Gold Price Plunges Almost 2% On Risk Rally Spurred By Tariff Delay

Image Source: Pixabay

Gold prices posted losses of nearly 2%, falling below the $3,300 figure, as market participants cheered US President Donald Trump's decision to delay tariffs on European Union goods. Consequently, an improvement in risk appetite and the Greenback trimming some of last week’s losses weighed on the non-yielding metal.

Over the weekend, a call between Trump and the EU chief, Ursula von der Leyen, ended with Washington's decision to postpone 50% tariffs on EU goods until July 9. This shift in investors' mood triggered outflows from haven assets, except for the US Dollar, and pushed global equities higher.

The US Dollar Index (DXY), which tracks the buck’s value against a basket of six currencies, rises over 0.62% to 99.54, fueled by an improvement in Consumer Confidence, which according to the Conference Board (CB) rose the most in four years.

News that Washington could be on the brink of securing additional trade deals in the near term added to the positive sentiment among traders. Fox Business News Gasparino, in a post on X, revealed that a framework between the US and India is close to being announced.

Other economic data in the US revealed that Durable Goods Orders fell in April the most since October, with business equipment diving sharply due to uncertainty about tariffs and US tax policy.

Bullion’s faith for the remainder of the week rests on the upcoming US economic docket. They will eye the Federal Reserve’s (Fed) last meeting minutes, the second estimate for Gross Domestic Product (GDP) in Q1 2025, and the Fed’s preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index.

Gold daily market movers: Bullion plummets on strong US Dollar and solid US Consumer Confidence

- US Treasury bond yields remain steady. The 10-year Treasury note yield falls six basis points (bps) down to 4.446%. Meanwhile, US real yields also declined by six basis points to 2.116%.

- US Consumer Confidence in May improved from 85.7 to 98.0, with the recovery attributed to the truce on tariffs. Stephanie Guichard, senior economist at The Conference Board, said, “The rebound was already visible before the May 12 US-China trade deal but gained momentum afterward.”

- US Durable Goods Orders disappointed investors, plunged -6.3% MoM in April, down from March's 7.6% increase but exceeded forecasts of -7.8% contraction.

- Minneapolis Fed President Neel Kashkari said that interest rates should remain on hold until there is clarity on how higher duties affect price stability.

- Despite the backdrop, the Gold price outlook remains optimistic due to the still fragile market mood on US assets, ignited by the growing fiscal deficit in the United States, which prompted Moody’s to downgrade US government debt from AAA to AA1.

- Besides this, Reuters revealed that “China's net gold imports via Hong Kong more than doubled in April from March, and were the highest since March 2024, data showed.”

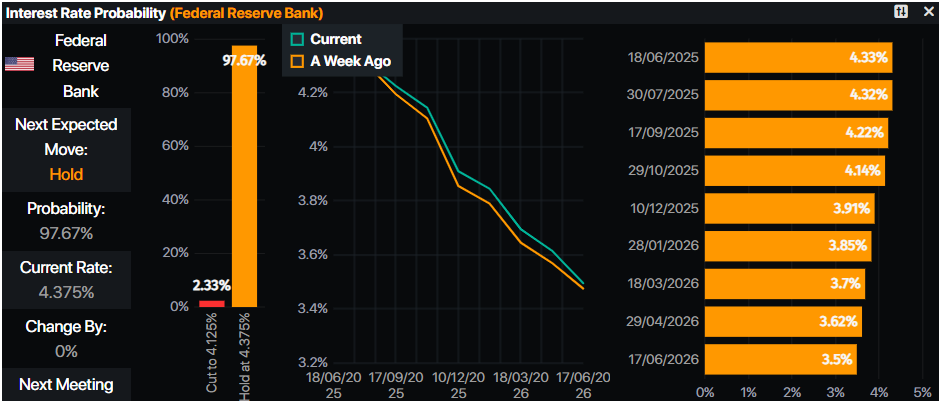

- Money markets suggest that traders are pricing in 46.5 basis points of easing toward the end of the year, according to Prime Market Terminal data.

(Click on image to enlarge)

Source: Prime Market Terminal

XAU/USD technical outlook: Gold price pullback to challenge $3,250

Gold price remains steady, hovering on the bottom of the $3,300 figure but set to consolidate within the $3,250-$3,300 range ahead. Nevertheless, the uptrend remains intact, with buyers eyeing a decisive break above $3,300, which could pave the way for testing last week’s peak of $3,365 ahead of a challenging $3,400. Further upside lies above the May 7 high of $3,438.

On the bearish side, if Gold drops below $3,250, expect a move to the confluence of the May 20 daily low and the 50-day Simple Moving Average (SMA) near $3,204/05.

(Click on image to enlarge)

More By This Author:

Silver Price Forecast: XAG/USD Holds Above $33.00 In Thin Holiday TradingGold Slips As Trump's Hits Pause On EU Duties Amid Thin Trading Volume

Gold Rallies Past $3,350 As Trump Escalates Trade War With EU

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more