Gold Prices Approach Potential Support As U.S. Dollar Surges Ahead Of U.S. CPI

Gold prices fell to the lowest level since September 2021 this morning, although prices have recovered intra-day losses and are slightly higher through Asia-Pacific trading. A deteriorating global growth outlook amid aggressive central bank tightening has put markets into a defensive posture. A fresh outbreak of Covid cases across China is weighing on sentiment across the APAC region. Hong Kong’s Hang Seng Index (HSI) is moving lower for the second day.

The US Dollar is benefiting from traders fleeing into safe-haven assets, which provides a headwind against gold prices. The DXY Index is tracking higher for the third week currently. Gold becomes more expensive to buy for foreign buyers as the Greenback strengthens. Meanwhile, the Euro and Japanese Yen look set to cede more ground against the USD. EUR/USD is within striking distance of parity, and USD/JPY is at the highest levels since 1998.

US Inflation Unlikely To Revive XAU

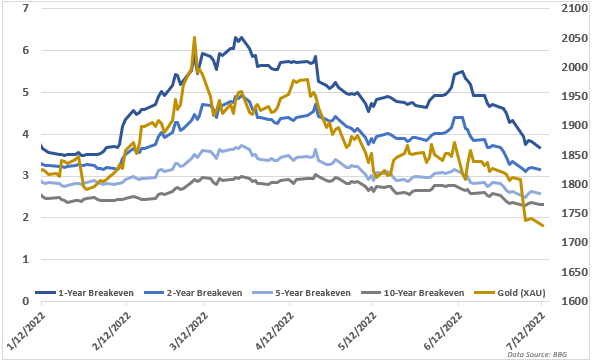

Some see gold as an inflation hedge. That thesis worked in early 2022 as inflation expectations were rising. However, the Federal Reserve grew increasingly hawkish, and markets began to price in lower inflation readings. US breakeven rates—measuring the difference between a Treasury’s nominal yield and the inflation-indexed yield—are used as a forward indicator for inflation. The chart below shows gold’s correlation with these inflation bets.

The US consumer price index (CPI) due out this Wednesday may show an increase in inflation for June. Analysts expect headline inflation to increase to 8.8% year-over-year, according to a Bloomberg survey. That would be a 0.2% y/y increase from May. Core inflation, a measure that removes food and energy prices, is seen easing to 5.7% y/y from 6.0%.

A higher-than-expected figure may see an initial bounce in bullion prices, but markets would likely move to price in a stronger Fed reaction. Higher rates are negative for gold, being a non-interest-bearing asset. Overall, given the Fed’s commitment to fighting inflation, a hot CPI print is unlikely to support gold prices in the near term.

Gold Technical Forecast

XAU prices are down over 4% since July 01, with much of that weakness following last week’s break below the psychologically important 1800 level. A Death Cross, where the 50-day SMA crosses below the 200-day SMA, was another high-profile signal that bodes poorly for the outlook.

Prices are currently near the September 2021 low (1721.71). A move lower would see a support zone around the 1680 level come into view. That level has offered support several times through 2021, making it a prime spot for bulls to regroup if prices continue to slide.

XAU/USD Daily Chart

(Click on image to enlarge)

Chart created with TradingView

More By This Author:

S&P 500, Nasdaq 100 Dive Ahead of Key US Inflation Data, Start of Earnings SeasonS&P 500 Under Pressure As Evening Star Formation Starts To Build

EUR/USD Update: Nord Stream Goes Offline, EURUSD Attempts Parity

Disclosure: See the full disclosure for DailyFX here.