Gold Moves Up And Then Down $100 On A Tariff That Never Existed

Image Source: Unsplash

In case you thought finance in the algorithm age was starting to get a little bit wild, the last 24 hours served as a reminder that we can expect to be stunned in the years and decades ahead.

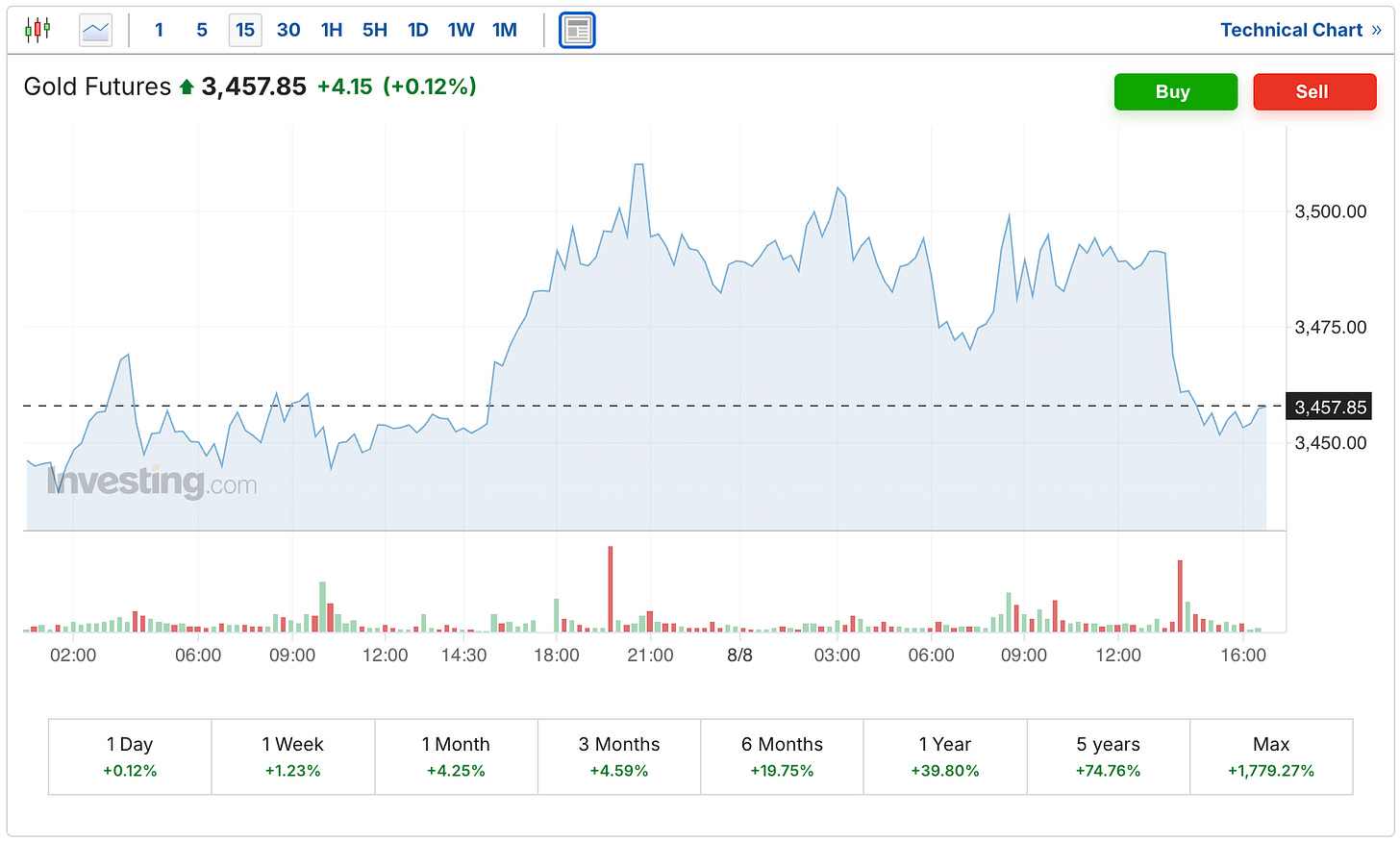

Because, as you’re likely already aware at this point, last night the gold futures surged to a new all-time record high of $3,534 in response to what has ultimately turned out to be an erroneous report.

Here you can see the spike higher last night, as well as how the price looks like it fell off a cliff once reports began to surface stating that last night's report was a mistake.

As I mentioned earlier, that $3,534 peak is the new all-time record high.

The reaction in the silver market was understandably not as extreme, given how this was gold-specific news. Yet the price still finished 21 cents higher on the day to close the week at $38.50.

This all began last night when the US Customs and Border Protection issued a ruling that said one-kilogram and 100-ounce gold bars are subject to tariffs.

From the Bloomberg article:

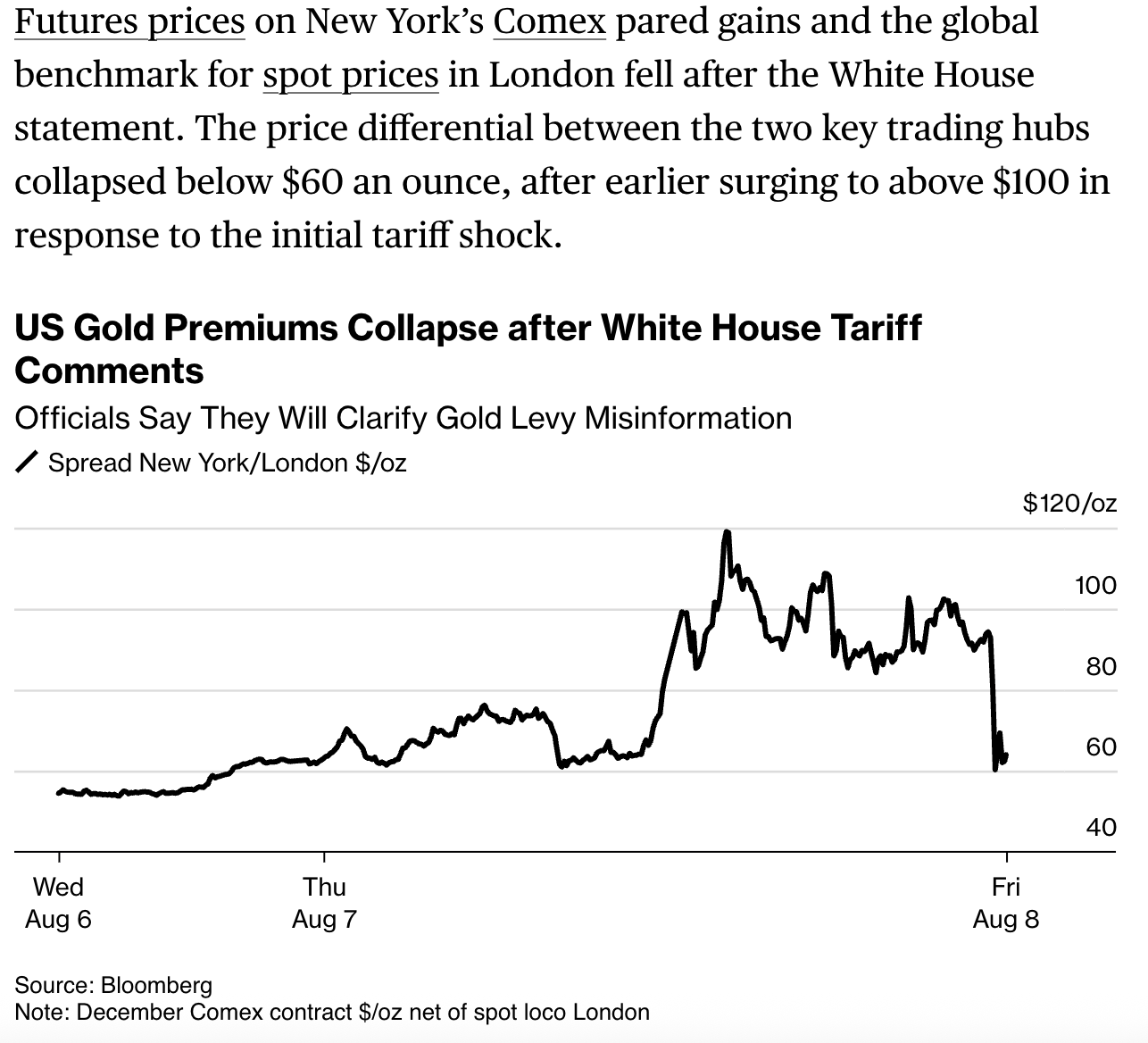

The ruling, posted on the agency’s website, came after a Swiss refiner sought clarity on the levies. Such a directive would bring sweeping implications for bullion around the world and could have disrupted the functioning of the US futures contract.

This had a significant impact on the EFP spread between the futures market in New York and the spot market in London.

However, the impact of the situation was not limited just to the gold and silver bullion prices.

Gold-related equities also quickly dropped after the White House statement, with larger gold mining stocks including Newmont Corp. and Agnico Eagle Mines Ltd. immediately erasing earlier gains, as did gold royalty provider Franco-Nevada Corp. and funds like the VanEck Gold Miners ETF.

It's also interesting to see the following note about how the supply chain was even impacted in such a short period of time.

Shipments were freezing up in response to the decision that gold imports would face US duties, traders said earlier Friday.

Some of the financial channels are saying that the Trump administration will issue some kind of announcement. Although I suppose at this point, it might be wise to just wait and see for sure how that plays out before making any assumptions.

A White House order clarifying its position would serve to calm the market chaos caused by fears of a tariff on gold imports.

My suspicion is that if the Trump administration really wants to calm the markets, there's a lot more they're going to need to do than just clarify the tariff policies. That would be a great start, although until anyone else on the planet actually understands how the US is ever going to address a debt load that is mathematically impossible to be repaid, the gold price is likely to continue doing what it's been doing.

I'm sure we'll hear plenty more about that next week. But for today, I do truly hope you're getting set for a fun and peaceful weekend, and that you'll have the chance to give a hug to someone you love.

More By This Author:

U.S. Tariff Shocks Gold Market, Sends New York Futures To RecordGold & Silver Bank COMEX Short Positions Remain Near All-Time Highs, While Silver 'Free Float' Is Running Low

Gold & Silver Miners Set Up For A Once In 50 Year Opportunity