Gold Price Outlook: XAU Prices Coiling For Potential Move On U.S. Inflation Data?

The price of gold shifted lower into Tuesday’s Asia-Pacific trading session as broader market volatility cooled. A firm US Dollar is keeping pressure on bullion prices. Treasury yields also rose to start the week. The 10-year note’s yield climbed above the recently surrendered 1.4% mark. Traders were encouraged to shift back into risk assets after the Omicron threat subsided. Scientists think the new strain may be less deadly than the Delta strain.

Traders will have their eyes on US inflation data later this week. Analysts expect to see the consumer price index rise to 6.7% on a year-over-year basis. That is a remarkably high level. However, markets are forecasting a softer stance on inflation expectations over the next one to five years. Breakeven rates, which measure the gap between a Treasury’s nominal and inflation-indexed yield, have fallen in recent weeks.

Image Source: Pixabay

The 5-year breakeven is at 2.79%, much below the current rate of inflation in the economy. If this forward gauge of inflation remains surprised relative to current inflation, it will likely continue to weigh on the yellow metal. Meanwhile, the total known ETF holdings of gold have been falling in recent weeks, reflecting the weaker investor demand. Prices will likely hinge on US CPI data this week, along with broader market volatility. Consumer sentiment is due out shortly after the CPI figures, with analysts expecting little change from November’s 67.4 print.

Gold Technical Forecast

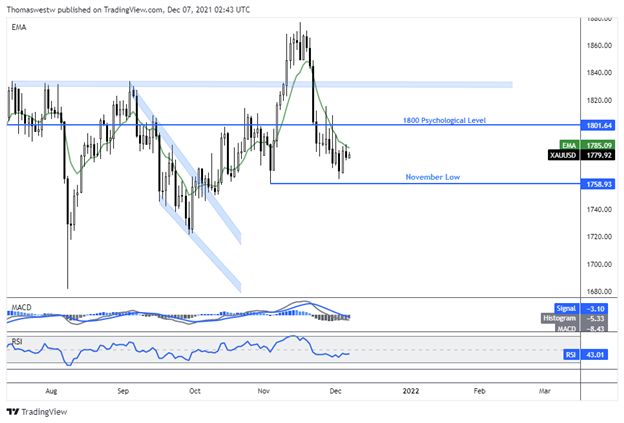

Gold is eyeing a move higher toward the falling 9-day Exponential Moving Average (EMA), which has extinguished several intra-day rallies over the past two weeks. A clean break higher would put the 1800 psychological level back into play. Alternatively, a move lower will have bears targeting the November low at 1758.93. A recent bullish crossover between the 50- and 200-day SMAs has failed to generate any bullish energy so far.

Gold Daily Chart

(Click on image to enlarge)

Chart created with TradingView

Disclaimer: See the full disclosure for DailyFX here.

Comments

No Thumbs up yet!

No Thumbs up yet!