Gold Price Sale Key Tactics For Investors

De-dollarization is here, and it’s boosting gold bug morale in a major way.

(Click on image to enlarge)

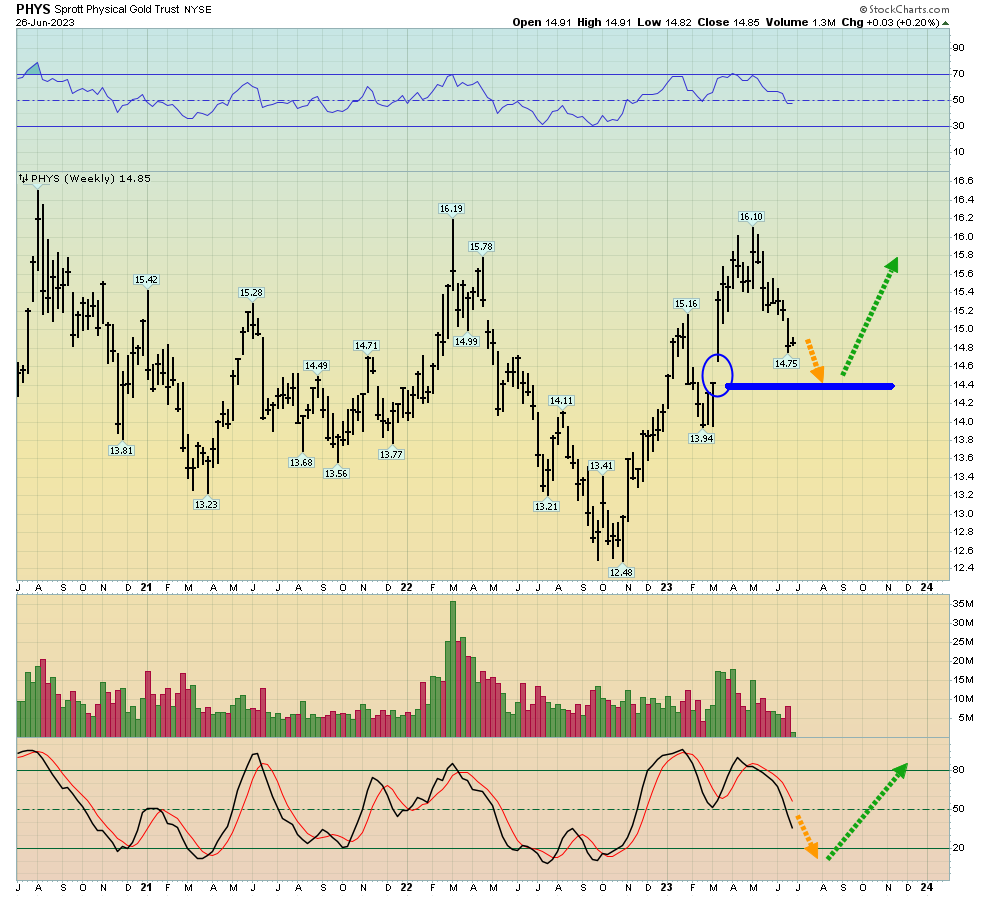

weekly PHYS (Sprott physical gold trust) chart

Gap enthusiasts may want to see the March gap filled before eagerly buying more gold. I’ll also note that the 14,5,5 series Stochastics oscillator is not quite oversold.

Gold is likely in the late stage of this reaction. Basis PHYS, there’s about an 8% price sale, and the good news is that gold community morale is solid.

Gold market investors certainly aren’t ecstatic, and nor should they be on a $170/oz gold price dip, but they are not engaging in the kind of panic or depression selling that I’ve seen during price sales of the past.

The global tidal wave of de-dollarization is only in its infancy, which means gold bug morale is almost certainly going to see gains… huge gains that continue for several decades.

Here’s the bottom line: Investors plan to buy price sales with their brain, but when it comes time to execute the actual buys… it’s all about the heart. The stronger the investor’s heart is, the more sustained wealth they can build, and it’s really that simple.

What about silver?

(Click on image to enlarge)

SIVR is a physical silver ETF. A 14% price sale is now in play.

What tactics should investors employ for gold and silver? For the likely answer to this question,

It can be argued that Indian citizens represent the pinnacle of how a gold bug should operate in the market.

The good news is that the citizens are buying now.

They are “nibbling” rather than “backing up the truck”, and with gold on an 8% price sale and silver sporting a sale of about 14%... I’ll dare to suggest that gold and silver bugs in the West should be nibbling too.

Tuesdays are often a soft day for the metals, and today could mark one of the last great opportunities to buy before a significant rally begins.

Interestingly, macro analyst Dave Hunter’s outlook is almost the same as mine for America in the coming decades… vastly higher rates, horrible stagflation, the stock market in a gulag, and unemployment (and gold!) in the stratosphere.

Any gold bug who is nervous about gold in a rate hiking environment should watch this important interview with Dave. The only real difference between our outlooks is that I’m reluctant to try to fit it all into an exact time frame. My bottom line: Time cycles work.Sometimes.

I like to see investors keep their focus on price sales that put gold at major support zones… zones that are bought by India, China, and the big bank COMEX traders.

This way, investors are positioned to benefit from the most positive scenarios for gold, but if something goes awry, these solid tactics keep them from getting into emotional and financial trouble.

While the potential insurrection in Russia was a dud for gold, I’ll ask investors to think bigger; the Wagner warriors were serious, armed with heavy weapons, and yet the Russian government diffused the situation very fast… and with amnesty for the insurrectionists.

In contrast, the small Jan 6 pepper spray and sticks riot in America was billed as a gargantuan insurrection by deranged politicians and judges. It featured decades of jail time for some of the rioters, rather than amnesty. The calm resolution of the events in Russia versus the idiotic antics in embittered America are another sign of “End of Empire Times” (for the fiat nation of America), and another reason for the citizens to own lots of gold!

What about fiat currencies, should investors own these too? Well, if an investor is trying to make fiat-denominated profits, they should own some fiat. Here’s why: What an investor holds won’t be lost in the market, and it’s another good way to boost morale.

(Click on image to enlarge)

I recommend holding a decent dollar position, but the DXY chart (dollar index) looks pathetic. A break under 100 would be ominous. It would likely usher in a substantial decline… and a big gold price rally!

(Click on image to enlarge)

I’ve been accumulating the Cbone (Canadian dollar basis FXC on this chart) in the triangle zone, and now there’s a nice upside breakout. The Cbone is also an oil currency and on that note…

(Click on image to enlarge)

Oil broke out of a bull wedge but has since drifted sideways, as I suggested it would. The next OPEC meet is July 5 and I expect this will bring an end to the “wet noodle” price action. The $65 area represents a 50% price sale from the $130 area highs. It’s a key buy zone for oil market enthusiasts.

What about the stock market?

(Click on image to enlarge)

QQQ daily chart

The Nasdaq is being carried higher by a small number of stocks and it is very overbought.

Having said that, the low-rate bonds that have fuelled the expansion are mostly short-term, and many will need to be rolled over by year-end…. At rates that could destroy many corporations! A market top could be in play now, but it may not come until early 2024. Regardless, investors should be in sell mode or buy protective put option insurance… pronto!

What about the miners?

(Click on image to enlarge)

The GDX chart is generally positive, and as noted, today may mark of one of the last Tuesday price sale days to buy before a major rally begins. My suggestion is to follow the Indian gold bug lead: Nibble now… and enjoy higher prices very soon!

More By This Author:

The Big Story Is Gold Bug Glory

Gold & The Fed - What Lies Ahead?

Gold $2025 Buyers Now Can Thrive