Gold Price Analysis: XAU/USD Consolidating On The Low End Near $1,820

Image Source: Pixabay

Spot Gold prices denominated in US Dollars are holding steady near $1,820 after skidding off of September's highs of $1,953 and is down from Gold's all-time peak of $2,079.76 set back in May of this year.

Rising Treasury yields have sent spot Gold prices into the planks as investors piled into the US Dollar in recent weeks, fueled by mounting concerns in the global markets that ongoing inflation battles at the majority of the world's major central banks will see financial market's lending and funding premiums remaining elevated for much longer than many previous expected.

US Treasuries have been marking in highs not seen since the global financial crisis, with the US 10-year Treasury yield tipping into 4.882% this week.

Spot Gold is now trading into seven-month lows as markets continue to get rattled by the prospect of interest rates remaining elevated for much longer than investors would have liked to see.

One of Gold's remaining bright spots is Chinese market demand for the yellow metal: the People's Bank of China (PBoC) has been hoarding gold at a blistering pace for at least two years, with foreign reserve data noting that the PBOC purchased 29 tones of Gold in August, bringing the Chinese central bank's year-to-date Gold acquisitions to 155 tonnes since the start of 2023.

XAU/USD technical outlook

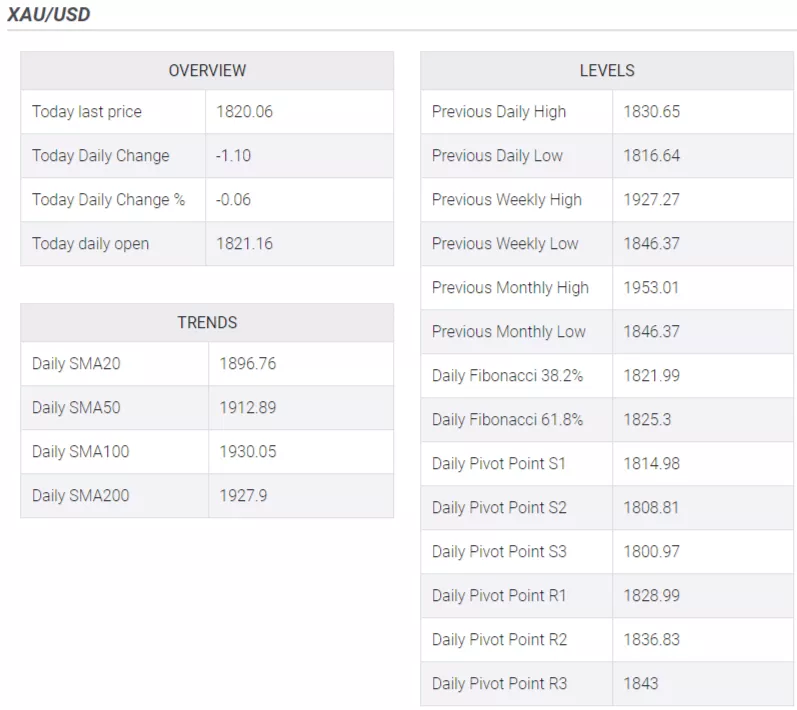

Spot Gold prices are steeply off near-term highs, trading into $1,8200 after testing a fresh seven-month low of $1,813.07 on Thursday. The XAU/USD has closed in the red for eleven of the last twelve consecutive trading days, but the pace of downside momentum has slowed this week, with Gold down a scant 0.42% from Tuesday's opening bids.

Gold prices are currently consolidating between $1,820 and $1,830 as market participants brace for Friday's upcoming US Non-Farm Payrolls (NFP) data drop, and XAU/USD's directional bias has twisted into the middle as investors wait to see how the US's economic outlook will lean on Federal Reserve (Fed) expectations.

Downside momentum in spot Gold has the 50-day Simple Moving Average (SMA) extending a bearish crossover of the 200-day SMA, and technical indicators are pinning into the low end, with the Relative Strength Index breaking the pins in oversold territory.

XAU/USD daily chart

(Click on image to enlarge)

XAU/USD technical levels

More By This Author:

USD/JPY Back Into 148.40 As Greenback Takes A BreatherUS Dollar Mixed Ahead Of Weekly Jobless Numbers

USD/JPY Price Analysis: Recovers Early Lost Ground, Struggles To Capitalize On Move Beyond 149.00

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more