Gold Price Bidding Higher Towards $1,800, Awaiting US NFP Data

The gold price rallied during the European session. The asset is now trading at 1,782 while writing. The short-term bias remains bullish as the Dollar Index remains under pressure.

Technically, the yellow metal is challenging a resistance area. It remains to see if the buyers will be strong enough to push the price above the immediate upside obstacle. Surprisingly or not, the price of gold rallied and erased yesterday’s losses even though the US ISM Services PMI came in at 56.7 above 53.5 in yesterday’s trading session.

Today, the BOE increased the Official Bank Rate from 1.25% to 1.75%, as expected. The MPC members voted unanimously for this decision. Later, the US Unemployment Claims indicator is expected at 262K versus 256K in the previous reporting period. At the same time, the Trade Balance could be reported at -80.5B above -85.5B in the previous reporting period.

Tomorrow, the fundamentals could drive the markets. The US NFP is expected at 250K, the Unemployment Rate could remain at 3.6%, while the Average Hourly Earnings could report a 0.3% growth. These are high-impact events and could bring high volatility and sharp movements.

Gold price technical analysis: Bullish momentum

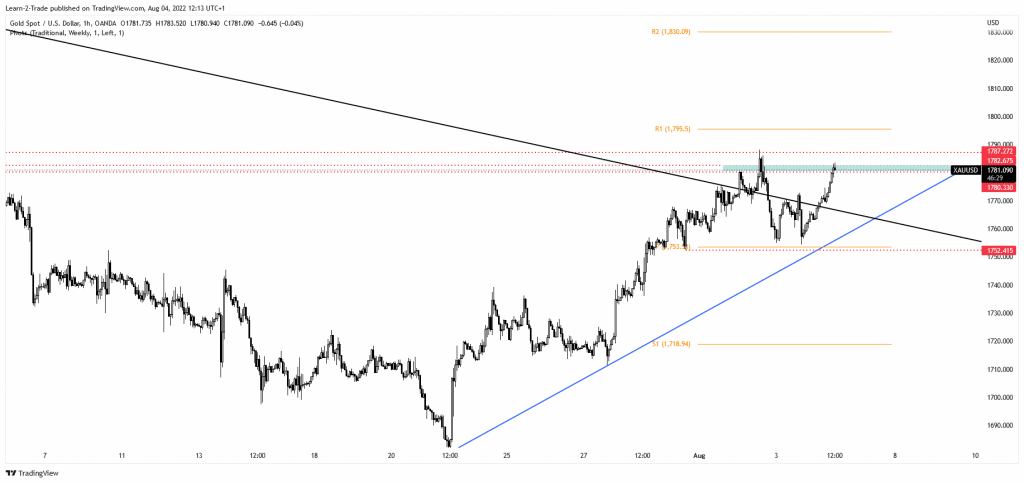

From the technical point of view, the gold price came back above the descending trendline after failing to reach the weekly pivot point of 1,753. Failing to test the ascending trendline signaled intense upside pressure. Now, it challenges the 1,780 – 1,782 resistance zone. The $1,787 level represents another substantial hurdle. A valid breakout through this crucial resistance could activate a larger upwards movement.

False breakouts above these levels may result in a new sell-off. Still, a more significant downside movement could be validated only by a valid breakdown below the ascending trendline. Fundamentally, the XAU/USD could jump towards new highs due to new geopolitical tensions and slowing the global economy down.

More By This Author:

USD/JPY Price Halts Downside As Greenback Gains, Eying Risk ModeAUD/USD Price Analysis: Australian Inflation Stimulating Bulls

AUD/USD Weekly Forecast: Upbeat Australia’s Inflation to Boost Aussie

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more