Gold Prices Recovered, But Future Hinges On USD Trends

Image Source: Pixabay

Gold prices stabilised around 2,690.00 USD per troy ounce on Friday. The quotes fell by almost 1% in the previous session, as investors assessed the latest US economic data. The statistics prompted a rally in the yields of US treasury bonds.

US manufacturing prices rose more than expected in November, fuelling concerns about the future trajectory of inflation, which could climb further and remain above the Federal Reserve's 2025 target.

Meanwhile, initial claims for unemployment benefits reached a two-month high, significantly exceeding forecasts and underscoring risks of a deterioration in the US labour market.

Investors continue to expect the US Federal Reserve to lower interest rates by 25 basis points next week. They also anticipate future rate cuts in 2025, although their magnitude is uncertain.

A Federal Reserve rate cut is a positive signal for Gold. As the precious metal does not generate coupon yield, rate reductions lower the opportunity cost of holding Gold, making such investments more attractive for traders.

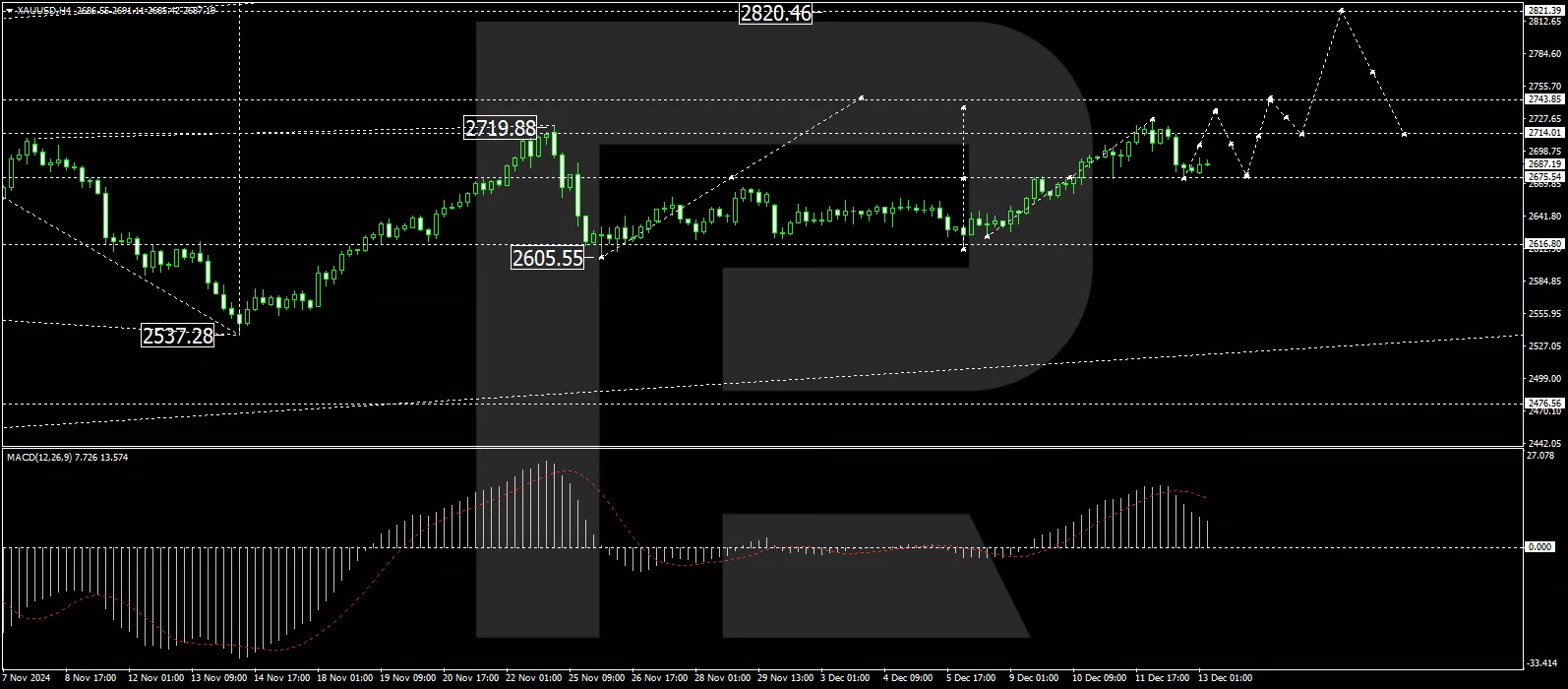

Technical analysis of XAU/USD

(Click on image to enlarge)

The Gold market has established a consolidation range around the level of 2,675.55. Following an upward breakout, a growth wave pushed the price to 2,726.26. A corrective movement towards 2670.66 is unfolding, after which another upward movement towards 2,743.85 is anticipated. This bullish scenario is supported by the MACD indicator, with its signal line positioned above zero and indicating upward momentum.

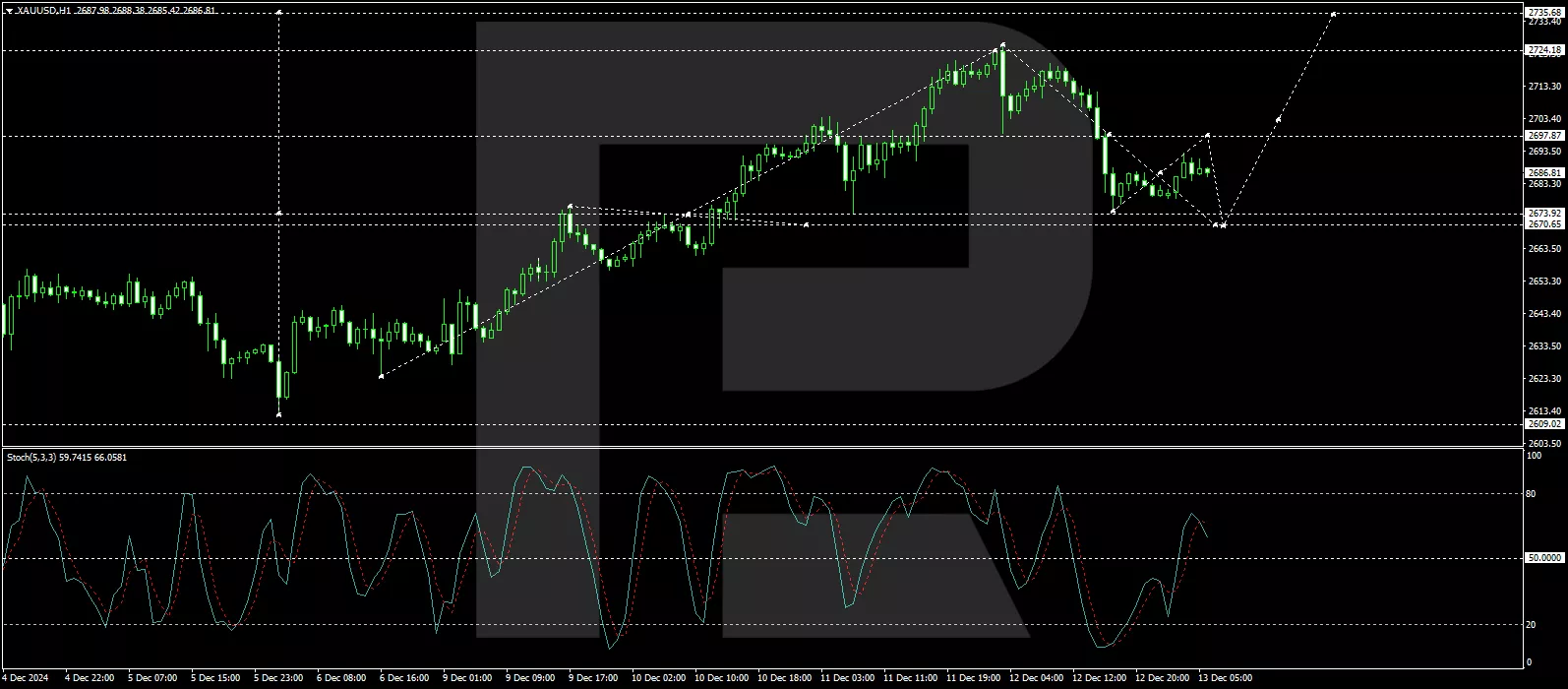

(Click on image to enlarge)

On the H1 chart, Gold is undergoing a correction towards 2,670.66. A rise to 2,697.77 could occur shortly, followed by a potential decline to the same level. Once this target is achieved, the possibility of initiating a new growth wave to 2,735.70 is expected, with a possible further extension to 2743.85. This analysis is corroborated by the Stochastic oscillator, whose signal line is currently above 50 and moving towards 80, suggesting continued upward potential.

More By This Author:

EUR/USD Under Pressure US Inflation, France, And ECB Rate

Australian Dollar Hits Four-Week Low Amid RBA Stance And US Dollar Strength

Japanese Yen Weakens As USD/JPY Climbs Amid BoJ Rate Hike Uncertainty

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for ...

more