Gold Pauses Near Record Highs As Bulls Struggle Below $5,000

- Gold pulls back after hitting a fresh record high near $4,967.

- Markets await US PMI and UoM data.

- Technicals show early signs of exhaustion below the $5,000 mark.

Gold (XAU/USD) eases modestly on Friday as mild profit-taking sets in following a surge to a fresh record high near $4,967 earlier in the Asian session. XAU/USD hovers around $4,930 at the time of writing and is set for a third straight weekly advance.

Bullion is up more than 7% this week, supported by strong safe-haven demand after renewed trade rhetoric from US President Donald Trump over the Greenland dispute unsettled global markets, reviving “Sell America” sentiment and weighing on the US Dollar (USD).

However, some of these tensions eased on Wednesday after Trump backed away from earlier threats to impose tariffs on several European nations following the announcement of a future-framework agreement on Greenland.

The move did little to cool Gold’s bullish momentum, as investors remain unconvinced that tensions are fully resolved, with the framework agreement lacking concrete details. At the same time, broader geopolitical and economic uncertainties continue to underpin demand for safe-haven assets, keeping the precious metal well bid.

Attention now turns to the US economic docket due later on Friday, with traders awaiting the preliminary S&P Global Purchasing Managers Index (PMI) surveys and the University of Michigan Consumer Sentiment data.

Market movers: US data, Fed leadership and policy credibility concerns

- Economic data released on Thursday showed the US economy expanded at an annualized pace of 4.4% in the third quarter, beating market expectations of 4.3% and accelerating from 3.8% in Q2. Core Personal Consumption Expenditures (PCE) inflation held steady at 2.9% QoQ, while Initial Jobless Claims rose to 200,000 from 199,000 the prior week.

- The US Dollar Index (DXY), which tracks the greenback against a basket of six major currencies, is trading around 98.36, near two-week lows, and is on track for its first weekly decline in three weeks.

- US President Donald Trump’s disruptive trade agenda and repeated use of tariffs as a policy weapon are eroding investor confidence in US assets, fueling debasement concerns and driving demand for traditional safe-haven assets.

- President Donald Trump said on Thursday that he has completed interviews for the next Federal Reserve (Fed) Chair and confirmed he has made his selection, adding that a formal announcement is likely before the end of January. Media reports suggest the shortlist includes Kevin Hassett, Rick Rieder, Christopher Waller, and Kevin Warsh, although Trump indicated last week that he may keep National Economic Council Director Kevin Hassett in his current role.

- Markets remain wary that President Trump’s choice for the next Fed Chair could push the central bank toward a more dovish policy path, following his repeated criticism of current Fed Chair Jerome Powell for not cutting interest rates more aggressively.

- On the monetary policy front, recent US economic data have reinforced the view that the Fed is likely to stick to a gradual easing path rather than aggressive rate cuts. Markets are almost fully pricing in no change at the upcoming January 27-28 meeting and broadly expect the central bank to remain on hold through the first quarter.

Technical analysis: Bulls pause below $5,000

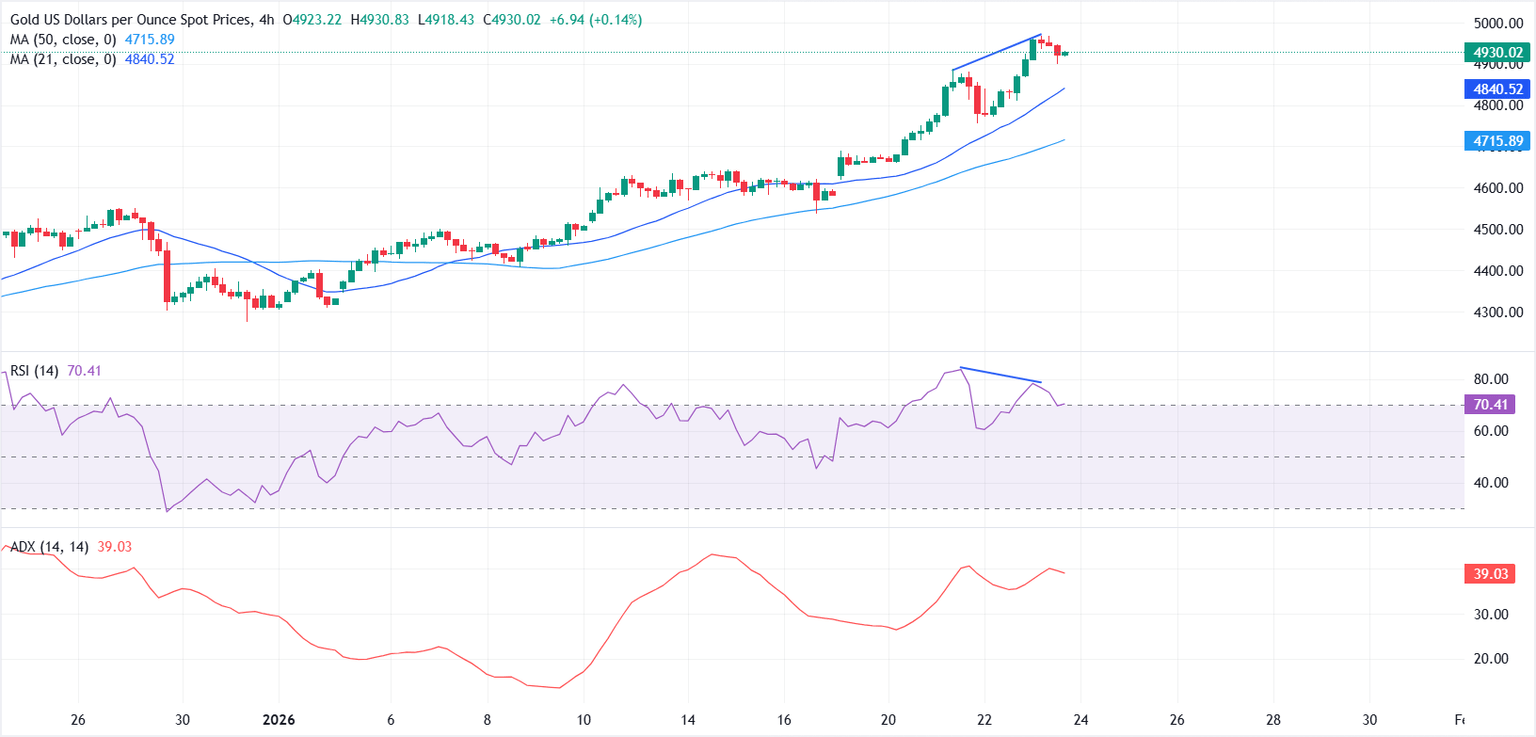

(Click on image to enlarge)

From a technical perspective, sellers have emerged ahead of the $5,000 psychological mark, capping the latest rally near record highs. However, the pullback has so far lacked strong follow-through, with buyers continuing to defend the $4,900 zone.

Trend conditions remain firm, with XAU/USD holding well above the 21-period and 50-period Simple Moving Averages (SMAs). The Average Directional Index (ADX) is hovering around 39, signaling a strong trend environment despite emerging signs of near-term exhaustion.

The risk of a deeper pullback is rising as overbought conditions persist across multiple timeframes. On the 4-hour chart, the Relative Strength Index (RSI) has eased back toward the 70 level and is printing a bearish divergence, signaling early signs of fading upside momentum.

On the downside, immediate support is seen at the $4,900 psychological level. A sustained break below this zone shifts focus to the 21-period SMA near $4,828, followed by the 50-period SMA around $4,709. On the upside, the $5,000 psychological mark remains the key resistance.

More By This Author:

Japanese Yen Languishes Near One-Week Low Vs. USD Ahead Of BoJ PresserGold Refreshes Daily Top As Fed Rate Cut Bets Offset Positive Risk Tone Ahead Of US PCE

GBP/USD Remains Confined In A Range Above 1.3400 As Traders Eye US PCE And GDP Data

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more