Gold Price Struggling To Recover After 6% Dip From All-Time High

The gold price registered a 6% drop from the freshly marked all-time highs in the last trading session. The precious metal is trading at $2,033 at the time of writing and is fighting hard to rebound.

The downside pressure remains high as the US dollar could resume its leg higher. Fundamentally, the XAU/USD turned to the upside in the short term also because the US Factory Orders reported a 3.6% drop versus 2.7% drop estimated.

Today, the Reserve Bank of Australia left the Cash Rate unchanged at 4.35% as expected. Later, the US is to release high-impact data. The ISM Services PMI is expected to jump from 51.8 points to 52.2 points, while JOLTS Job Openings may drop to 9.31M from 9.55M.

In addition, the Final Services PMI and RCM/TIPP Economic Optimism data will also be released. Positive economic figures could boost the greenback, so the XAU/USD could hit new lows.

The BOC is expected to keep the Overnight Rate at 5.00% tomorrow. In addition, the ADP Non-Farm Employment Change and the Australian GDP could shake the markets.

Gold Price Technical Analysis: Correction

(Click on image to enlarge)

Gold 1-hour chart

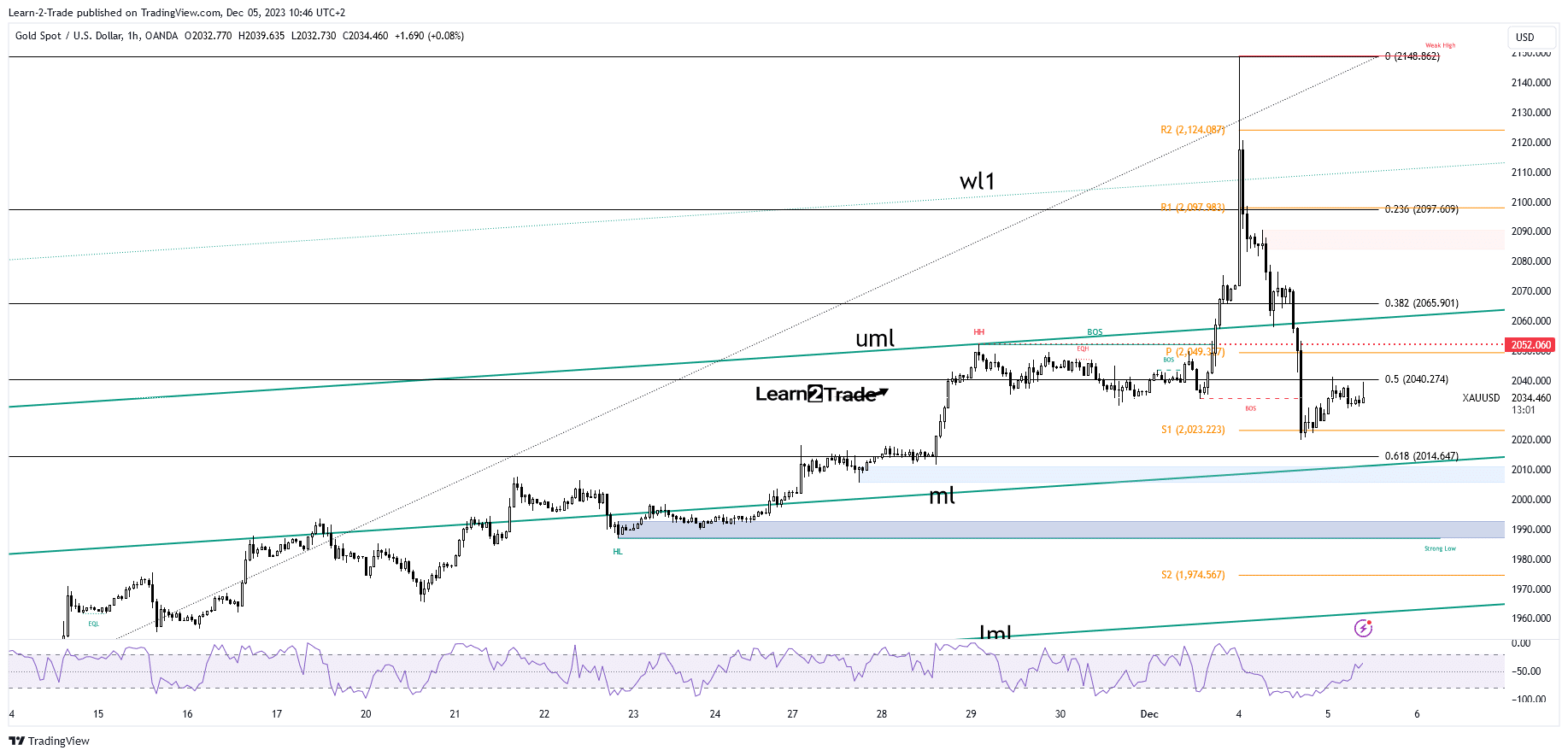

As you can see on the hourly chart, the price registered a false breakout with a sharp decline through the weekly R2 of 2,124 signaling exhausted buyers.

It has invalidated the breakout above the warning line (wl1) with a massive drop. The sell-off was paused by the weekly S1 of 2,023. The price came back to retest the 50% (2,040) retracement level but as long as it stays below it, the bias remains bearish.

From the technical point of view, the 61.8% (2,014) and the median line (ml) of the ascending pitchfork represent key and critical downside obstacles. Testing these levels and registering false breakdowns may announce a new leg higher. On the contrary, taking out these support levels activates more declines.

More By This Author:

USD/JPY Outlook: Yen Firm Despite Downbeat Tokyo CPIUSD/CAD Outlook: Dollar Mounts A Comeback Post Powell

AUD/USD Forecast: Markets Reflect On Powell’s Cautious Remarks

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more