Gold Pretty Stretched

Image Source: Pixabay

Gold’s massive breakout this month has left it pretty stretched technically. Blasting back up into extreme-overbought territory multiplies gold’s odds for an imminent rebalancing selloff. That would be very healthy for this mighty bull’s longevity, normalizing these record prices and bleeding off excessive greed. Gold is also facing other factors beyond overboughtness arguing for a breather, which would be a buying opportunity.

From a short-term-market-action perspective, absolute price levels don’t matter much. Traders are quick to adapt to new price regimes, soon accepting them as normal. But how fast prices moved to any new prevailing levels is very important. If they rallied or plunged too far too fast to be sustainable, the resulting extremes are likely to soon spawn sharp reversals. Traders can rapidly earn big profits trading these events.

While overboughtness and oversoldness seem subjective, they can be measured empirically. All it takes is some mathematically-defined baseline for any given price and the history of how that price interacted with its baseline. Decades ago I studied various gold measuring rods to define its excessive price moves, and settled on a simple one. I called it Relativity Trading, which I first wrote about in an essay 21 years ago!

Relativity’s baseline is gold’s 200-day moving average, the most-common long-term one by far in all of technical analysis. 200dmas move slowly enough that outsized gold moves deviate far from them, yet still gradually evolve to reflect changing price regimes. Specifically the Relative Gold or rGold construct just divides gold’s daily closes by their 200dmas. The resulting multiples charted over time often form trading ranges.

Month-to-date alone, gold has surged a big 6.2% higher. That’s part of a way-larger magnificent year-to-date run soaring 39.4%!That extended gold’s mighty cyclical bull since early October 2023 to utterly-spectacular 102.9% gains as of this Tuesday!And remarkably that also proved a single monster upleg, with gold suffering zero 10%+ corrections over these last 23.4 months!That has left gold extremely overbought.

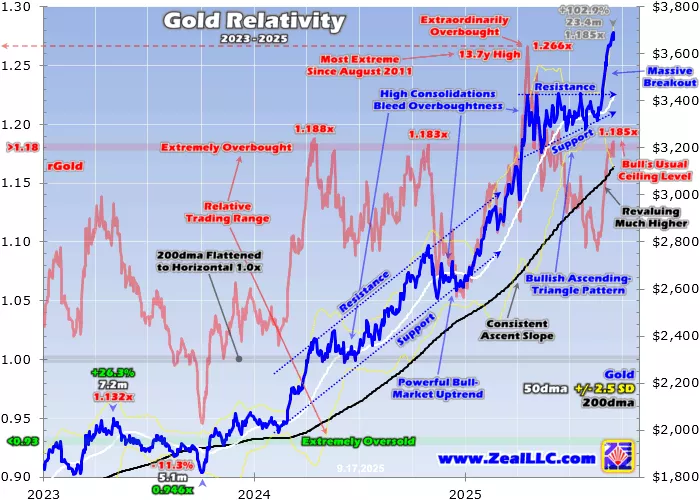

This past-several-years Relative Gold chart really drives home that point. Gold and its normal technicals including its 200dma are slaved to the right axis. Those are superimposed over the rGold multiples which are rendered on the left side. Relative Gold basically flattens gold’s 200dma to horizontal at 1.00x, then reveals how gold oscillates around that key baseline in perfectly-comparable percentage terms over time.

This Tuesday leading into the latest Fed decision, gold closed 18.5% above its 200dma or at 1.185x in rGold terms. Relativity trading ranges are defined based on the last five calendar years of price action, and I just updated gold’s in recent weeks. Gold tends to be extremely-oversold and a great buy when down under 0.93x its 200dma, and extremely-overbought and likely to sell off when stretched above 1.18x it.

Most technical analysis focuses on the blue gold-price line, which doesn’t offer many clues about how overbought gold is. Gold can be low compared to recent years and still hit extreme overboughtness, or high and yet not-particularly-overbought at all. But looking at gold as a multiple of its 200dma baseline brings into sharp focus how far and fast it has run. The red rGold line reveals this bull’s overboughtness.

Over these last couple years, gold has become pretty stretched technically four separate times. The first three all halted this mighty bull’s upward progress, requiring some selling and grinding to rebalance both excessive technicals and sentiment. There’s no reason to expect this latest fourth to play out differently. Gold has rallied too far too fast to be sustainable in recent weeks, dramatically upping odds for a breather.

The first time gold soared to extremely-overbought levels in this bull was back in mid-April 2024. Gold blasted up 16.9% in just over six weeks, catapulting it way up to 1.188x its 200dma! That proved the highest rGold read in 3.7 years, since just after gold’s previous 40%+ monster upleg crested back in early August 2020. I warned about gold’s extreme overboughtness at the time in an essay right as gold was peaking.

Gold’s $2,388 absolute levels didn’t matter much then, but surging there so darned fast required some kind of pause. Extreme overboughtness can be worked off two ways, more quickly through fairly-big-and-sharp selloffs or more gradually through sideways-grinding high consolidations. As a speculator I much prefer the faster former since it brings trading opportunities sooner. Eat the broccoli before getting to steak.

But in spring 2024 gold consolidated high instead of correcting. Selloffs are classified based on their sizes. Under 10% they are pullbacks, above 10% they are corrections, and over 20% they become bear markets. Despite mid-April 2024’s extreme overboughtness, gold only pulled back 4.0% into late April. Surprisingly next it surged to more record highs in mid-May, but then suffered another 5.7% pullback into early June.

Overall that made for the sideways drift evident in this chart. Notice that gave gold’s 200dma in black time to start catching up with stretched gold price levels in blue. That high consolidation nicely working off overboughtness is readily evident in the red rGold line meandering lower in spring 2024. From mid-April to late June, rGold retreated from that risky 1.188x back to just 1.088x. Much overboughtness was worked off.

That healthy rebalancing selling and drifting primed gold’s bull for another run higher, which happened into late October 2024. Then gold crested at $2,786 less than a week before Election Day, stretched up a similar 1.183x its 200dma. I wrote another essay earlier that month explaining why gold’s selloff risk was high since it was so extremely-overbought. When prices run too far too fast per their own precedent, rallies stall.

Indeed not surprisingly since markets are forever-cyclical, gold sold off fairly hard into mid-November with a correction-challenging 8.0% pullback. That was still fairly-mild considering gold had soared a colossal 35.0% YTD at that point!Yet after that selloff, gold’s price action morphed into another high consolidation into late December 2024. Gold didn’t carve new selloff lows, but drifted back down towards mid-November’s.

From late October to late December, gold’s overboughtness shrunk from 1.183x to just 1.053x in rGold terms. Such essential rebalancings extend bulls’ longevities. The biggest risk factor for strong bulls is prematurely burning themselves out. If they soar too far too fast attracting in all-available near-term buyers too soon, that leaves only sellers. And they come out in droves after parabolic blowoffs, slaying bulls.

At that point gold’s mighty cyclical bull had operated within a tight extreme-overboughtness profile. Twice it peaked at 1.188x and 1.183x gold’s 200dma, right where gold again closed this Tuesday at 1.185x. As gold stretching 18%+ above that key technical baseline two previous times forced pullbacks and drifts, today’s extreme overboughtness ought to follow that script. Gold again needs to sell off sizably or consolidate.

But then in late-April 2025, gold didn’t stall at 18%+. In just under six weeks, gold soared 18.5% to a new record $3,421. Gold had so much upside momentum it didn’t stop until an astounding 1.266x its 200dma!Those were dangerous crazy-overbought levels, as I warned in another essay that very week. That was so wild I did a study of every gold bull and bear, and every upleg and correction, since way back in January 1971.

It turned out gold soaring 26%+ above its 200dma was exceedingly-rarefied territory. That proved the most overbought gold had been since late August 2011, a whopping 13.7 years earlier!And that was just gold’s third trading day stretched to 1.26x+ since January 2011. Gold’s historical action over the last 54+ years argued a sharp correction was highly-probable, so we battened down the hatches on our gold-stock trades.

Excluding the unique 1970s superbulls after the US dollar was severed from gold, the next-ten-largest gold bulls of modern times averaged 58.0% gains over 13.9 months. They peaked at an average of 1.265x gold’s 200dma, exactly where it was in late April!Those were followed by average corrections of 15.5% over just 1.9 months!A similar one would’ve slammed gold back near $2,891 by mid-to-late June.

So we ratcheted up the trailing stop losses on our extensive newsletter gold-stock trades, in order to preserve more of their big gains if gold rolled over into a correction. I changed my short-term gold bias to short, and we added some GLD put options. The first correction of gold’s mighty cyclical bull was highly likely to unfold soon. The more extreme overboughtness mounts, the greater the near-term risks for big selloffs.

While that 1.266x rGold was crazy and far over the 1.18x threshold, it doesn’t impair the model too much. When traders wax super-greedy and rush to chase soaring prices, they pile in fast near the end of such surges. Gold first crept 18%+ above its 200dma at the end of March at 1.181x, but soon retreated back to 1.118x. Then in mid-April it surged back to 1.186x. From there gold took just six trading days to soar to 1.266x!

So could gold again grow more stretched than 18%+ in the coming weeks?Of course. But even if it does, odds are any foray even deeper into extreme overboughtness won’t last long. We are talking days or maybe a couple weeks on the outside. And gold growing even more overbought raises the likelihood of an imminent sizable selloff or longer sideways drift. Greater overboughtness increases near-term risks.

Remarkably despite gold’s long precedent over the past half-century, again it mostly consolidated higher after late April’s crazy overboughtness! At worst gold pulled back 7.1% pretty rapidly in mid-May 2025, but largely drifted sideways. Note in the chart above this latest high consolidation was a bullish technical pattern called an ascending triangle. Those are defined by rising lower support and flat upper resistance.

These are bullish continuation patterns in technical analysis, meaning prices meandering within them soon tend to break out to the upside in the same direction they entered. By late June it was becoming more apparent gold was consolidating high rather than correcting, so we started aggressively reloading our newsletter trading books with fundamentally-superior mid-tier and junior gold-stock trades after stoppings.

As of midweek these young trades are already enjoying huge unrealized gains as big as +81%!Selloffs out of extreme overboughtness usually cascade fairly-rapidly. So if such peaks are followed by drifts for four-to-six weeks or so, odds increase that high consolidations will prove sufficient to do enough of that essential technical and sentimental rebalancing work. Traders have to adapt to conditions in real-time.

In late August I wrote another essay on gold’s ascending-triangle breakout nearing. Its horizontal upper resistance had been running near $3,425 all summer. Indeed gold soared to new record highs right after, surging 8.0% to $3,691 in just over a couple weeks ending Tuesday!That pushed gold back up into that extreme-overbought territory, again stretching to 1.185x its 200dma. So again a selloff or drift is highly-probable.

Arguing for a high consolidation, this remarkable mighty bull has yet to see a single 10%+ correction. A big reason those have been avoided is strong foreign demand has been a major driver for much of gold’s upside over these last couple years. Chinese investors, world central banks, and Indian investors have often been big buyers. It wouldn’t surprise me at all to see gold drift on balance for another couple months.

But even a high consolidation could mean another sizable selloff. Prior pullbacks in this bull have run 4.0%, 5.7%, 8.0%, and 7.1%. Sliding from 4% to 8% again would force gold down to $3,544 to $3,396 from Tuesday’s latest record. Those certainly aren’t bad levels, but would spawn plenty of gold-stock selling. The major gold miners of the leading GDX gold-stock ETF tend to amplify material gold moves by 2x to 3x.

Interestingly gold’s modern seasonals align with a sideways drift. For the past quarter-century or so, gold has tended to suffer a seasonal lull from late September to late October between its autumn and winter rallies. While gold’s average loss during that span has been quite mild at 1.1%, entering that period in extreme overboughtness could certainly exacerbate selling. Seasonal headwinds will blow for a month or so.

But speculators’ gold-futures positioning is more aligned with a correction-grade selloff. These guys are normally gold’s dominant short-term driver, as the extreme leverage inherent in gold-futures trading lets them punch way above their weights in gold-price impact. And spec longs are more important than shorts in moving gold, as during this mighty bull longs have outnumbered shorts by an average of 3.9x weekly.

Spec longs can be considered in terms of how far they are up into their gold-bull trading range. Down near 0% specs have vast room to buy with little room to sell, pushing gold higher. But the opposite is true up near 100%, they have tons of gold-futures contracts to dump with little capital firepower left for buying. The higher spec longs, the greater the odds gold is in for a selloff soon regardless if it is overbought or not.

Specs’ gold-futures-positioning data is only published weekly, current to Tuesday closes. In mid-April 2024 when rGold hit 1.188x, spec longs were only 40% up into their current gold-bull range. In late October 2024 near 1.183x, spec longs ran 89% up in!Interestingly that was just before gold’s biggest-and-fastest selloff of this bull, that 8.0% large-pullback plunge in just over a couple weeks into mid-November.

Then at late-April 2025’s crazy 1.266x, spec longs had already fallen back down near just 30%!These guys had done huge long dumping in early April as gold grew more overbought, but big foreign buying overcame that. During gold’s latest high consolidation from late April to late August, total spec longs only averaged 34% up into their current gold-bull trading range. That certainly supported gold consolidating high.

But this week as gold soared back up to 1.185x its 200dma, spec longs are quite-high. The latest futures data when this essay was published was as of a week earlier, when total spec longs had just surged back to 70% up in!That implies these hyper-leveraged traders running up to 22.9x midweek now have over double the room to sell than buy!And this metric could’ve stretched higher still as of this Tuesday’s peak.

So spec gold-futures positioning today seems to support a sharper gold selloff. That doesn’t mean it will play out that way, but gold’s downside risks at 70% are much higher than at 30%. Running such extreme leverage, specs simply can’t afford to be wrong for long. At 22.9x, a mere 4.4% gold move against their bets wipes out 100% of their capital risked!So when they sell, they tend to do it hard and fast as a herd.

With gold pretty stretched here making another selloff or high consolidation probable, what should traders do?If your stop losses on gold-stock trades are too loose, you can ratchet them tighter to protect more of your big unrealized gains. If you want to add new gold-stock trades, it is far more prudent to wait until gold works off a good chunk of this latest extreme overboughtness. Gold stocks will amplify any gold downside.

That GDX gold-stock ETF is also extremely-overbought, much more so than gold itself. That implies gold stocks face outsized selling if gold rolls over materially. Extreme-overboughtness episodes are great times to do your homework. Instead of buying really high and hoping for a greater fool later, hold off on adding new positions while you research fundamentally-superior ones to add later after gold takes a breather.

The bottom line is gold is pretty stretched technically here. Its recent breakout surge blasted it back up into extreme-overboughtness territory. That means gold has rallied too far too fast to be sustainable per its own bull’s precedent. Previous similar episodes were soon followed by combinations of pullbacks and sideways drifts. Those high consolidations gradually rebalanced overextended technicals and sentiment.

While gold could get more overbought yet, that wouldn’t last long and just ramps the odds for a breather. Gold’s usual seasonal lull over the next month or so argues for a high consolidation. But speculators have been flooding into gold-futures longs recently, leaving them with much more room to sell these super-leveraged trades than buy. If they get spooked, their herd selling could force gold into a full-blown correction.

More By This Author:

GDX Finally Bests RecordsGold-Stock Records Nigh

Gold Breakout Nears