Gold Price Aims To Regain $2,000, Eyes On US Retail Sales

The gold price turned to the upside and is trading at 1996 at the time of writing. The weakening dollar helped the XAU/USD buyers to take it higher in the short term.

After a significant drop, the yellow metal could try to rebound and recover. Gold prices slumped after the United States reported higher inflation than expected in January.

Yesterday, the United Kingdom Consumer Price Index reported only a 4.0% growth versus the 4.1% growth estimated, while the Core CPI registered a 5.1% growth, less compared to the 5.2% growth forecasted.

The Australian data reported poor figures today, while the UK announced mixed economic figures. Later, the US data should be decisive.

Retail Sales are expected to report a 0.2% drop, Core Retail Sales may announce a 0.2% growth, the Empire State Manufacturing Index could be reported at -13.7 points, while Unemployment Claims could jump from 218K to 219K.

Furthermore, the Philly Fed Manufacturing Index, Industrial Production, Capacity Utilization Rate, and Business Inventories data will also be released. Poor economic figures should weaken the USD and may force the XAU/USD to register a larger rebound.

Gold Price Technical Analysis: Leg Higher

(Click on image to enlarge)

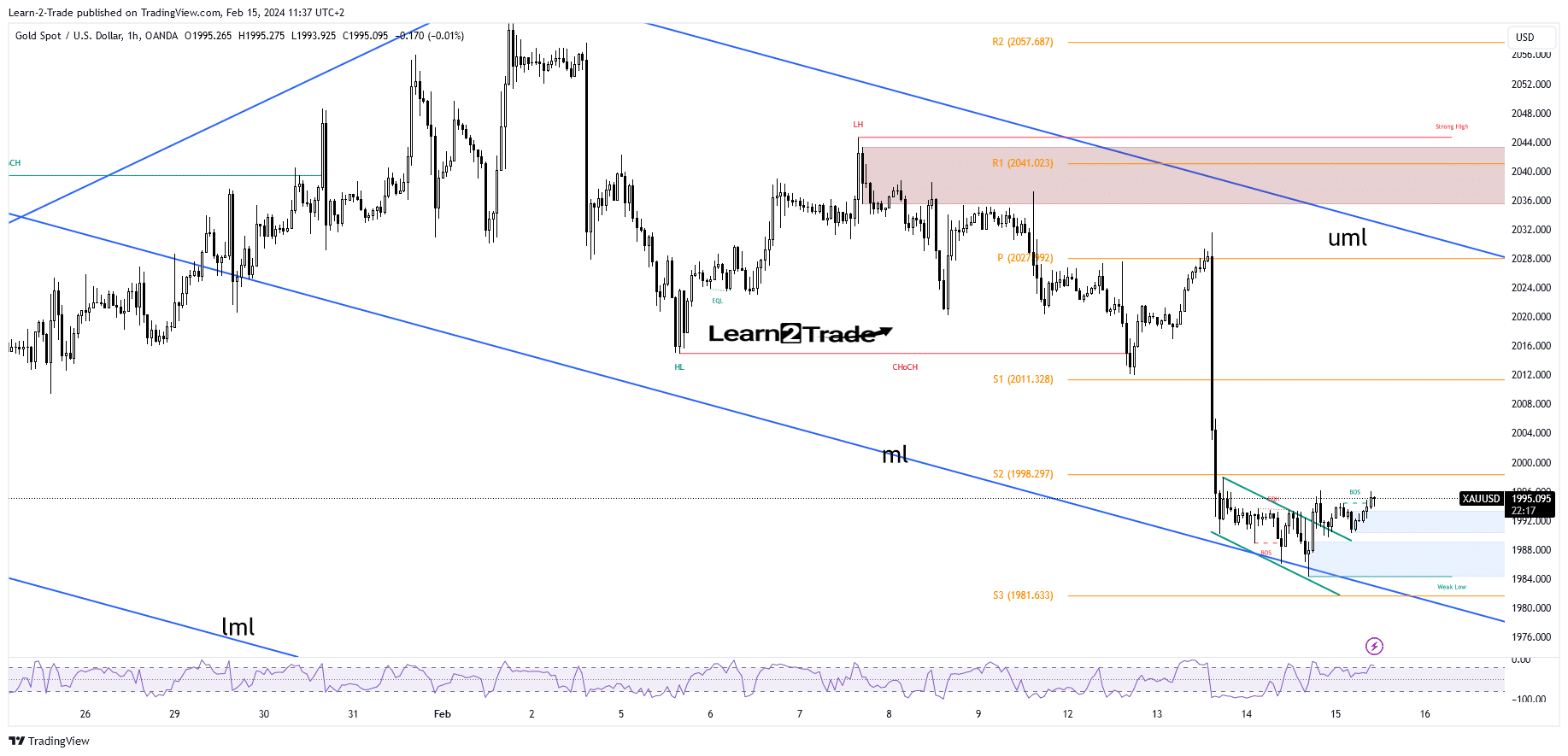

Gold 1-hour chart

From the technical point of view, the XAU/USD found support on the descending pitchfork’s median line (ml). This represents a dynamic obstacle: the false breakdowns announced exhausted sellers. The first upside obstacle is represented by the weekly S2 of 1998.

Taking out this resistance and making a new higher high activates further growth towards the S1 (2011). If the DXY develops a larger drop, the price of gold could approach the upper median line (uml). Still, it’s premature to talk about such a larger rebound.

More By This Author:

AUD/USD Forecast: Profit-Taking In Dollar After Inflation Led RallyUSD/JPY Outlook: Yen Soars Amid Japanese Officials’ Concerns

EUR/USD Price Under Selling Pressure After Upbeat US CPI

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more