Gold Price Hits Record High As Trump Tariffs Trigger Trade War Fears

Image Source: Pixabay

Gold price uptrend continued on Thursday with the yellow metal hitting a new record high of $3,059 amid uncertainty over trade policies enacted by US President Donald Trump, which escalated the trade war by imposing tariffs on automobiles. The XAU/USD trades at $3,051, up more than 1%.

Tariffs continue to drive price action, following Trump's announcement of 25% duties on cars and automotive parts not manufactured in the United States (US). As uncertainty rises, Bullion traders bought the precious metal, which extended its gains past $3,050.

Consequently, risk appetite deteriorated with Wall Street trading in the red. The Greenback is also feeling the pain as the US Dollar Index (DXY), which measures the performance of the buck against a basket of six currencies, makes a U-turn, dropping 0.33% to 104.31.

This sparked reactions from global governments with Canada and the European Union (EU) threatening to retaliate against Trump’s actions.

The US labor market remains firm, following the unemployment claims report for the last week, while the economy remains strong after the release of Gross Domestic Product (GDP) data for the last quarter of 2024. Housing data improved but confirmed the slowdown in the housing market.

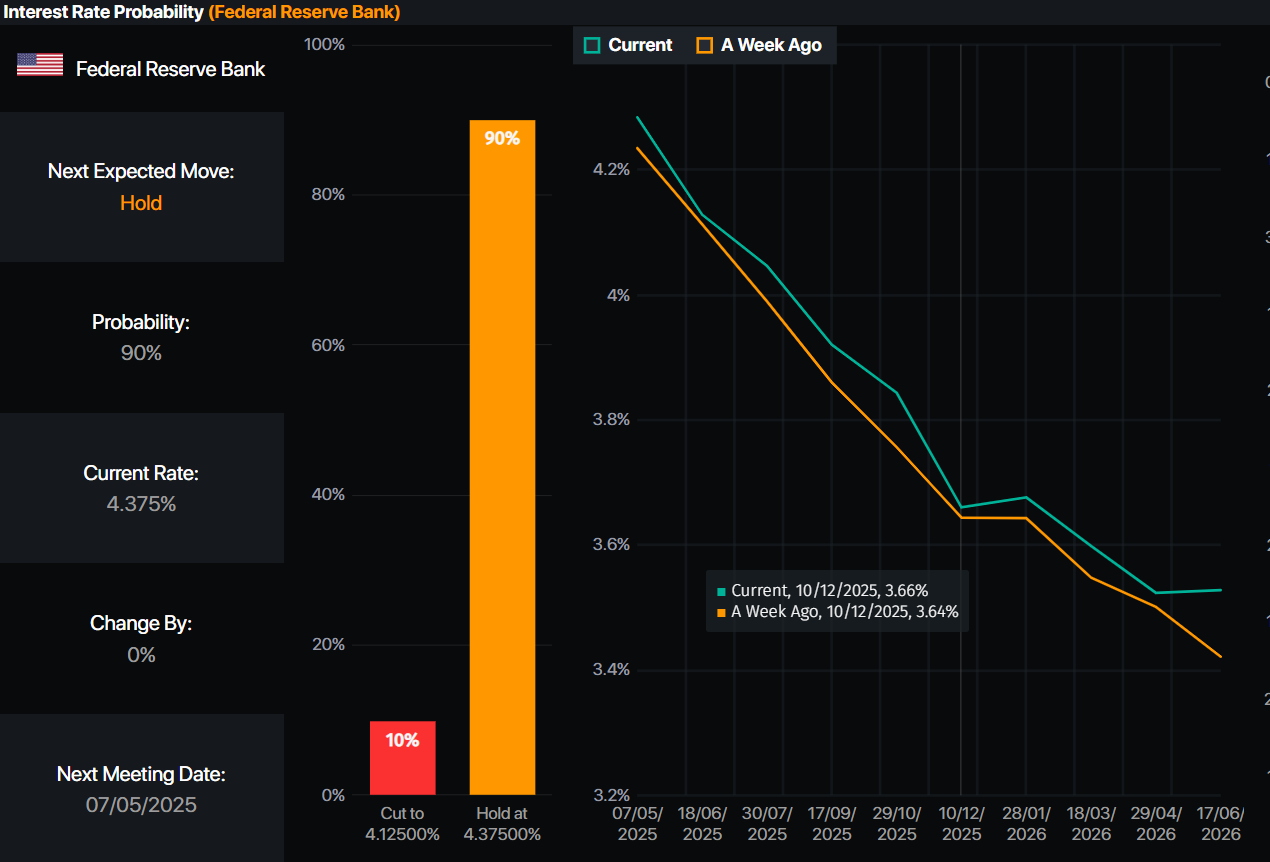

Meanwhile, money markets have priced in 64.5 basis points of Fed easing in 2025, according to Prime Market Terminal interest rate probabilities.

(Click on image to enlarge)

Source: Prime Market Terminal

Aside from this, traders' focus shifts to the announcement of the Fed’s preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index.

Daily digest market movers: Gold price trades firm near $3,000, unfazed by Trump’s comments

- The US 10-year T-note yield is almost flat, up one basis point at 4.371%. US real yields edge down one bps to 1.979%, according to US 10-year Treasury Inflation-Protected Securities (TIPS) yields.

- US Initial Jobless Claims for the week ending March 22 rose to 224K, slightly below expectations of 225K, signaling continued strength in the labor market.

- The final reading of Q4 2024 GDP came in at 2.3% QoQ, up from the previous estimate of 1.9%, though just below the forecast of 2.4%.

- Pending Home Sales declined 3.6% YoY in February, marking an improvement from January’s steeper 5.2% drop, suggesting a modest recovery in housing activity.

XAU/USD technical outlook: Gold price rallies past $3,050

Gold price registered a new all-time high (ATH) of $3,059 as Trump provided the awaited catalyst before the release of PCE inflation figures on Friday. As the yellow metal reaches a new milestone, it sees that buyers are stepping in, putting a test of $3,100 in the near term back on the table.

The Relative Strength Index (RSI) suggests that buyers are gathering steam with the index turning overbought. Nevertheless, traders should be aware that in aggressive movements, the most extreme level would be 80.

The next resistance for XAU/USD would be $3,059. A breach of the latter will result in a $3,100 exposure. Conversely, Gold’s first support is $3,050. Once cleared, the next stop would be $3,000, followed by the February 24 swing high at $2,956, then the $2,900 mark and the 50-day Simple Moving Average (SMA) at $2,887.

(Click on image to enlarge)

More By This Author:

Mexican Peso Tanks To 2-Week Low As Trump’s Auto Tariffs Roil MarketsSilver Price Forecast: XAG/USD Retreats From 4-Day Peak, Beneath $34

Gold Price Flat Near $3,020 As U.S. Dollar Rebounds On Trump Tariff Comments

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more