Gold Price Loses Ground Under $1,940, As US Inflation Looms

The current price of gold stands at $1,938 as of the latest update. In the short term, it appears uncertain following a significant recent drop. The minimal change can be attributed to the Dollar Index moving sideways. The overall trend remains bearish, suggesting further declines are likely.

Despite a worse-than-expected US Prelim UoM Consumer Sentiment, which dropped from 63.8 to 60.4, the price of gold has shown resilience. The yellow metal has maintained its downward trend, even in light of the unfavorable sentiment data.

Looking ahead, the XAU/USD may continue to trade within a range until the release of US inflation data. Tomorrow’s fundamentals are expected to influence the rate, potentially leading to increased volatility.

Notably, the Consumer Price Index (CPI) month-over-month is anticipated to show a 0.1% growth in October, compared to a 0.4% growth in September. The year-over-year CPI is projected to register a 3.3% growth, a decrease from the 3.7% growth in the previous period. Additionally, Core CPI is expected to announce a 0.3% growth.

These upcoming events are considered high-impact, and as a result, the XAU/USD may experience significant and abrupt movements in response to the inflation figures publication.

Gold price technical analysis

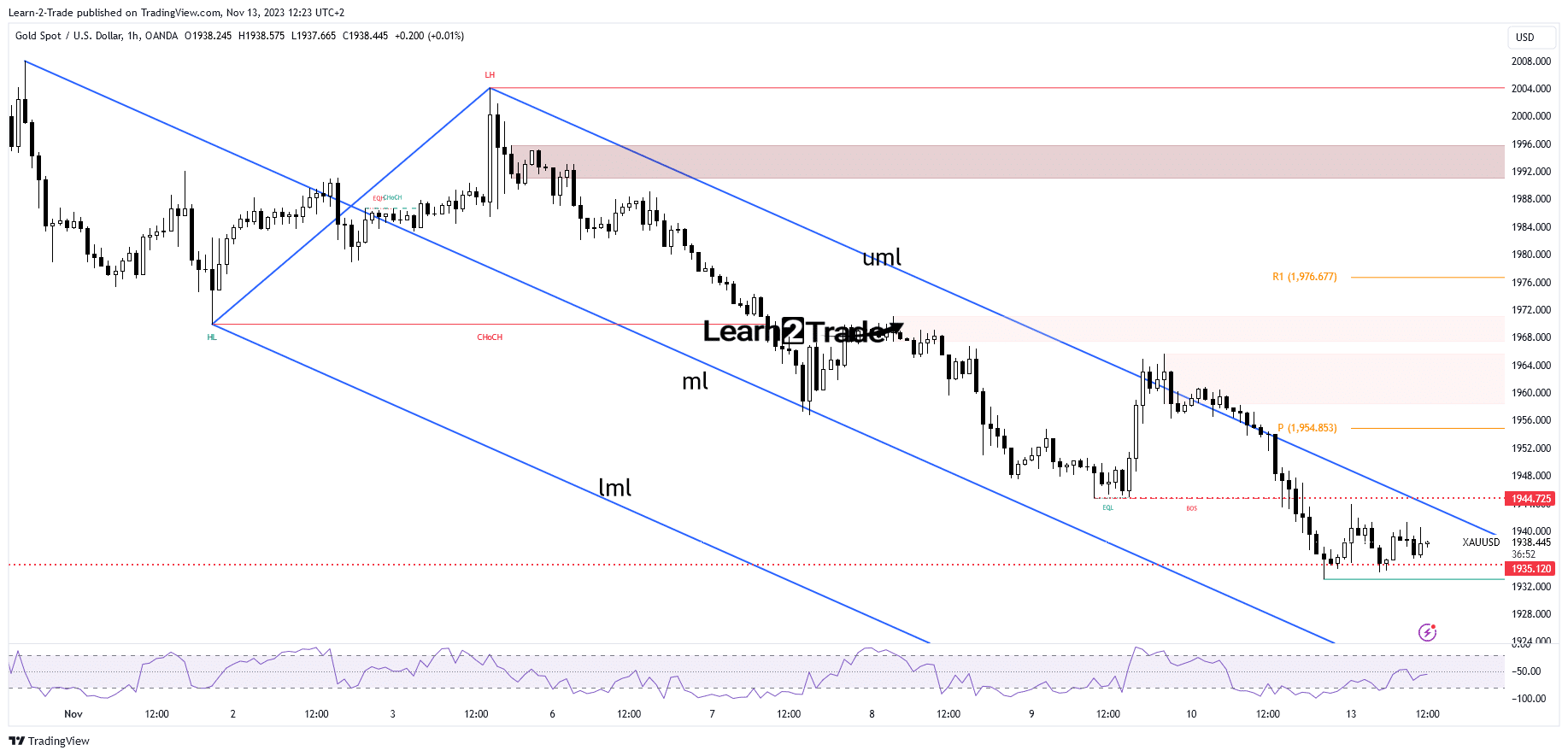

Gold price hourly chart

From a technical perspective, the XAU/USD has extended its downward trend, failing to establish stability above the upper median line (uml). Currently finding support at the historical level of 1,935, there is an attempt at a rebound. However, the overall outlook remains bearish if the price stays below the upper median line (uml) and the former low of 1,944.

The present trading range suggests a potential continuation of the downside pattern. The rate seems to be gathering bearish momentum before potentially reaching new lows. If a new lower low is achieved, breaking below 1,935, it could trigger further declines, presenting new short trading opportunities.

The median line (ml) is a significant downside target if the rate continues its descent. The possibility of a downside continuation would be reconsidered if the rate remains above 1,935 and manages a valid breakout above the upper median line (uml). Monitoring these key levels is crucial for assessing the potential direction of the market.

More By This Author:

USD/CAD Weekly Forecast: Fed Comments Revive The DollarEUR/USD Weekly Forecast: Fed Officials Voice Inflation Concerns

GBP/USD Price Analysis: Rebounds As UK Avoids Recession

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more