Gold Price (XAU/USD) Looks Set To Test Multi-Month Support

Gold Price Forecast – Consolidation Before Breaking Lower

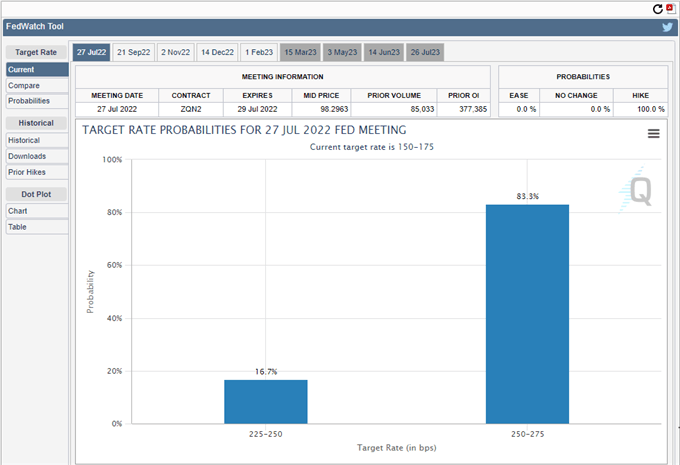

With headline inflation in the U.S. now running at a red-hot annualized pace of 9.1%, and with the Fed now seen hiking interest rates by 100 basis points at the end of the month, gold looks set to move lower in the days and weeks ahead. The CME FedWatch Tool is now showing an 80%+ probability that the Federal Reserve will hike interest rates by 100 basis points at the July 27 FOMC meeting, while an additional 75 basis points are also expected at the September 21 meeting. As interest rates continue to rise, non-interest rate-bearing gold will continue to suffer.

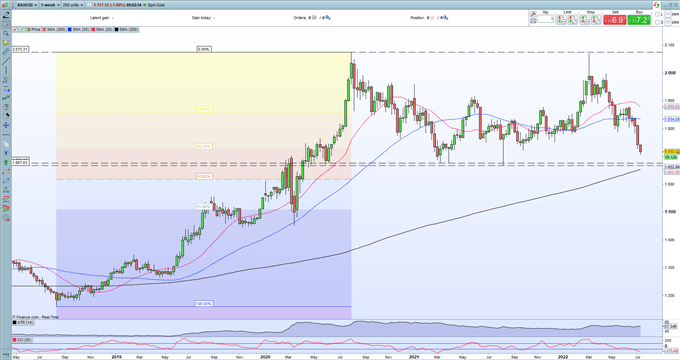

The weekly gold chart is looking weak with the precious metal likely to test an important support zone between $1,667/oz. and $1,676/oz. Before this test, gold will likely find short-term, big figure support at $1,700/oz. but this is unlikely to hold. A look at the CCI indicator shows that gold is at its most oversold level since March 2021 and this may slow any further sell-off. Initial resistance is seen between $1,721/oz. (late-September 2021 swing low) and $1,726/oz. (38.2% Fibonacci retracement) before $1,750/oz. comes into view.

Gold Weekly Price Chart

(Click on image to enlarge)

Retail trader data show 84.80% of traders are net-long with the ratio of traders long to short at 5.58 to 1. The number of traders net-long is 4.46% lower than yesterday and 4.12% lower from last week, while the number of traders net-short is 4.89% lower than yesterday and 12.69% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall. Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed Gold trading bias.

What is your view on Gold – bullish or bearish?

More By This Author:

Crude Oil Latest – Will US CPI Help To Provide Any Demand Clarity?British Pound Latest – GBP/USD Bludgeoned By A Rampant US Dollar

USD/JPY Outlook – A Fresh Multi-Decade High But The Move Looks Tired

Disclosure: See the full disclosure for DailyFX here.