Gold Price Retreats As Tensions Ease Following Israel Attack

The gold price pared gains after reaching today’s high of $2,417. The metal is trading at $2,381 at the time of writing. Despite the temporary correction, the bias is still bullish in the medium to long term.

After its strong upward movement, minor drops may occur due to profit-taking. Yesterday, the US reported mixed economic data. The Unemployment Claims remained at 212K in the last week, even if the traders expected a potential growth to 215K.

At the same time, the Philly Fed Manufacturing Index came in at 15.5 points versus 1.5 points in the previous reporting period.

On the other hand, the Existing Home Sales and CB Leading Index report poor data. Today, the yellow metal rallied on geopolitical tensions in the Middle East. However, the XAU/USD seems overbought in the short term, posing a risk of downside correction.

Fundamentally, the MPC members, Breeden, Rasmsden, and Mann speeches could bring some action later today. Right now, Gold is fighting hard to rebound and recover after the last sell-off because UK retail sales rose by 0.0%, less than the estimated 0.3% growth and 0.1% growth in the previous reporting period.

Gold Price Technical Analysis: Bearish Pattern

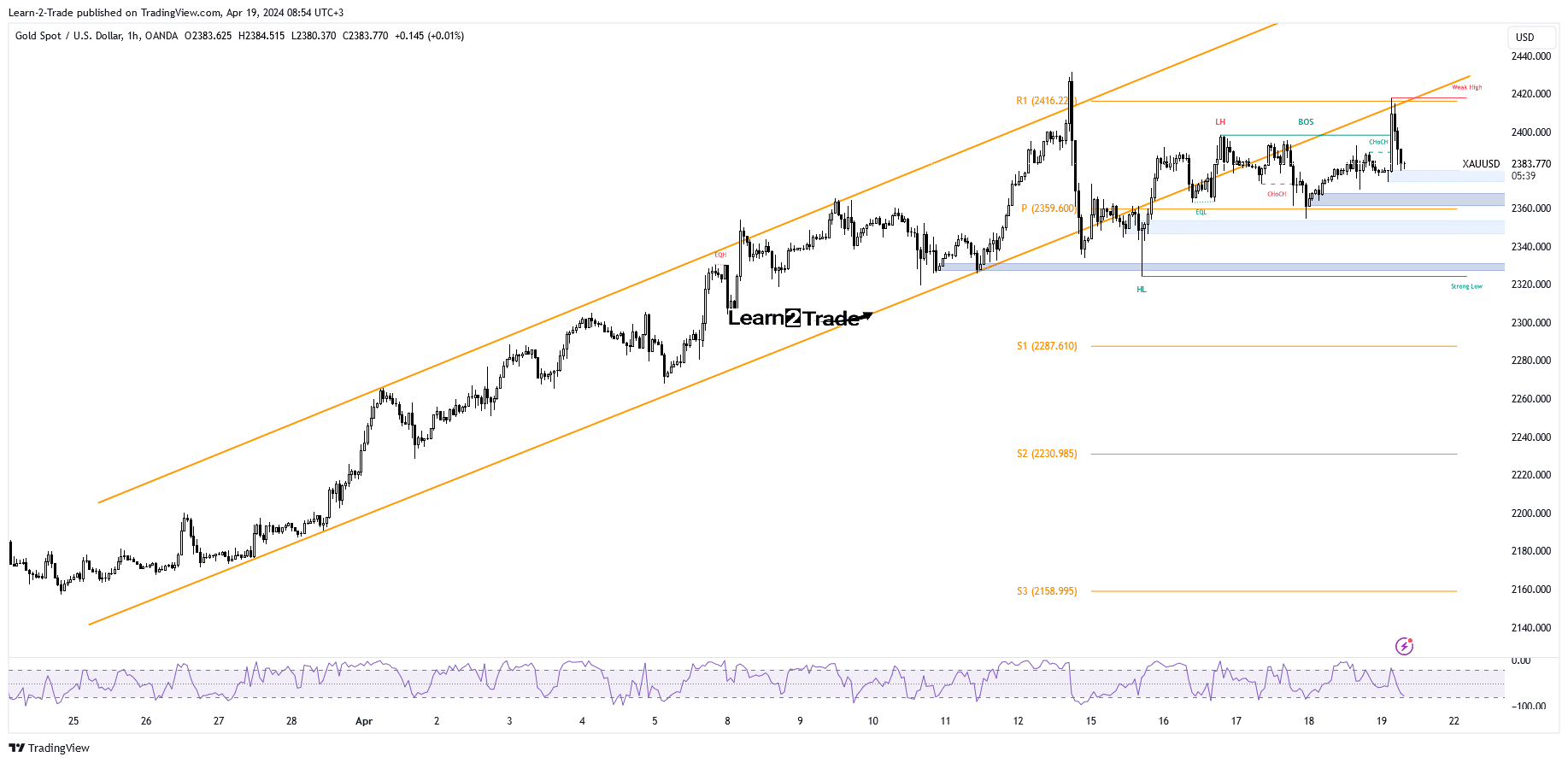

Gold 1-hour chart

As you can see on the hourly chart, the XAU/USD extended its growth within an ascending channel, reaching a new all-time high of $2,431. Now, it has escaped from this pattern, signaling buyers’ exhaustion.

However, the prices returned higher, and the broken uptrend line was tested. It has found resistance at the weekly R1 of 2,416. The false breakouts with great separation through this static resistance and above the uptrend line reveal an overbought situation. It’s trapped between R1 (2,416) and the pivot point $2,359.

Escaping from this range could bring us new opportunities. If it closes below the pivot point, a corrective phase could be activated after making a new lower low. However, a larger correction will be confirmed only after taking out the 2,318 downside obstacle.

More By This Author:

USD/JPY Price Analysis: Yen’s Demand Soars After Israel AttackAUD/USD Outlook: Volatility Surges Amid Israel-Iran Tension

EUR/USD Price Aiming To Test 1.07 Level As Risk Tone Improves

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more