Gold Market Trends: An Analytical Deep Dive Into Price Correction And Support Levels

Image Source: Unsplash

The international gold market has been continuing its price correction phase, just like we anticipated in our previous review. As the market dynamics continue to oscillate, the correlation between gold prices, U.S. consumer spending, and macroeconomic indicators such as diesel prices create a fascinating tableau of interconnected influences.

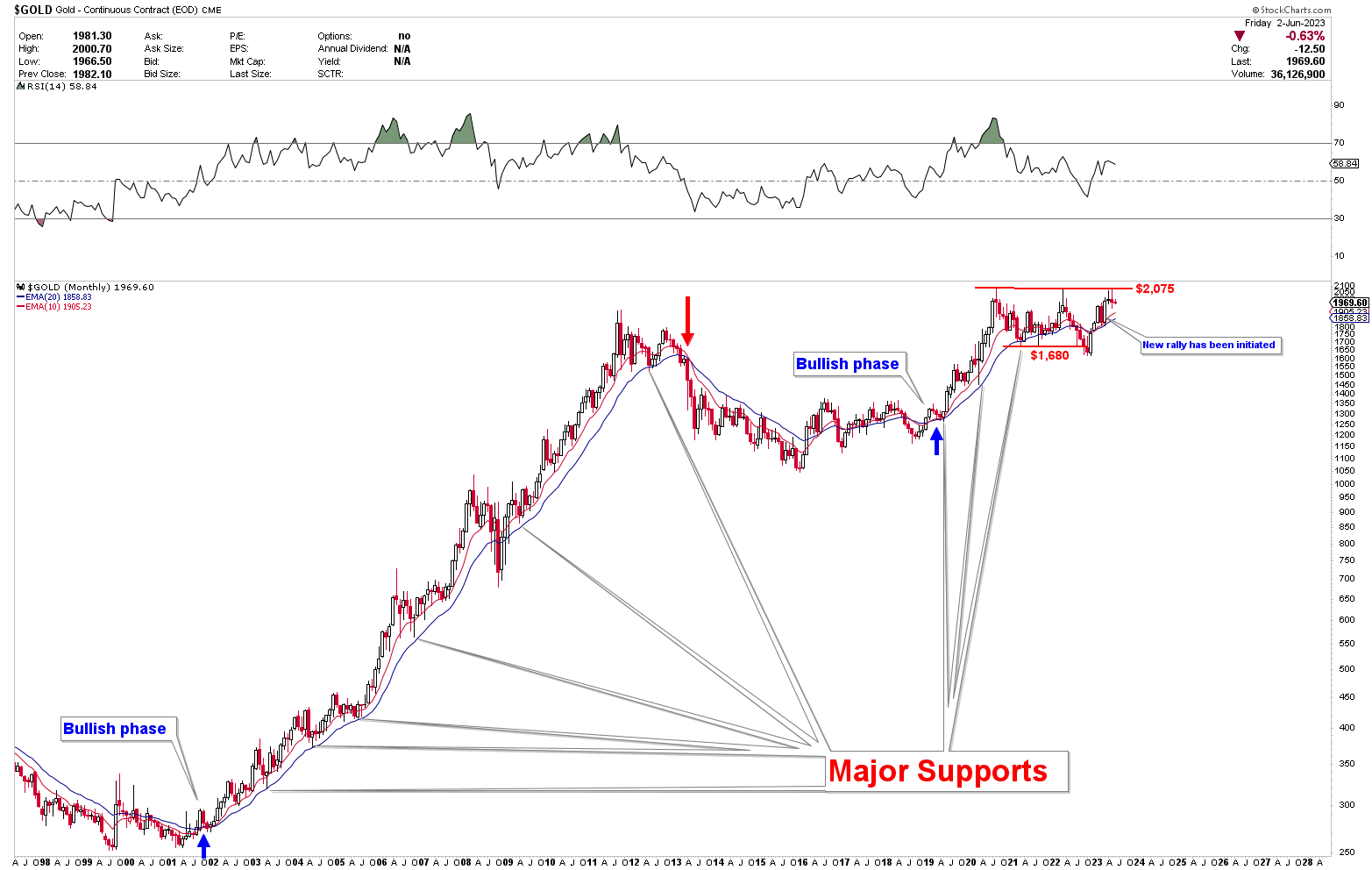

The gold market charts offer insightful trends about the bull and bear phases, as well as potential strong support for upcoming investment decisions.

As per our recent analysis, gold prices have been undergoing a correction phase, with the metal trading between well-defined support and resistance levels. Despite the robust resistance experienced around the $2,075 mark, the precious metal has managed to stay afloat above the 10- and 20-month moving averages. The market has been demonstrating a healthy consolidation, as it is preparing for its next significant move.

U.S. Consumer Spending and Economic Signals

The American consumer market continues to show resilience with steady spending patterns. However, the economic compass indicates a looming slowdown. The precursors are evident in the subtle shift in commodities, such as diesel prices.

Diesel prices, despite restricted supply, have been recording a downward trend – a reliable indicator of contracting economic activity. This trend affects commodities across the board, with the gold market not being an exception. Investors must therefore factor in these broad economic indicators when planning their gold trading strategies.

The Bull and Bear Phases

The monthly chart for the gold market elucidates the bull and bear phases distinctly, using the 10- and 20-month moving averages. Despite the resistance at the $2,075 zone, gold prices have continued to trend above these averages, indicating a generally bullish outlook in the medium-term.

Interestingly, the $1,905 level aligns seamlessly with the 10-month moving average, while the $1,800+ midpoint corresponds with the 20-month moving average. These levels play a crucial role in shaping market sentiment and future price movements.

Given the current trajectory of the gold market’s correction, it’s plausible to anticipate a strong bounce from the $1,900 region. This level also happens to be the Fibonacci retracement support of the recent price surge, further cementing its significance.

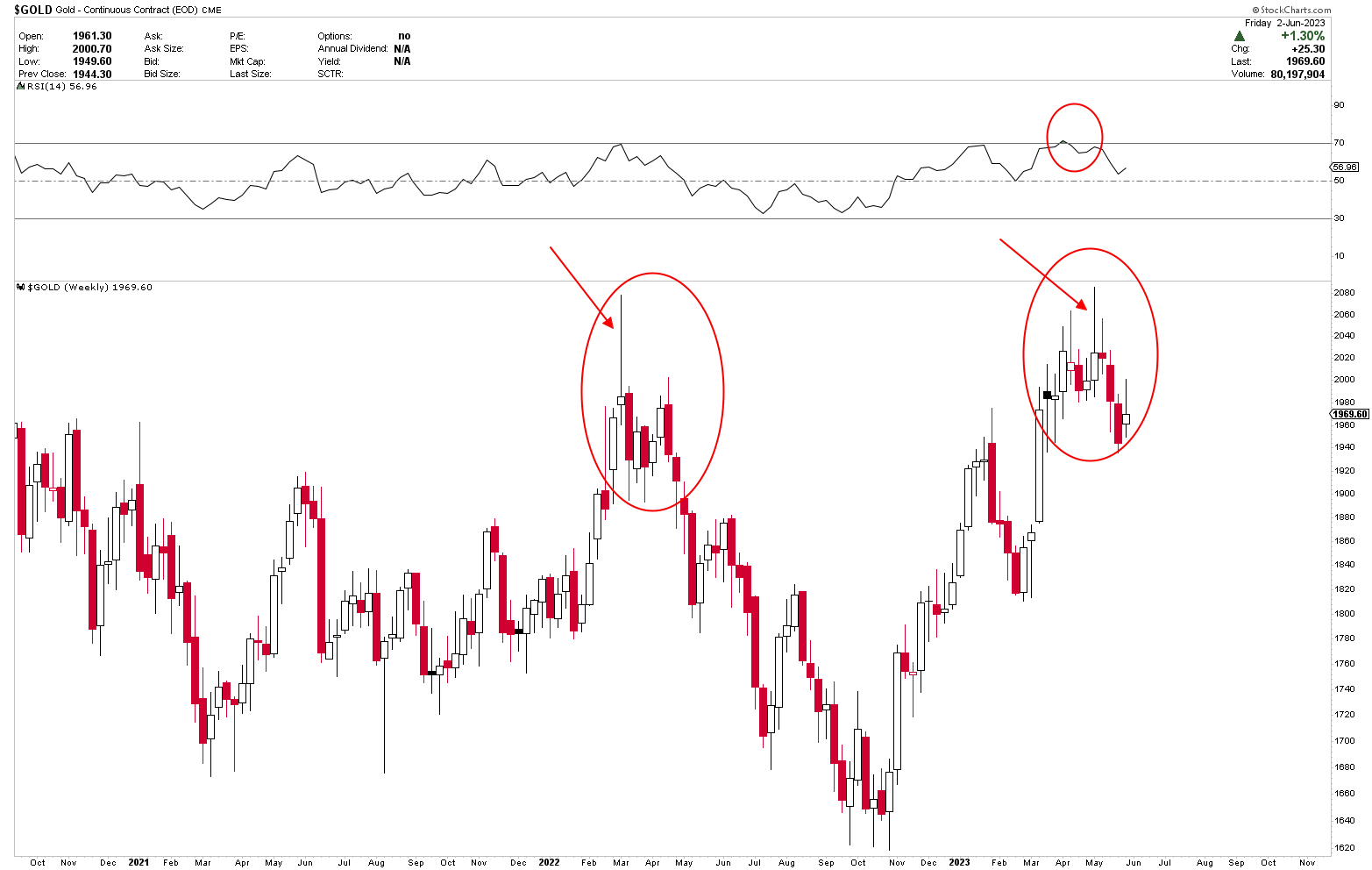

Short-Term Perspective: Daily and Weekly Chart Insights

The weekly chart reinforces the imminent encounter of the gold market with a robust barrier. A reaction appears to be in the cards, and market participants will be keenly watching how gold prices react at this crucial juncture.

The daily chart clearly presents the short-term outlook for the gold market. As discussed in last week’s article, the gold price rebounded from the channel line, suggesting a return of bullish sentiment. However, this rebound was limited at the double top’s neckline, instigating the price to resume its downward path. Given the current conditions, it appears the price could potentially drop further, opening opportunities for buyer influence in the market.

Final Words

In summary, the region between $1,900 to $1,950 emerges as a strong support zone. Although the first support at $1,950 was tested, the gold price seems to be seeking further validation and might continue its downward trajectory to find robust support around the $1,900 mark.

The ongoing price correction, coupled with the U.S. economic indicators, presents both challenges and opportunities for gold traders and investors. Staying informed and understanding the subtle nuances of these market movements is key to successful gold trading. As we continue to monitor these trends, our goal is to provide valuable insights that empower your investment decisions.

More By This Author:

The Golden Opportunity: Navigating The Recent Drop In Gold Prices

Gold Current Situation And Future Implications

The Gold Market Amid The Financial Crisis: An Investor’s Opportunity

Disclosure: Materials distributed by GoldPredictors.com has no regard to the specific investment objectives, financial situation or the particular needs of any visitor or subscriber. This site ...

more

WELL WRITTEN..