Gold Price Forecast: Gold To Outperform On Rising US Inflation

Gold Price Talking Points

The price of gold appears to be on track to test the June 2021 high ($1917) as it climbs to a fresh yearly high ($1903). Fresh data prints coming out of the US may keep the precious metal afloat as the Federal Reserve’s preferred gauge for inflation is expected to increase for the fifth consecutive month.

Fundamental Forecast for Gold Price: Bullish

The price of gold rallies for the third week as ongoing Russia-Ukraine tensions drag on investor confidence. A further shift in risk appetite may lead to higher gold prices as bullion outperforms against other precious metals.

While silver appears to be stuck in the January range, the price of gold may continue to retrace the decline from last year, even though the Federal Open Market Committee (FOMC) prepares to normalize monetary policy as market participants look to hedge against inflation.

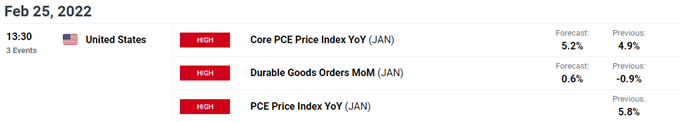

As a result, the update to the US Personal Consumption Expenditure (PCE) Price Index may influence the near-term outlook for bullion as the Fed’s preferred gauge for inflation is expected to increase to 5.2% from 4.9% per annum in December, which would mark the highest reading since 1983.

Evidence of persistent inflation may generate higher gold prices ahead of the next Fed interest rate decision on March 16 as the FOMC Minutes warn that “financial conditions might tighten unduly in response to a rapid removal of policy accommodation.” It remains to be seen if the central bank will adjust its exit strategy as price growth remains well above the 2% target.

With that said, current market conditions may lead to a test the June 2021 high ($1917) as there appears to be a flight to safety, and another uptick in the US PCE Price Index may keep the price of gold as market participants look to hedge against inflation.

Disclosure: See the full disclosure for DailyFX here.