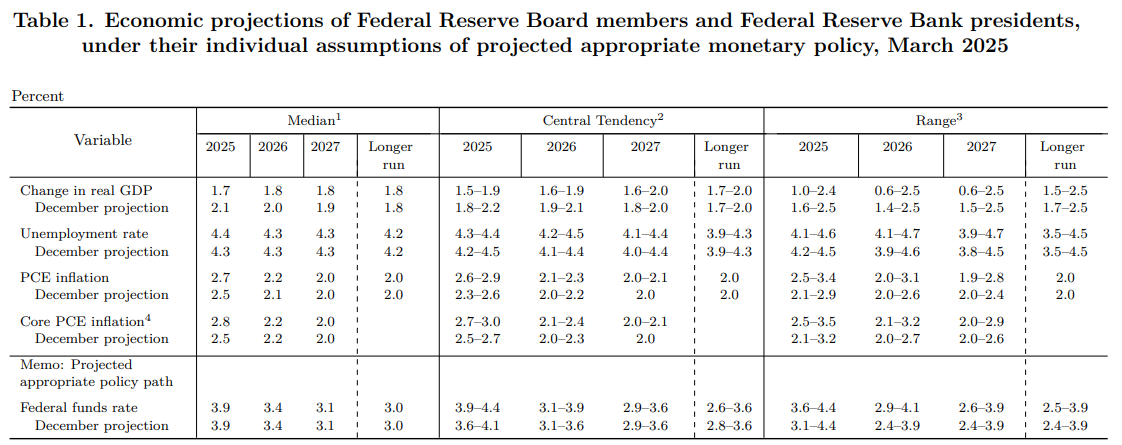

They also updated their projections about interest rates, economic growth, the Unemployment rate and inflation. Policymakers foresee two rate cuts in 2025, revising the economy downward, and project inflation ticking higher alongside the Unemployment Rate.

Traders are also digesting Fed Chair Powell's neutral and patient stance. He said that “uncertainty around the (economic) outlook has increased,” adding that some tariff inflation has been passed on to consumers. Powell commented, "Our current policy stance is well positioned to deal with the risk and uncertainties we face.”

Powell added that some of Trump’s policies weighed on growth and increased prices.

In Gaza, Israel airstrikes continued with at least 91 Palestinians killed and dozens wounded, according to Reuters.

Daily digest market movers: Gold price poised to extend rally amid steady real yields

- The US 10-year T-note yield recovers and falls one basis point to 4.183%. At the same time, the US Dollar Index (DXY), which tracks the buck’s performance against a basket of six currencies, rises 0.34% to 103.80.

- US real yields, as measured by the US 10-year Treasury Inflation-Protected Securities (TIPS) yield that correlates inversely to Gold prices, are almost flat at 1.904%.

- The Summary of Economic Projections (SEP) revealed that Fed officials anticipate two rate cuts in 2025, keeping the fed funds rate forecast at 3.9%, unchanged from December’s projections. The PCE Price Index — the Fed’s preferred inflation gauge — and the Unemployment Rate were revised higher, while GDP growth is now projected to fall below 2%, signaling a slowdown linked to President Donald Trump’s trade policies.

(Click on image to enlarge)

Source: Fed - Summary of Economic Projections

- Initial Jobless Claims for the week ending March 15 edged up slightly from 221K to 223K, but remained below the 224K forecast, indicating a still-resilient labor market.

- Meanwhile, the Philadelphia Fed Manufacturing Index declined from 18.1 to 12.5 in February, pointing to slower manufacturing activity.

- The money market has priced in 69.5 basis points of Fed easing in 2025, which has sent US Treasury yields plunging alongside the American currency.

XAU/USD technical outlook: Gold price conquers $3,000 and is set to end above that level

Bullion’s trend remains upward even though today’s price action seems to be forming a Doji candlestick which could lead to a pullback before Gold resumes its rally.

The Relative Strength Index (RSI) is overbought but is set to dip to 70 as bulls take risk off the table. This means that bears are not out of the woods but could enjoy some profits on Gold’s way down.

XAU/USD’s first support would be the $3,000 mark. Once surpassed, the next stop would be the February 20 daily high at $2,954, followed by the $2,900 mark. Conversely, Gold rising above $3,050 would pave the way to challenge $3,100.

(Click on image to enlarge)

More By This Author:

Silver Price Forecast: XAG/USD Slips Below $34.00 As Fed Acknowledges UncertaintyGold Price Nears $3,000 As U.S. Economy Shows Signs Of Cooling

Mexican Peso Defies Gloomy Data, Rockets Higher On USD Weakness

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more