Gold Price Hangs Near One-Month Low Amid Bullish USD, Bears Await Break Below $2,600

Image Source: Pixabay

- Gold price remains depressed near its lowest level since October 10 touched the previous day.

- The Trump-related trades keep the USD close to a multi-month top and weigh on the XAU/USD.

- Elevated US bond yields support prospects for the precious metal to experience further downside.

Gold price (XAU/USD) remains on the defensive through the Asian session on Tuesday and currently trades just above its lowest level since October 10 touched the previous day. The US Dollar (USD) stands firm near a four-month high in the wake of optimism over Donald Trump's anticipated expansionary policies and continues to undermine the commodity. Furthermore, elevated US Treasury bond yields, bolstered by hopes that Trump's tariffs and corporate tax cuts could boost inflation, turn out to be another factor weighing on the non-yielding yellow metal.

That said, fears that Trump’s protectionist stance might trigger a trade war and impact the global economy offer some support to the safe-haven Gold price. Traders might also refrain from placing aggressive bets ahead of this week's release of the US consumer inflation figures. Apart from this, speeches from a slew of influential FOMC members, including Fed Chair Jerome Powell, will be looked upon for cues about the rate-cut path. This, in turn, will play a key role in driving the USD demand and help determine the near-term trajectory for the XAU/USD.

Gold price bears retain control amid bullish USD, elevated US bond yields

- The US Dollar prolonged its positive trend that followed Donald Trump's victory in the US presidential election and shot to its highest level since early July, which prompted heavy selling around the Gold price on Monday.

- Trump's expansionary policies and corporate tax cuts could put upward pressure on inflation, and limit the Federal Reserve's scope to ease its monetary policy more aggressively. This continues to underpin the Greenback.

- Minneapolis Fed President Neel Kashkari said on Sunday that the central bank wants to have confidence and needs to see more evidence that inflation will go back to the 2% target before deciding on further interest rate cuts.

- The US Treasury bond yields hold steady below the post-US election swing high as investors assess broader implications of Trump's victory in the US presidential election on fiscal policy and interest rate cut expectations.

- Before the election, Trump had pledged to impose a universal 10% tariff on imports from all countries. This fuels concerns about an escalation of the global trade war and offers some support to the safe-haven XAU/USD.

- Traders now await speeches from influential FOMC members, including Fed Chair Jerome Powell, for cues about the future of interest rates in the US amid speculations that the US central bank might delay its easing cycle.

- According to the CME Group's Fedwatch tool, traders are now pricing in a 65% chance of another 25-basis-point rate cut by the Fed and a 35% probability of a ‘no change’ at the next FOMC monetary policy meeting in December.

- Investors this week will also confront the release of the US consumer inflation figures and the US Producer Price Index (PPI), which might contribute to determining the next leg of a directional move for the commodity.

Gold price remains vulnerable, 50-day SMA breakdown in play

From a technical perspective, the overnight breakdown below the 50-day Simple Moving Average (SMA) was seen as a fresh trigger for bearish traders. Moreover, oscillators on the daily chart have been gaining negative traction and are still away from being in the oversold zone, suggesting that the path of least resistance for the Gold price is to the downside.

That said, the overnight slump stalled ahead of the $2,600 mark, which represents the 38.2% Fibonacci retracement level of the June-October rally and should act as a key pivotal point. A convincing break below the said handle should pave the way for an extension of the recent pullback from the all-time peak and drag the Gold price to the $2,540-2,539 confluence. This comprises 50% Fibo. level and the 100-day SMA, which if broken decisively will reaffirm that the XAU/USD has topped out in the near term.

On the flip side, the $2,632-2,635 area now seems to act as an immediate hurdle, above which a bout of a short-covering move could lift the Gold price to the $2,659-2.660 static resistance. A sustained strength beyond the latter should pave the way for a move towards the $2,684-2,685 region en route to the $2,700 mark and the $2,710 supply zone. Some follow-through buying will suggest that the recent corrective decline has run its course and shift the bias back in favor of bullish traders.

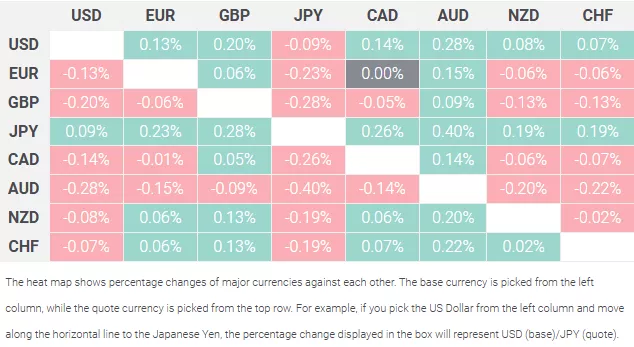

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Australian Dollar.

More By This Author:

EUR/CAD Price Forecast: Breaks Out Of Rectangular Price Pattern And DeclinesEUR/GBP Price Prediction: Resumes Bear Trend After Breaking Decisively Below Range Floor

NZD/JPY Price Analysis: Bearish Momentum Intensifies, Threatening 91.00

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more