Gold May See Larger Degree Correction

Image Source: Pixabay

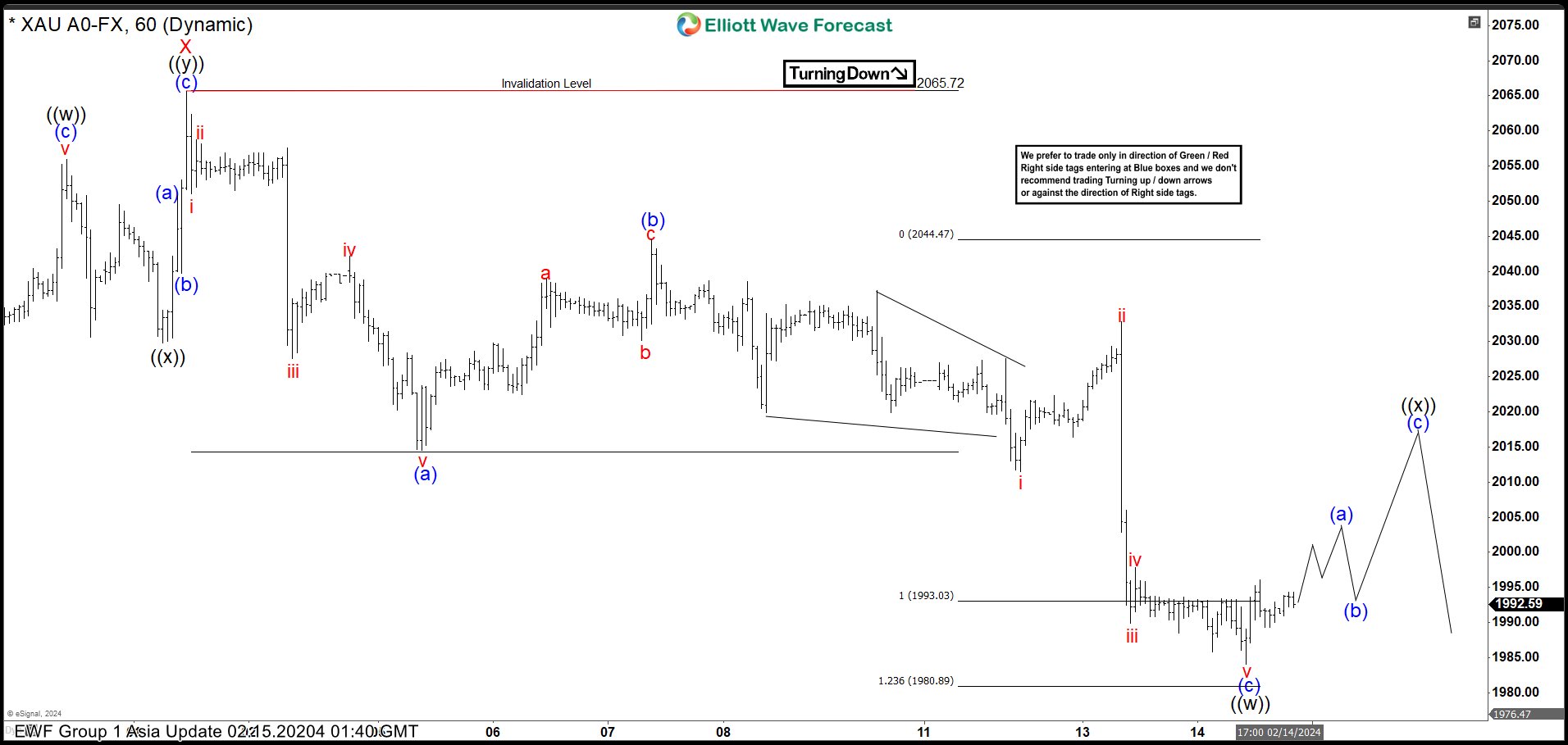

Gold (XAUUSD) cyclc from 12.28.2023 high is in progress as a double three Elliott Wave structure. Down from 12.28.2023 high, wave W ended at 2001.6 and rally in wave X ended at 2065.6. The metal then turns lower again in wave Y. Wave Y subdivides into another double three in lesser degree. Down from wave X, wave i ended at 2051 and wave ii ended at 2058.70. Wave iii lower ended at 2027.6, wave iv ended at 2042.22, and wave v lower ended at 2014.50. This completed wave (a) in higher degree. Rally in wave (b) ended at 2044.55 as a zigzag. Up from wave (a), wave a ended at 2038.8 and wave b ended at 2030.2.

Wave c higher ended at 2044.55 which completed wave (b). Down from there, wave i ended at 2011.5 and wave ii ended at 2032.85. Wave iii lower ended at 1989.9 and wave iv ended at 1997.81. Last leg lower wave v ended at 1984.09 which completed wave (c) of ((w)). Wave ((x)) rally is now in progress to correct cycle from 2.1.2024 high in 3, 7, or 11 swing before it resumes lower. Near term, as far as pivot at 2065.7 high stays intact, expect rally to fail for further downside.

Gold (XAUUSD) 60 Minutes Elliott Wave Chart

XAUUSD Elliott Wave Video

Video Length: 00:14:37

More By This Author:

Apple Should See Further DownsideCHF/JPY Perfectly Reacting Higher From Blue Box Area

Visa Inc Nest Structure Signals Further Upside

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more