Gold Price Turns Up As Traders Await US Inflation Data

Gold price rallied on Tuesday even though the Dollar Index showed strength. Now, the metal is trading at $2,026 at the time of writing.

Fundamentally, the XAU/USD turned upside ahead of the US inflation figures as the specialists expect lower inflation in January. The Consumer Price Index m/m may announce only a 0.2% growth versus the 0.3% growth in December, while CPI y/y is expected at 2.9%, less compared to 3.4% in the previous reporting period.

Furthermore, the Core CPI could report a 0.3% growth again. Lower inflation could help the Federal Reserve cut the interest rate in the upcoming monetary policy meetings. On the contrary, higher inflation should boost the greenback. This scenario may force the yellow metal to drop again.

The XAU/USD tries to approach new highs after the Switzerland Consumer Price Index reported only a 0.2% growth in January versus a 0.6% growth estimate. Also, the German and Eurozone ZEW Economic Sentiment came in better than expected, but the price changed little as the traders awaited the US data before taking action.

Gold Price Technical Analysis: Leg Higher

(Click on image to enlarge)

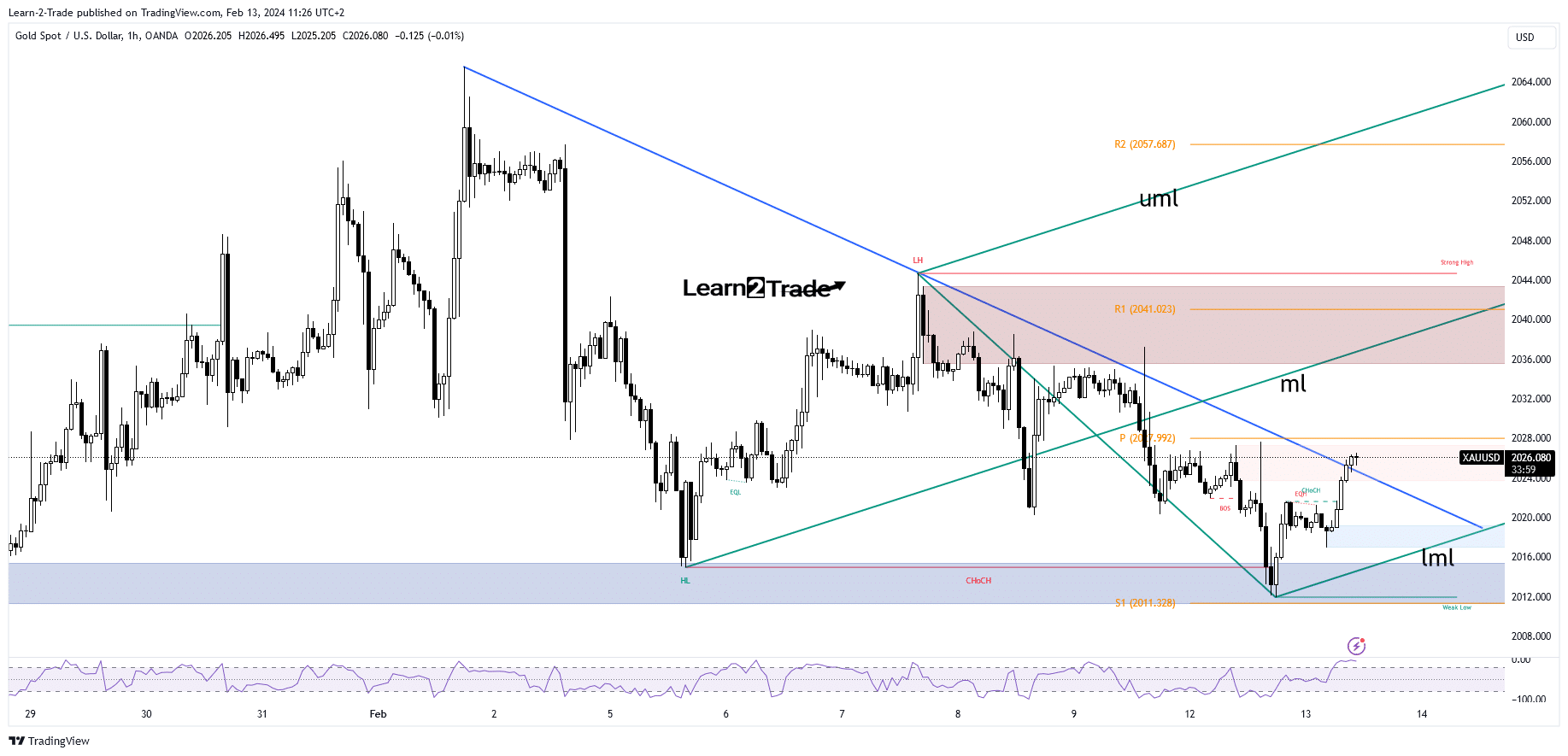

Gold 1-hour chart

Technically, the XAU/USD turned to the upside after failing to close below the $2,012 psychological level. A major demand zone stopped the sell-off. Now, it has passed above the downtrend line, signaling a larger leg higher. It is about to reach the weekly pivot point of $2,027.99, a static resistance. Taking out this obstacle activates more gains ahead.

The median line (ml) could attract the price if it stays within the ascending pitchfork’s body. Still, after such impressive growth, the price could try to retest the broken downtrend line before reaching new highs.

More By This Author:

USD/JPY Price Analysis: Yen Slips as Focus Shifts to US CPIUSD/CAD Forecast: Upbeat Jobs Report Supporting Loonie

AUD/USD Weekly Forecast: RBA/Fed Embrace Hawkish Stances

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more