Gold Overview: A Whole Lot Of Nothing

If there was a way to describe the last days on the precious metals market, it would be “a whole lot of nothing”. More or less, that’s what happened.

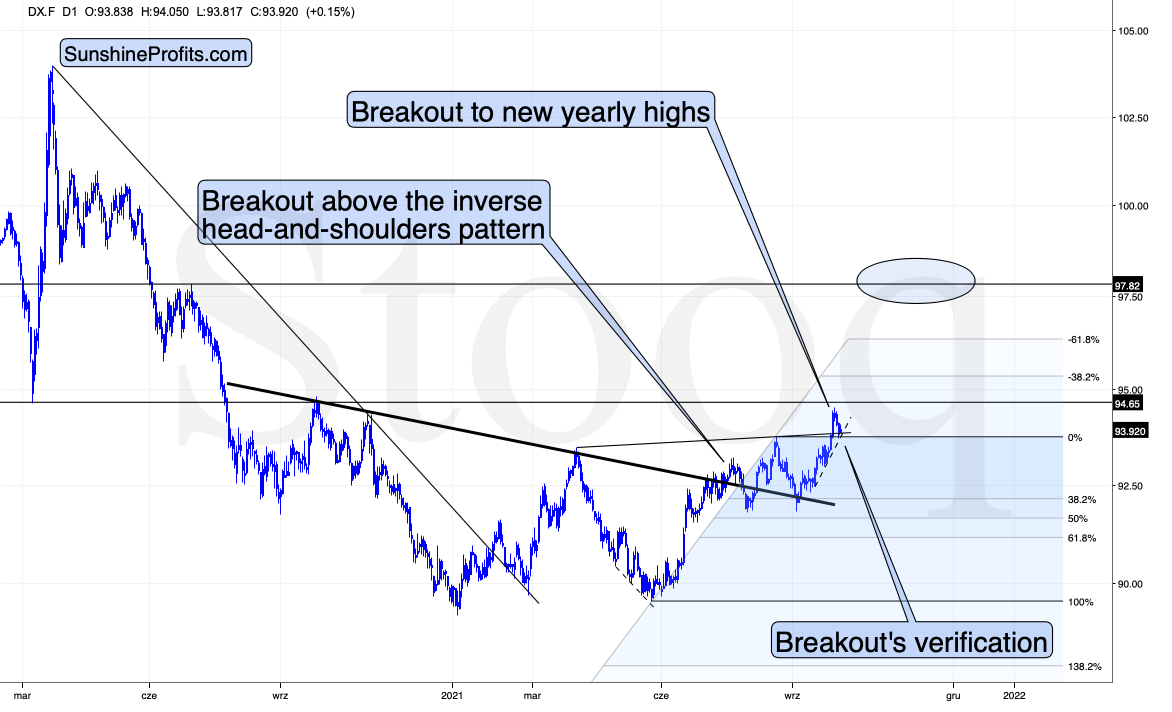

Let’s start with the nothing that happened in the USD Index.

The USDX moved lower very recently, but it changed absolutely nothing. The USD Index moved back to:

- Its previous highs

- Its previous rising resistance line based on the previous highs, which it has verified as support

- The rising dashed support line based on the recent lows.

Moving to a rising support line and verifying a previous breakdown is not a bearish development. Conversely, it’s something quite common during an uptrend.

I previously mentioned that the USD Index is likely to consolidate either below or above its horizontal resistance at about 94.5, and what we’re seeing right now is a consolidation below this level. Once this level is taken out, the USDX could actually rally further without a bigger post-breakout consolidation. Consequently, I’m removing the short-term target area around this level as it no longer seems likely that the USDX will form a meaningful top there.

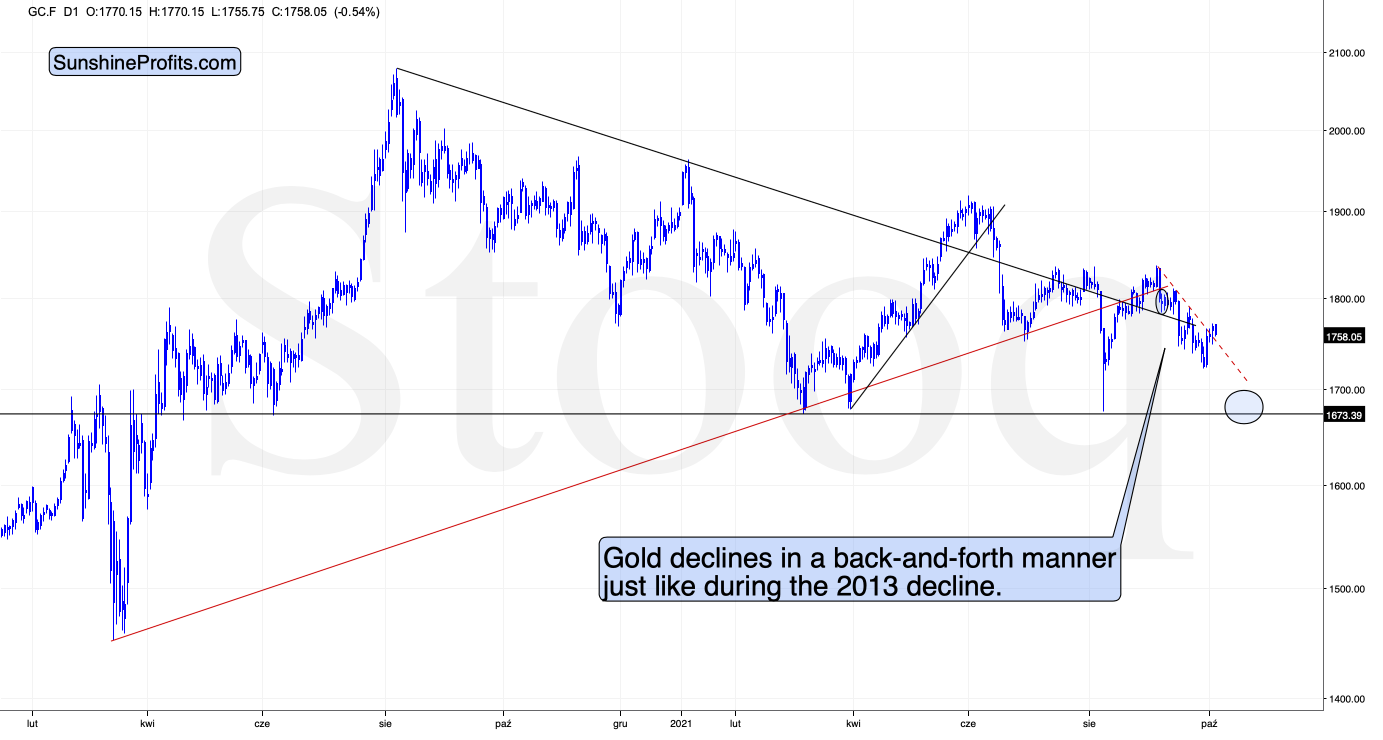

The next “nothing” comes from the gold market.

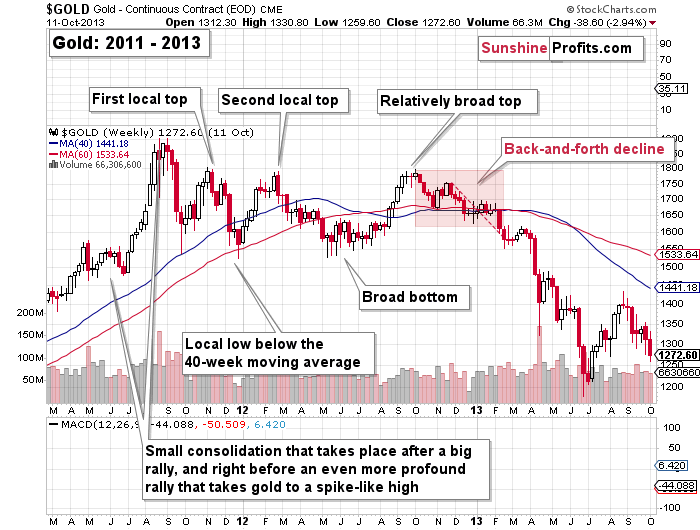

There’s a local breakout above the dashed resistance line, but it’s so much in tune with what happened in 2013 that it’s difficult to view it as bullish.

Likewise, the very short-term breakout that we just saw is similar to what we saw in… early 2013. Remember the similarity to early 2013 that I described on multiple markets? It’s not just gold, it’s the HUI Index, the HUI to gold ratio, and even the 10-year yield.

The small breakout above the red dashed line in early 2013 didn’t take the yellow metal much higher. Gold only finished moving back and forth before sliding to previous important lows, and that was just the beginning of a much bigger move lower.

The very bearish analogy remains intact, so what changed? Nothing.

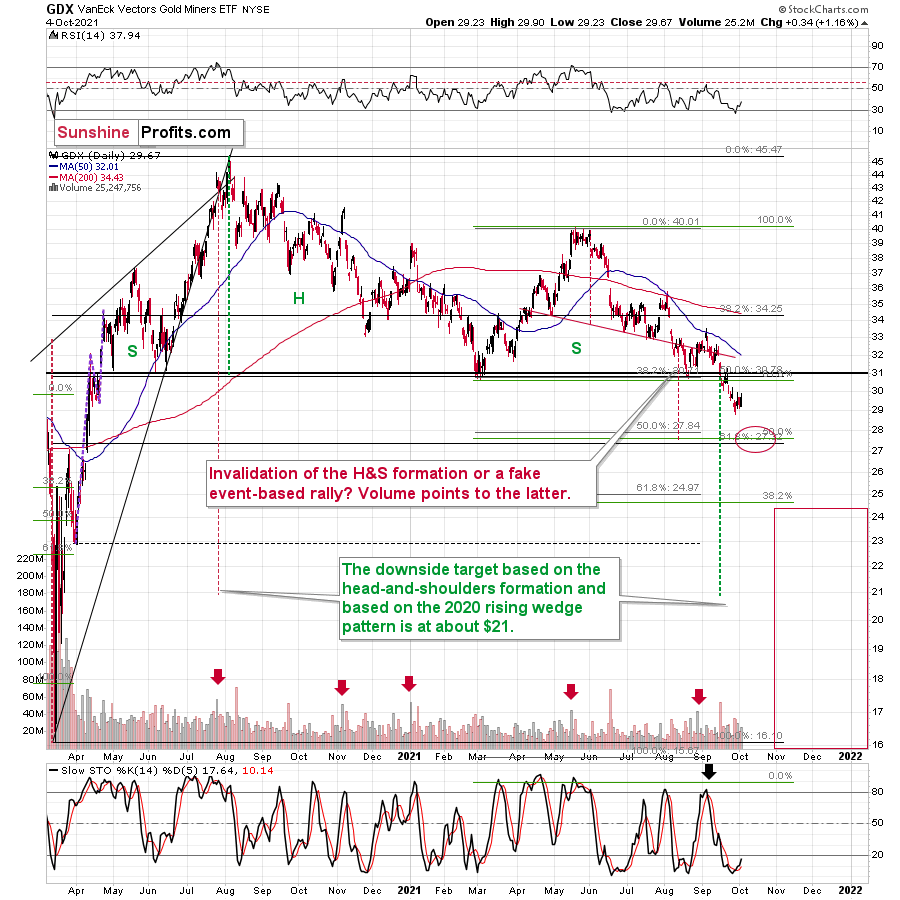

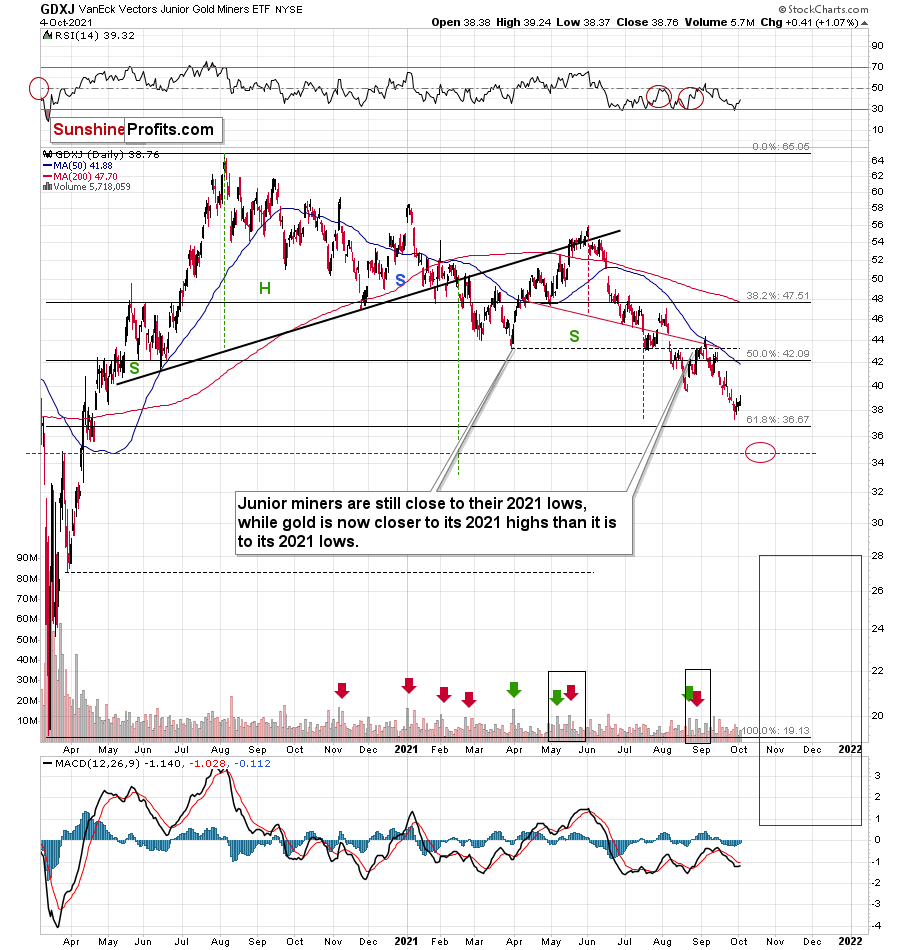

Any Impact On Miners?

Additionally, please have a look at how weak the mining stocks’ reaction to gold’s upswing was.

Even without looking at exact percentage gains, it’s clear that the GDX has barely moved back up. It didn’t even manage to move back above $30 in yesterday’s intraday trading.

Juniors (GDXJ) confirm seniors’ (GDX) relative weakness, and they both suggest that the precious metals sector is likely to move lower in the following weeks.