Gold Miners: Which Door Will Investors Choose?

With the current situation suggestive of a Monty Hall problem, investors are clinging to the first, bullish door. But what if a different option is more likely?

The Monty Hall problem is a form of a probability puzzle, and what it shows is immensely unintuitive. Suppose you are on a game show, and you need to choose one of three doors. Behind one of them is a car and behind the others, goats. You pick a door, and then the host (who knows what’s behind them) opens one of the remaining doors, behind which there is a goat. The host now asks: “Do you want to change your door choice for the remaining doors?” So, what do you do?

It turns out that if you change the door, the probability of winning the car increases… two times! You have a 2/3 chance, instead of a 1/3. Tremendously unintuitive, indeed, but what if the same is happening on the market now? With a bullish prospect representing the door of the first choice, and the technicals and fundamentals the host’s help, wouldn’t it be safer to switch the door to win eventually?

Image Source: Pixabay

The Gold Miners

With investors stuck in their own version of the Monty Hall problem, guessing ‘what's behind door No.1’ has market participants scrambling to find the bullish gateway. However, with doors two and three signaling a much more ominous outcome for gold, silver and mining stocks, the key to unlocking their future performance may already be hiding in plain sight.

Case in point: with the analogue from 2012 signaling a forthcoming rush for the exits, there are no fire escapes available for investors that overstay their welcome. And because those who cannot remember the past are condemned to repeat it (George Santayana), doubters are likely to lose more than just their pride.

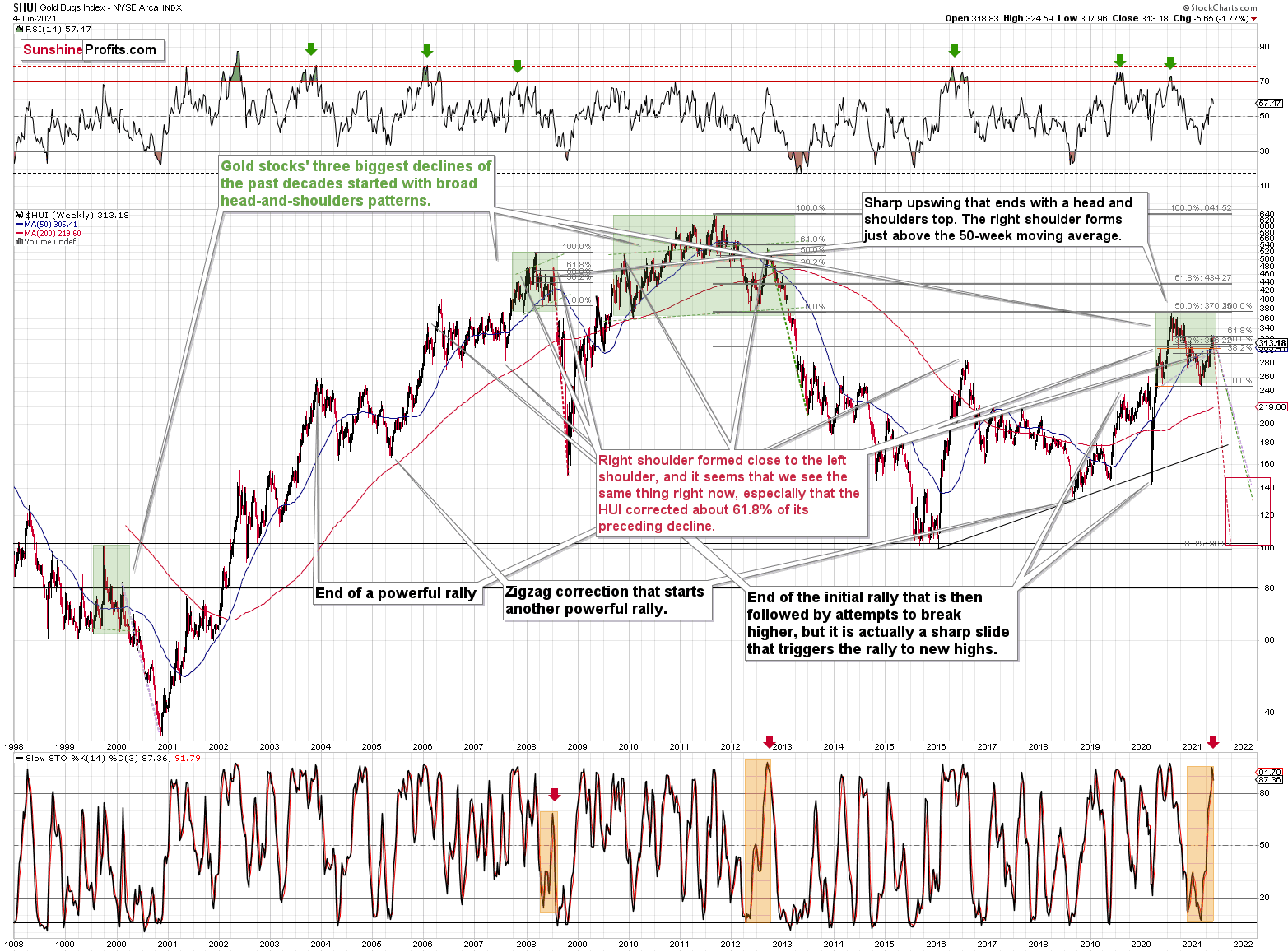

While the most recent price action is best visible in the short-term charts, it is actually the HUI Index’s very long-term chart that provides the most important details (today’s full analysis includes 44 charts, but the graph below is one of the key ones). The crucial thing happened two weeks ago, and what we saw last week was simply a major confirmation.

(Click on image to enlarge)

What happened two weeks ago was that gold rallied by almost $30 ($28.60) and at the same time, the HUI – a flagship proxy for gold stocks… Declined by 1.37. In other words, gold stocks completely ignored gold’s gains.

That shows exceptional weakness on the weekly basis and is a very bearish sign for the following weeks. And it has important historical analogies.

Back in 2008, right before a huge slide, in late September and early October gold was still moving to new intraday highs, but the HUI Index was ignoring that, and then it declined despite gold’s rally. However, it was also the case that the general stock market declined then. If stocks hadn’t declined back then so profoundly, gold stocks’ underperformance of gold would likely be present but more moderate. In fact, that’s exactly what happened in 2012.

The HUI Index topped on September 21, 2012, and that was just the initial high in gold. At that time the S&P 500 was moving back and forth with lower highs – so a bit more bearish than the current back-and-forth movement in this stock index. What happened in the end? Gold moved to new highs and formed the final top (October 5, 2012). It was when the S&P 500 almost (!) moved to new highs, and despite both, the HUI Index didn’t move to new highs.

The similarity to how the final counter-trend rally ended in 2012 (and to a smaller extent in 2008) ended is uncanny. The implications are very bearish for the following weeks, especially given that the gold price is following the analogy to 2008 and 2012 as well.

All the above is what we had already known last week. In that case, let’s move to last week’s confirmation. The thing is that the stochastic oscillator just flashed a clear sell signal. This is important on its own as these signals often preceded massive price declines. However, extremely bearish implications come from combining both: the sell signal and the analogy of 2008 and 2012. Therefore, we should consider the sell signal in the HUI-based stochastic oscillator as yet another sign serving as confirmation that the huge decline has just begun.

Thus, if history rhymes, as it tends to, the HUI Index will likely decline profoundly. How low could the gold stocks fall? If the similarity to the previous years continues, the HUI could find medium-term support in the 100-to-150 range. For context, high-end 2020 support implies a move back to 150, while low-end 2015 support implies a move back to 100. And yes, it could really happen, even though it seems unthinkable.

But which part of the mining stock sector is likely to decline the most? In my view, the junior mining stocks.

The Junior Miners

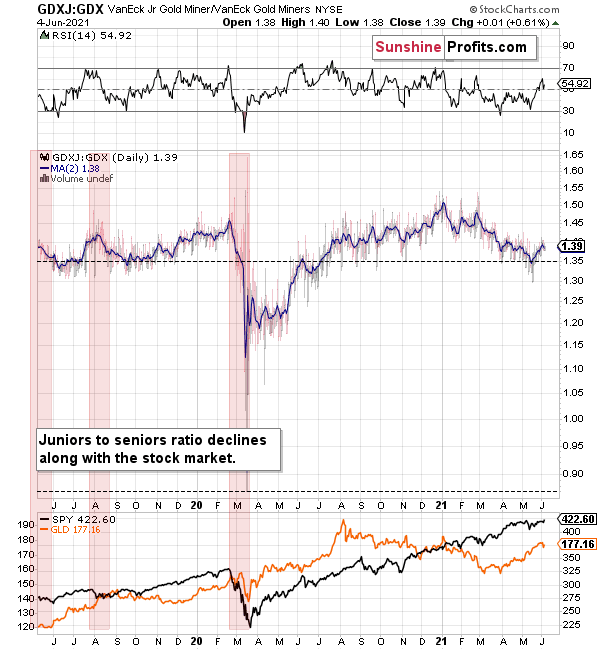

GDXJ is underperforming GDX just as I’ve been expecting it to. Once one realizes that GDXJ is more correlated with the general stock market than GDX is, GDXJ should be showing strength here, and it isn’t. If stocks don’t decline, GDXJ is likely to underperform by just a bit, but when (not if) stocks slide, GDXJ is likely to plunge visibly more than GDX.

Expanding on that point, the GDXJ/GDX ratio has been declining since the beginning of the year, which is remarkable because the general stock market hasn’t plunged yet. And once the general stock market suffers a material decline, the GDXJ ETF’s underperformance will likely be heard loud and clear.

Please see below:

Why haven’t the juniors been soaring relative to senior mining stocks? What makes them so special (and weak) right now? In my opinion, it’s the fact that we now – unlike at any other time in the past – have an asset class that seems similarly appealing to the investment public. Not to everyone, but to some. And this “some” is enough for juniors to underperform.

Instead of speculating on an individual junior miner making a killing after striking gold or silver in some extremely rich deposit, it’s now easier than ever to get the same kind of thrill by buying… an altcoin (like Dogecoin or something else). In fact, people themselves can engage in “mining” these coins. And just like bitcoin seems similar to gold to many (especially the younger generation) investors, altcoins might serve as the “junior mining stocks” of the electronic future. At least they might be perceived as such by some.

Consequently, a part of the demand for juniors was not based on the “sympathy” toward the precious metals market, but rather on the emotional thrill (striking gold) combined with the anti-establishment tendencies (gold and silver are the anti- metals, but cryptocurrencies are anti-establishment in their own way). And since everyone and their brother seem to be talking about how much this or that altcoin has gained recently, it’s easy to see why some people jumped on that bandwagon instead of investing in junior miners.

This tendency is not likely to go away in the near term, so it seems that we have yet another reason to think that the GDXJ ETF is going to move much lower in the following months – declining more than the GDX ETF. The above + gold’s decline + stocks’ decline is truly an extremely bearish combination, in my view.

In conclusion, once gold, silver and mining stocks’ doors finally slam shut, over-optimistic investors will likely go down with the ship. And with the most volatile segments of the precious metals market eliciting the most bearish signals, those left holding the bag will likely wonder how it all went wrong. Moreover, with gold’s relative outperformance signaling waning investors’ optimism, the miners – and more specifically, the GDXJ ETF – will likely suffer the brunt of the forthcoming selling pressure. The bottom line? With the walls closing in on gold, silver and mining stocks, the game show will likely end with investors left empty-handed.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more