Gold Price Outlook: XAU/USD Reaches A Monthly High, US Equities Limits Gains

Gold prices have recently reached a one-month high after the number of worldwide Covid cases reached a record high.

However, although rising inflation and geopolitical factors have supported the demand for the precious metal, the Santa Claus rally and a stronger Dollar has hindered further progression.

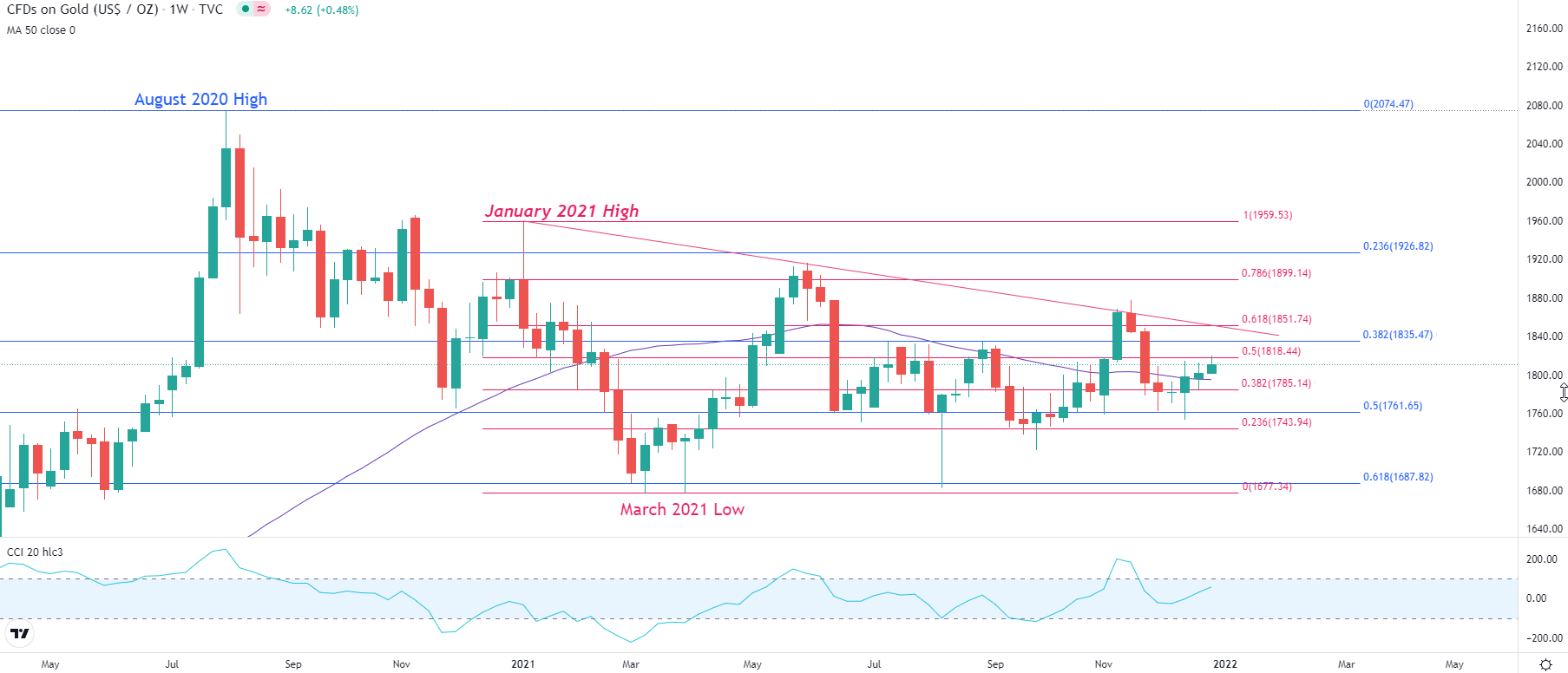

GOLD (XAU/USD) WEEKLY CHART

Over the past three weeks, Gold bulls have managed to regain temporary control over the systemic, prominent trend in an effort to drive prices back towards the 38.2% Fibonacci retracement of the 2020 move at $1,835.

Although the downward trajectory from the August 2020 high currently remains intact, prices have risen above the 50-week moving average, currently providing support at the key psychological level of $1,800.

(Click on image to enlarge)

Chart prepared by Tammy Da Costa using TradingView

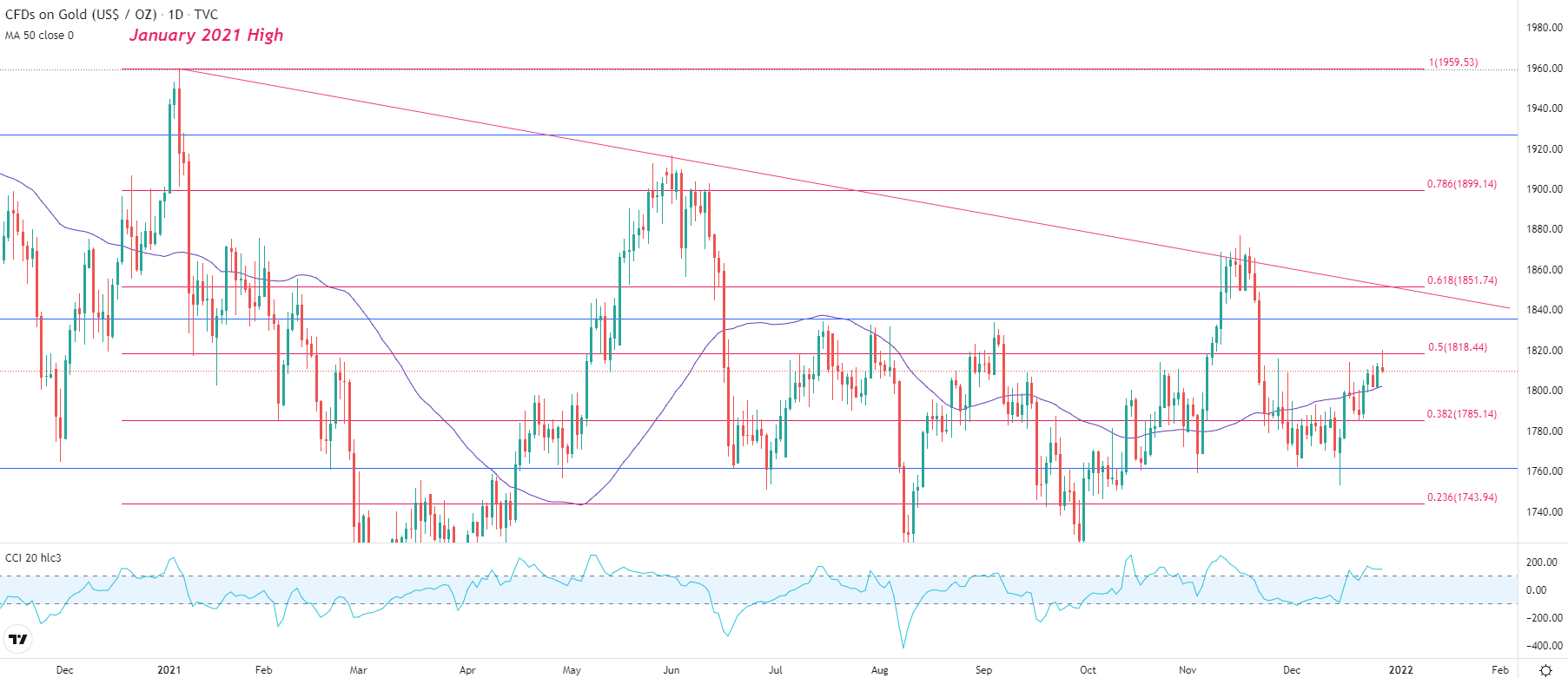

Meanwhile, on the daily time frame, price action has temporarily stalled at the 50% retracement level of the 2021 move which continues to provide resistance for the imminent move at $1,818.

As bulls and bears battle it out, the CCI (commodity channel index) has broken above the normal range, a potential indication that XAU/USD may be overbought.

GOLD (XAU/USD) DAILY CHART

(Click on image to enlarge)

Chart prepared by Tammy Da Costa using TradingView

Disclaimer: See the full disclosure for DailyFX here.