Gold Miners Still On A Rise – Where Will The Top Be?

To answer this question, let’s take a look at what happened in junior mining stocks over the last few days. In yesterday’s analysis, I wrote the following:

Of course, there will be some back-and-forth movement on an intraday basis, but it doesn’t change anything. Junior miners are likely to rally this week nonetheless. And perhaps not longer than that, as the next triangle-vertex-based reversal is just around the corner – on Friday/Monday.

The previous few days were the “forth” and yesterday [May 18] was the “back” movement – so far, my comments remain up-to-date. However, comparing the market action with what I wrote previously isn’t what I meant by analogies to past situations. I meant this:

(Click on image to enlarge)

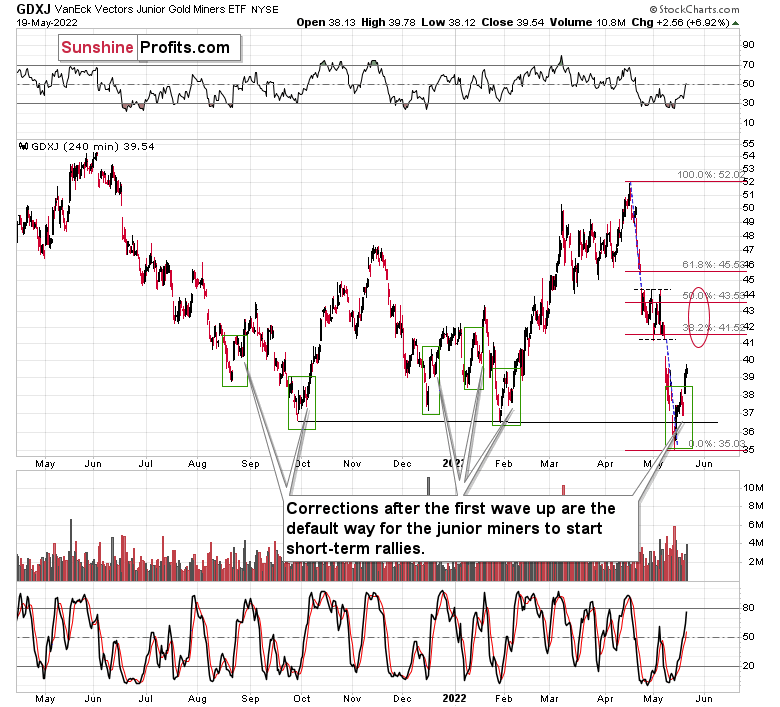

The areas marked with green rectangles are the starting moments of the previous short-term rallies. Some were bigger than others, and yet they all had one thing in common. They all included a corrective downswing after the initial post-bottom rally.

Consequently, what we saw yesterday [May 18] couldn’t be more normal during a short-term rally. This means that yesterday’s decline is not bearish at all and the profits from our long positions are likely to increase in the following days.

Besides, the general stock market declined by over 4%, while the GDXJ (normally moving more than stocks) ETF – a proxy for junior mining stocks – declined by only about 2%.

Well, that’s exactly what happened. Juniors soared yesterday, and so did profits from our long positions (which we managed to open practically right at the bottom).

I would like to clarify one of the points that I made previously with regard to timing the top. I previously wrote that based on the next triangle-vertex-based reversal, it’s likely that the top will take place today (Friday) or on Monday. However, I re-visited the charts to make sure that I got the date right, and when I applied the same methodology on a bigger chart, it turned out that the vertex that I described was already behind us, and that it simply confirmed the bottom when we switched from short to long positions.

(Click on image to enlarge)

Consequently, it’s not very likely that the final top for the rally will take place today or on Monday. It could be the case based on other reasons, but not based on the triangle-vertex-based reversal.

Since gold and silver are likely to move higher, so are junior miners.

I previously wrote that the target for junior miners is at the 38.2% Fibonacci retracement and the recent short-term low, a bit above $41. However, it could be the case that the next resistance is a bit higher, closer to the upper border of the previous consolidation. This could correspond to the 50% Fibonacci retracement close to the $44 level.

Still, remaining conservative and keeping our chances of exiting the current trade and cashing profits at all, I’m keeping the profit-take level intact.

On a very short-term basis, junior miners could be driven by stock market moves. Meanwhile, the stock market appears to be repeating its very recent consolidation pattern.

(Click on image to enlarge)

After stocks’ initial rebound (late April), they declined once again, and then they rallied back up to their previous high before sliding to new lows.

So far, we’re seeing something similar. The initial rebound was indeed followed by a sharp decline. In fact, even the intraday performance is similar. The daily decline was big and sharp, and it was followed by a daily reversal. What followed then was a small daily rally and then a huge daily rally, which was the final top.

If history rhymes, then perhaps today’s or Monday’s (or Tuesday’s) rallies will be significant and take stocks to the final short-term top. This could correspond to a short-term top in junior miners as well.

The above would fit the scenario in which the miners continue to rally for the next 1-3 days.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more

The top is limitless.