Gold Price Falls Below $3,300 On Strong U.S. Dollar As Trump Reignites China Tensions

Photo by Dmitry Demidko on Unsplash

Gold price slumped on Friday as the US Dollar recovered some ground despite witnessing a drop in US Treasury bond yields following a strong inflation report, which keeps traders hopeful that the US Federal Reserve (Fed) will ease policy in 2025. XAU/USD trades at $3,289, down 0.83%.

Sentiment shifted sour as US President Donald Trump complained that China is not fulfilling the agreement negotiated between both parties in Switzerland. He wrote, “China, perhaps not surprisingly to some, HAS TOTALLY VIOLATED ITS AGREEMENT WITH US. So much for being Mr. NICE GUY!”

Consequently, US equities fell, while the American Dollar recovered from near daily lows, according to the US Dollar Index (DXY).

Turning to trade-related news, a US Federal Appeals Court reinstated most of Trump’s tariffs imposed on April 2, “Liberation Day,” following a decision by a US Court of International Trade, which blocked most of the duties as they were considered illegal.

The US Core Personal Consumption Expenditures (PCE) Price Index dipped in April compared to March’s meeting. Other data showed that the University of Michigan's (UoM) Consumer Sentiment in May's final reading improved compared to estimates, while inflation expectations declined.

Gold daily market movers: Tumbles despite soft US inflation data amid US Dollar strength

- Gold price is pressured due to a strong US Dollar.The DXY, which tracks the US Dollar’s value against a basket of six currencies, edges up 0.11% to 99.44.

- US Treasury bond yields are falling. The US 10-year Treasury note yield falls two basis points to 4.40%, while US real yields are also edging down by the same amount 2.086%, slightly below the May 29 close.

- The US core PCE in April showed the evolution of the disinflation process, which was driven by the Fed's restrictive interest rates. The reading came in at 2.5% YoY, down from 2.6%. Headline inflation came in at 2.1% YoY, below March’s 2.3% rise.

- Despite witnessing a lower inflation environment, Bullion prices failed to gain traction as US Dollar short positions in the futures market were trimmed in the last week, according to Commitments of Traders (COT) data.

- The UoM Consumer Sentiment in May improved from 50.8 to 52.2, exceeding estimates on its final reading. It is worth noting that inflation expectations fell. For the 12 months ahead, expectations fell from 7.3% to 6.6%, and for the next five years, they dropped from 4.6% to 4.2%.

- After the data release, the Atlanta Fed’s GDPNow preliminary reading of economic growth for Q2 2025 rose sharply from 2.2% to 3.8%.

- Federal Reserve officials crossed the wires on Thursday, emphasizing that the monetary policy is in a good place and that it would take some time to see a shift in the balance of risks for the Fed's dual mandate.

- San Francisco’s Fed President Mary Daly said the labor market is in solid shape and revealed that it would not reach the 2% inflation goal in 2025. Despite this, she said that if jobs are solid and the disinflation process continues, it would make sense to cut rates twice as markets expect.

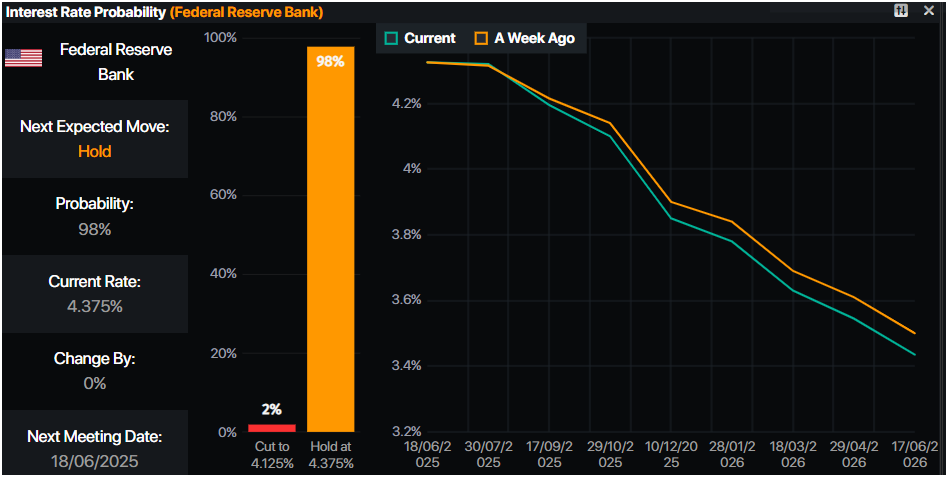

- Money markets suggest that traders are pricing in 52 basis points of easing toward the end of the year, following the release of US data, according to Prime Market Terminal data.

(Click on image to enlarge)

Source: Prime Market Terminal

XAU/USD technical outlook: Tumbles and poised to test $3,250

Gold price uptrend is intact, though XAU/USD spot prices achieving a daily/weekly close below $3,300 could sponsor some sideways trading action within the $3,250-$3,300 range amid the lack of fresh catalysts ahead of the weekend.

For a bearish resumption, sellers must drive Gold prices below $3,250, ahead of the 50-day Simple Moving Average (SMA) at $3,221. A breach of the latter will expose the April 3 high turned support at $3,167.

Conversely, if bulls push XAU/USD past $3,300, the next key resistance levels will be $3,350, $3,400, the May 7 swing high of $3,438 and the record high $3,500.

(Click on image to enlarge)

More By This Author:

Silver Price Forecast: XAG/USD Reaclims $33.00 On Weak U.S. Jobs Data Boosting Haven DemandEUR/USD Slips Below 1.13 As Fed Turns Cautious Amid Looming Stagflationary Risk

Gold Slips Below $3,300 On US Dollar Strength As Traders Await Fed Minutes

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more