Gold Miners: The Short-Term Reversal We Were Waiting For

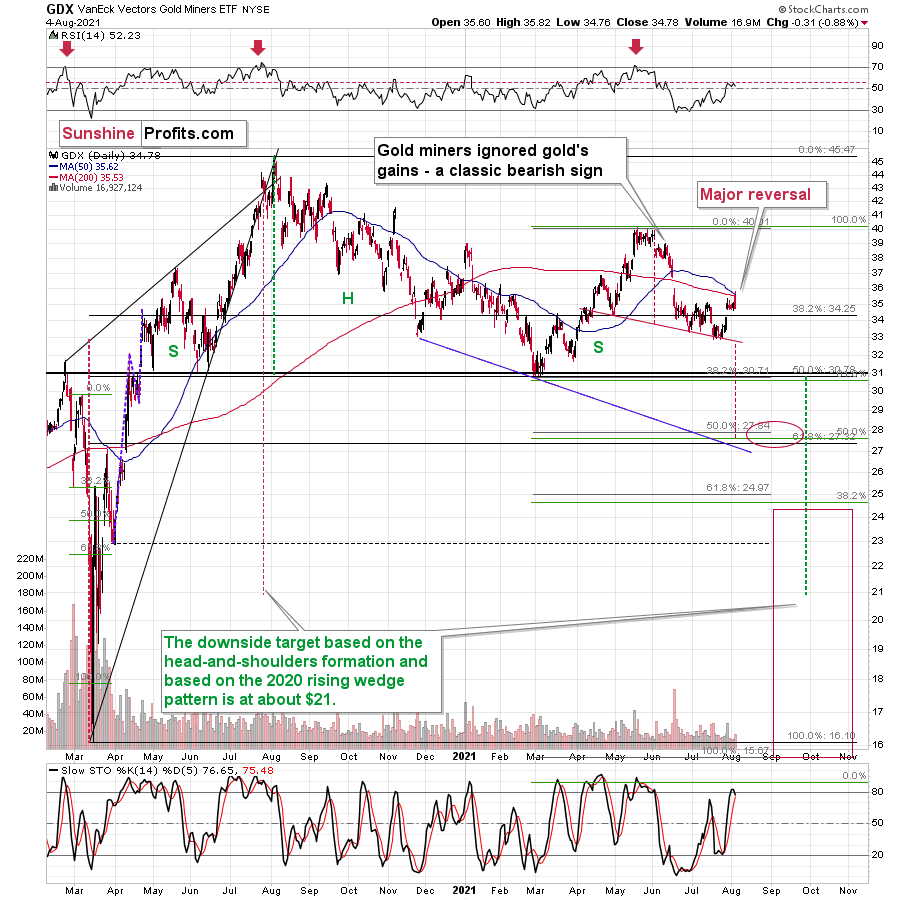

Despite spiking at first, the miners’ hike was quickly invalidated. And what an invalidation it was! The GDX and GDXJ ended yesterday’s session lower.

Now, that’s what a major short-term reversal looks like!

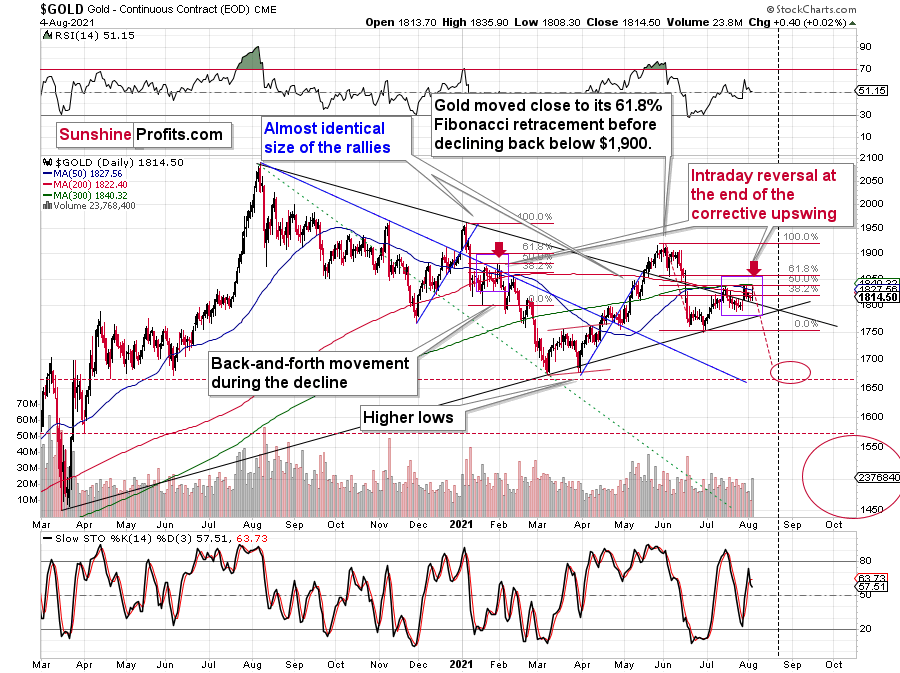

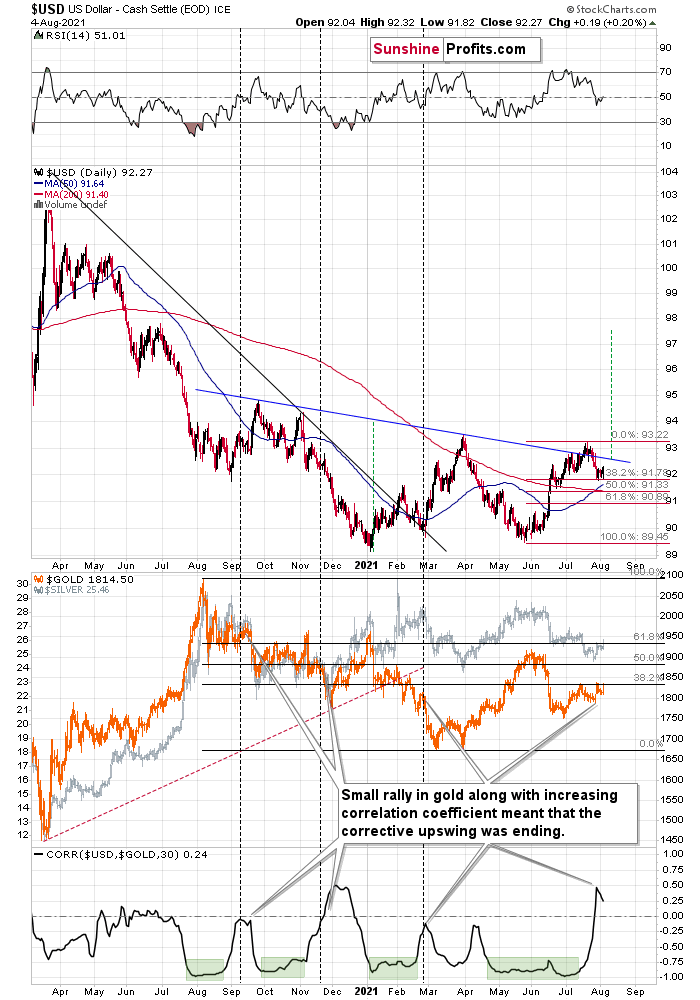

If there was one sentence to summarize yesterday’s session, it would be the above. Not only did gold, silver, and mining stocks – all – reverse in a profound manner but also we saw multiple signs which further confirmed the critical nature of this price performance. Namely, the USD Index bounced off its 38.2% Fibonacci retracement once again, and gold stocks once again underperformed gold.

And speaking of underperformance, the most profound thing was that all the above happened despite a piece of news that could have (should have?) made gold rally. The ADP Nonfarm Employment Change was surprisingly negative (only 330K vs. 695K expected), which indicated that the upcoming (to be released tomorrow) Nonfarm Payrolls will also be negative. This makes investors think that the Fed might be more dovish, or be just as dovish, but for longer. In other words, it makes tapering less likely. Consequently, it was something bullish for gold and gold rallied, but only for a few hours. It then took less than an hour for the entire intraday rally to be erased.

What seemed like a possible game-changer turned out to be a clear sell signal. The reversal was clear, and the accompanying volume was much higher than what we saw in the past few days. Consequently, it should be treated as an important move.

Why would that happen? You already know the answer. Because gold wants to move lower, not higher! More precisely, because gold is repeating its past performance, which implies that a bigger move lower, not higher is next. In yesterday’s analysis, I replied to a question about gold’s performance compared to what’s going on in the treasury yields and in the USD Index, and my explanation of gold’s relative performance (or lack of thereof) remains up-to-date. We can also see that gold managed to ignore a piece of news that was actually bullish.

Gold’s reversal despite positive news is very bearish on its own. The fact that it was accompanied by multiple bearish confirmations makes it even more bearish.

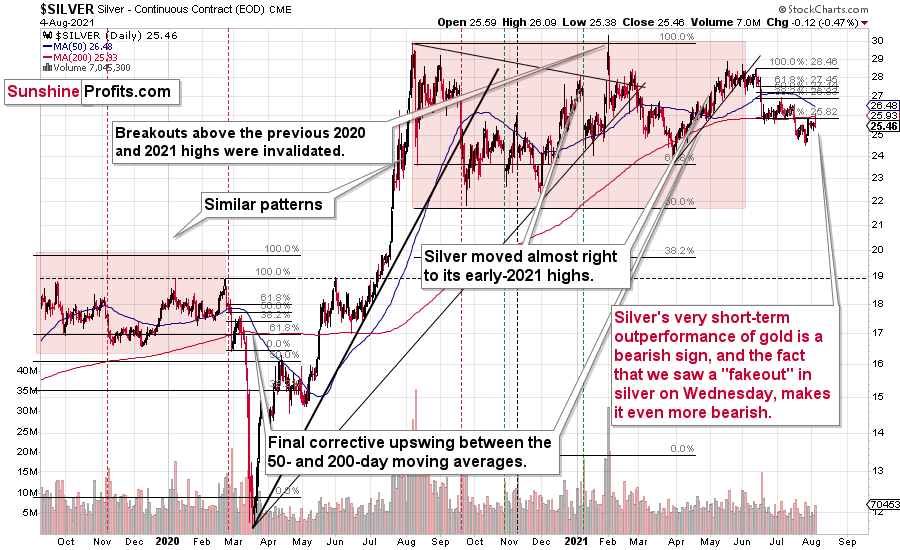

In yesterday’s analysis, I wrote the following about silver’s performance relative to gold:

Silver moved higher as well, and while this move was relatively insignificant in nominal and percentage terms (+0.78%), it was much bigger than what we saw in gold (+0.22%); the difference is crystal-clear when we compare today’s pre-market moves to the most recent short-term highs in both precious metals.

Silver moved to its recent short-term high while gold is not even close to being halfway back up. This means that on a very short-term basis, silver is clearly outperforming gold.

This is also what tends to happen shortly before significant declines across the precious metals sector.

Now, the sizes of both moves were not that significant, so this performance could also be more or less random, and, if that was the case, the outperformance would be just accidental. Consequently, it’s not a game-changing signal in terms of its importance. It is something that’s on top of multiple other indications that we have, and the most important ones are not of a short-term nature at all. The long-term self-similarities in gold and the HUI Index (gold stocks) are the true key to understanding where the precious metals sector is likely to head next, and you already know about those, as I described them thoroughly on Monday.

The above is very much up-to-date. Not only did the early indications prove to be correct, but we actually saw a fresh sell signal in the form of silver’s “fakeout”.

The white metal appeared to be moving back above its June lows, but it was quickly hammered back down, and it ended the session a bit lower. Invalidations of breakouts are very bearish, and silver is known for breaking above certain resistance levels very briefly (without analogous action in gold and gold stocks) only to invalidate them shortly – and it usually happens right before significant moves to the downside.

The implications are clearly bearish, and, more importantly, it’s not the only confirmation that gold received.

The Gold Miners

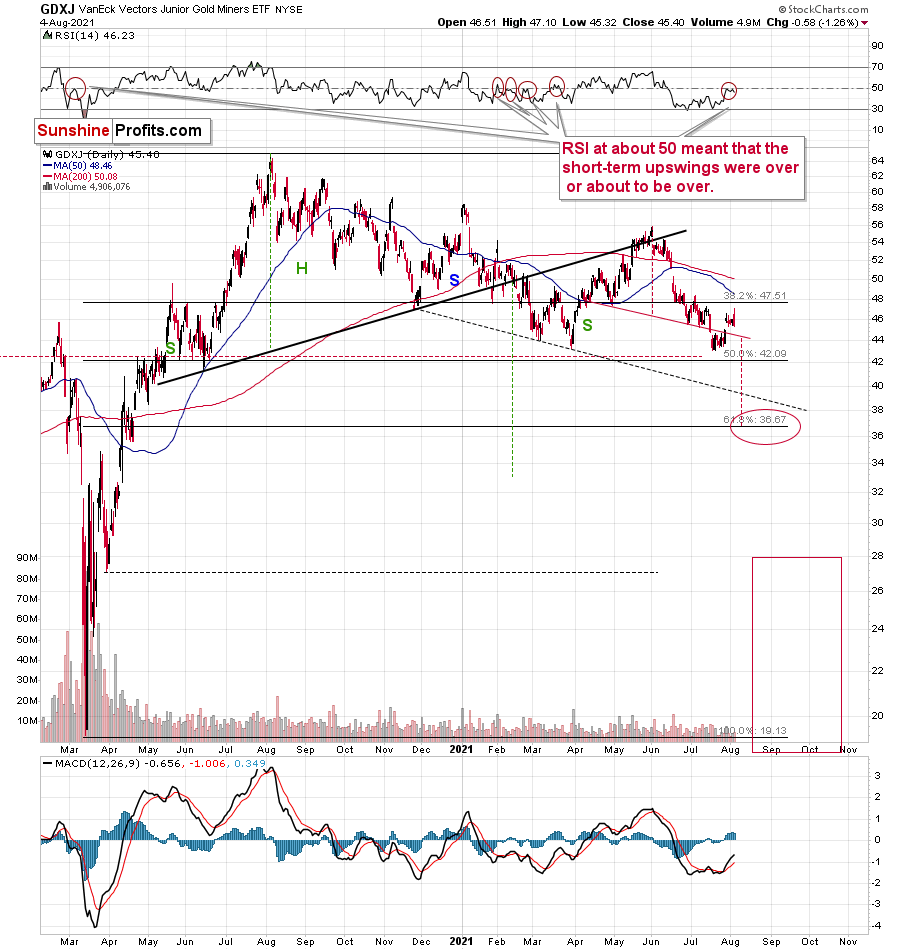

Despite the early move higher in the miners, their climb was invalidated. Both seniors (GDX) and juniors (GDXJ) ended yesterday’s session lower. This means that we saw sell signals from both ETFs based on their reversals, as well as one general sell signal based on the miners’ underperformance of gold (which ended yesterday’s session slightly higher).

Please note that both mining stock ETFs’ RSI indicators are at the levels that triggered short-term reversals in the past. In particular, please note that the RSI based on the GDXJ formed specific double tops before junior miners started their short-term declines (late February and March 2021). Based on yesterday’s reversal, we saw exactly the same thing once again. The implications are bearish.

And while the precious metals sector seems to have topped, the USD Index seems to have found its bottom at its 38.2% Fibonacci retracement.

After another move lower on an intraday basis, the USDX ended the day slightly higher. It seems that the short-term bottom might already be in (I’m not ruling out a move to the 50% retracement though) and that the next attempt to break above the blue declining resistance line will be successful. That resistance line is particularly important, as it’s the neck level of the broad inverse head-and-shoulders pattern with the upside target close to 98. Naturally, such a move would be likely to have devastating consequences for the precious metals sector.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more