Gold Price Analysis: Stays Choppy Under $1790 Despite Poor Risk

Today, gold price analysis suggests no direction as the metal is trading flat and bearish. Bulls are capped by the key barrier of $1,790, while the decline remains around $1,780. Market sentiment places a new bet under the US dollar as a safe haven and weighs gold’s upside. Omicron Covid’s rapid spread and potential risks for the global economy have dampened risk-taking.

Image Source: Pixabay

Meanwhile, US Treasury bond yields remain low amid Federal Reserve concerns, giving gold bulls hope. Omicron updates and Fed sentiment will continue to affect market sentiment, affecting the yellow metal. The US PPI data will also boost trading as the two-day Fed meeting progresses.

New developments in the virus strain include the first Omicron death in the UK and a return of the mask mandate in California. G7 finance ministers and central bank governors are urged to address supply chain issues and COVID-19 variants. In the Asian Development Bank (ADB) update, the Omicron effect is also apparent. Reuters reported on Tuesday that a new variant of the Omicron coronavirus has lowered the ADB’s growth forecasts for this year and next to reflect these risks.

Bloomberg reports that the US House of Representatives and Senate are nearing an agreement on an Uyghur anti-China bill that sparked geopolitical tensions between Washington and Beijing. In addition, according to Axios, “National Security Advisor Sullivan will visit Israel next week to discuss Iran.”

Market participants speculate about a faster Fed cut and hint of a rate hike during Wednesday’s FOMC meeting, which contrasts with the recent easing of US inflation expectations and supports gold’s price. In addition, global rating agency Moody recently drew attention to a delicate decision that the US Federal Reserve (FRS) will have to make during its monetary policy meeting on Wednesday.

Despite mixed fears, US Democrats’ push for a $1.75 trillion bailout by the end of 2021 appears to favor stocks.

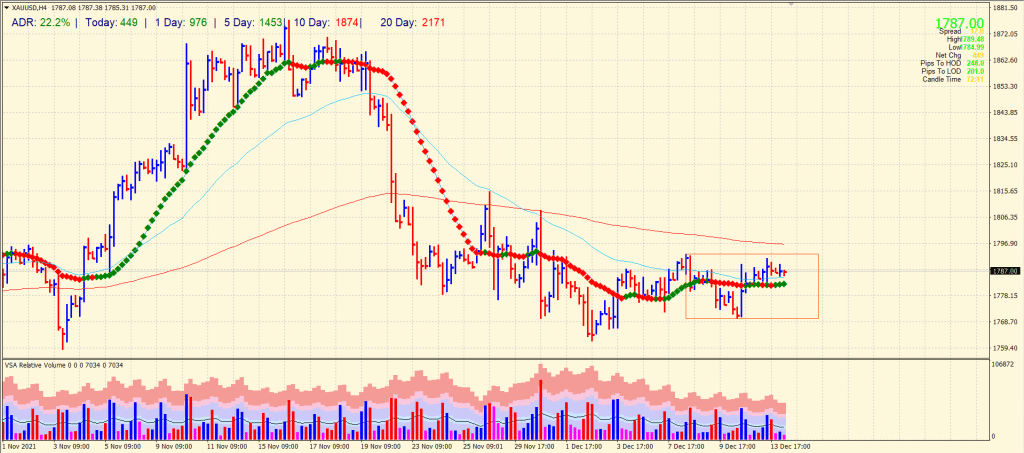

Gold Price Technical Analysis: Choppy Market To Continue

(Click on image to enlarge)

The gold price stays in a tight range within the 20-period and 200-period SMAs on the 4-hour chart. The precious metal looks soft as the widespread up bar closed near the middle, followed by many narrow-spread bars with very low volume. The average daily range is 22%, which is quite lower than usual. Traders should look for a decisive breakout of the current range ($1770 – 1800) for a valid trading opportunity.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more